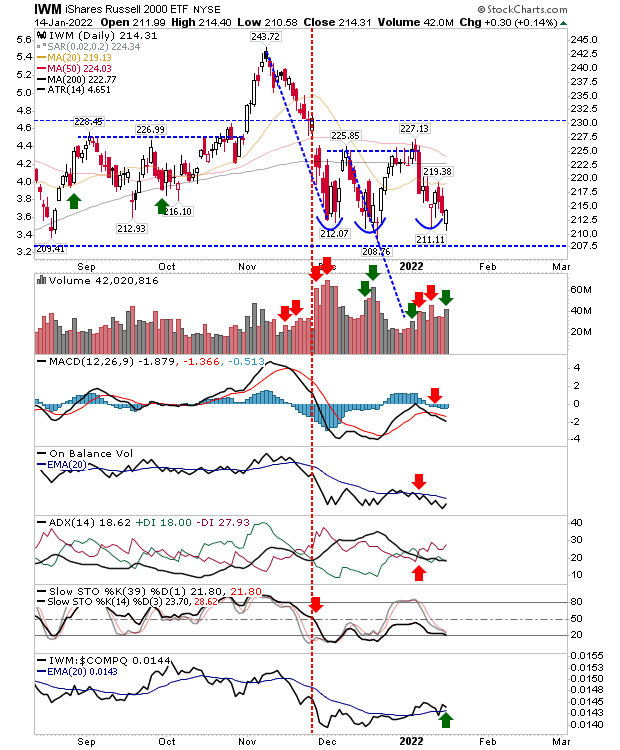

Friday was a defense by bulls day, but the frequency of the support test was a concern. The Russell 2000 (IWM) was looking the most vulnerable as it attempted a (failed) bullish piercing pattern.

Friday's buying barely cut into Thursday's selling but the index was outperforming the NASDAQ. It would need to push from here if it's not to collapse. Either way, I'm not liking Friday's action...

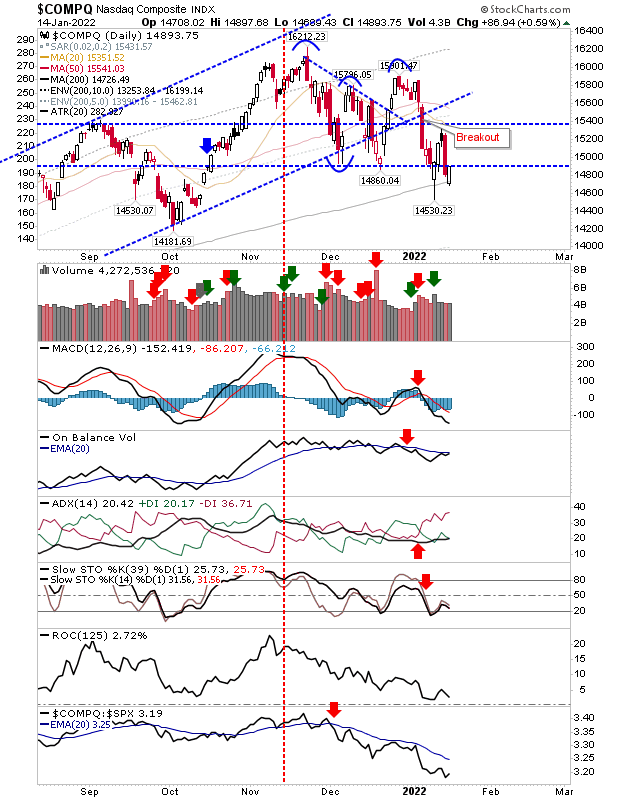

The NASDAQ made a second attempt at 200-day MA support but buying volume was above previous selling (and buying). Technicals were net negative and the index lost more ground against the S&P. Yes, Friday was a successful test of the moving average, but for this to happen twice in the one week was a but much.

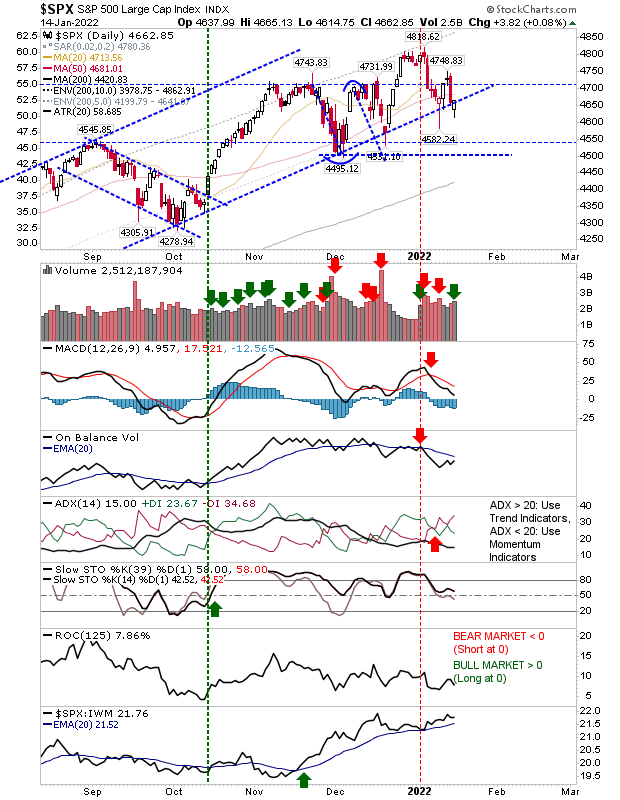

The S&P was not left out of the party as it successfully tested channel support. Unlike the aforementioned indices, it registered as a day of accumulation. There was also the relative performance of the index to the Russell 2000 and momentum (stochastics) holding the mid-line, although other indicators were negative.

On the surface, Friday looked good, but the likelihood of a sustainable bounce was looking more unlikely as of the same time last week.