Roku (NASDAQ:) reported third-quarter 2019 loss of 22 cents per share that was narrower than the Zacks Consensus Estimate of a loss of 28 cents. The company had reported loss of 9 cents per share in the year-ago quarter.

Revenues soared 50.5% from the year-ago quarter to $260.9 million and comfortably beat the consensus mark of $258 million.

Active accounts surged 36% year over year to 32.3 million. Streaming hours increased 68% year over year to 10.3 billion. Moreover, average revenue per user (ARPU) increased 30% to $22.58 (on a trailing 12-month basis).

Top-Line Details

Platform revenues (68.7% of revenues) surged 79.2% year over year to $179.3 million.

Robust growth in advertising continued as monetized video ad impressions once again more than doubled year over year, the key catalyst in boosting top-line growth. The Roku Channel contributed to this growth as ad impressions within the channel grew faster than ad impressions in the third quarter.

In August, Roku launched Kids & Family within The Roku Channel for families to find a wide selection of free and Premium Subscription content at one, easy-to-access destination. The Roku Channel’s new parental control features give parents control over what their kids can playback within the channel.

Moreover, the company also partnered with Lego Systems as a sponsor on The Roku Channel Kids & Family home screen, allowing the brand to gain visibility while offering viewers free access to a collection of movies. Such sponsorships boosted viewer engagement in the third quarter.

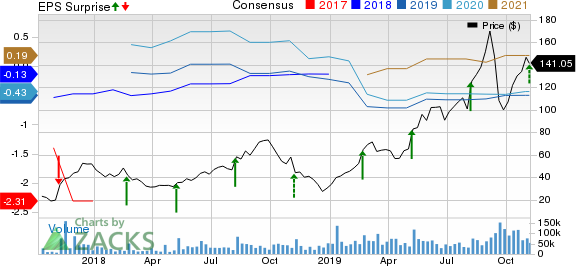

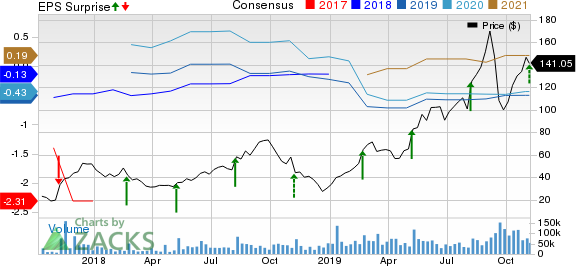

Roku, Inc. Price, Consensus and EPS Surprise

Roku, Inc. price-consensus-eps-surprise-chart | Roku, Inc. Quote

Player revenues (31.3% of revenues) increased 11.3% from the year-ago quarter to $81.6 million. Player unit sales were up 21% year over year, primarily attributed to sales growth in the core retail channels of the company.

Average sales price (ASP) declined 9% due to the company’s strategy of offering players attractive discounts.

Notably, the company launched audio devices including a smart soundbar and a wireless subwoofer under the Roku brand at Best Buy and exclusive models at Walmart (NYSE:) in the United States.

Roku witnessed strong unit sales of Roku TV during the third quarter. The company believes that Roku TV represented more than one in three smart TVs sold in the United States during the first nine months of the year.

Operating Details

Gross margin contracted 20 basis points (bps) on a year-over-year basis to 45.4%. Decline in ASPs affected gross margin.

Operating expenses, as a percentage of revenues, increased 320 bps from the year-ago quarter to 55.6%. Growth in headcount and sales & marketing expenses led to increase in operating expenses.

Sales & marketing (S&M) and research & development (R&D) expenses increased 310 bps and 10 bps respectively. However, general & administrative (G&A) expenses remained flat on a year-over-year basis.

In the third-quarter, adjusted EBITDA loss was $0.4 million. The company reported adjusted EBITDA of $1.9 million in the year-ago quarter.

Operating loss was $26.5 million compared with a loss of $11.7 million in the year-ago quarter.

Balance Sheet & Cash Flow

As of Sep 30, 2019, cash and cash equivalents including short-term investments was $387.5 million compared with $386.5 million as of Jun 30, 2019.

Guidance

For 2019, Roku expects revenues between $1.09 billion and $1.11 billion. The Zacks Consensus Estimate for revenues is pegged at $1.1 billion.

Improvement in monetized video ad impressions is expected to continue through 2019, thereby driving advertising revenues.

Gross profit is expected between $489 million and $494 million. Adjusted EBITDA is expected between $28 million and $33 million.

For fourth-quarter 2019, Roku expects revenues between $380 million and $396 million. The Zacks Consensus Estimate for revenues is pegged at $387.2 million.

The company expects platform revenues to represent roughly two-thirds of total revenues in the quarter including approximately $13 million in revenues from the dataxu acquisition.

Gross profit is expected between $156 million and $161 million. Adjusted EBITDA is expected between $7 million and $12 million.

Zacks Rank & Other Stocks to Consider

Roku currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks include Twin River Worldwide Holdings (NYSE:) , Cumulus Media (NASDAQ:) and Liberty Broadband Corporation (NASDAQ:) , each with a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Twin River Worldwide, Cumulus Media and Liberty Broadband are all set to report their quarterly earnings on Nov 11.

Wall Street’s Next Amazon (NASDAQ:)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>