The Easter holiday in Europe and a lack of scheduled publications in the US ensure a quiet trading session this Monday. Only a batch of data from China provides some volatility.

Chinese stocks were under moderate pressure on Monday, and the Chinese renminbi has changed little since the start of the day. As many expected, investors are concerned that the People's Bank of China did not ease its monetary policy on Friday or Monday. In addition, retail activity is declining – a worrying signal of the impact of lockdowns.

According to the released statistics package, the economy added 1.3% in the first quarter and is 4.8% higher than a year ago. This data is noticeably better than forecasts which expected 0.6% and 4.2%, respectively.

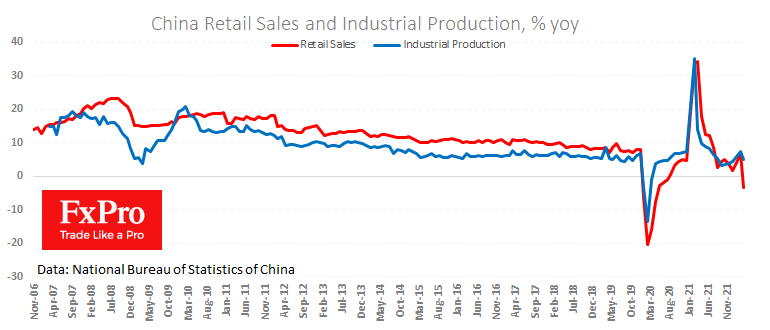

Industrial production added 5% in March compared to the same month a year earlier, better than the 4.0% expected. However, the 3.5% y/y drop in retail sales in response to last month's tight lockdowns caught our attention. To a large extent, they persisted or even intensified in some regions in the first half of April.

At the same time, the resilience of the Chinese renminbi cannot be overlooked. In no small measure, its ability to withstand a strengthening dollar is due to its tighter monetary policy. China seems to be paying more attention to the dynamics of the currency and economic indicators, disregarding the stock market's weakness.

Key equity indices - FTSE China A50, Hang Seng, FTSE China H Share – are now below pre-pandemic levels, in stark contrast to the 8.5% rise in the Chinese yuan against the dollar near the bottom of the last six and a half years. The ability of the renminbi to withstand a rising dollar environment is a demonstration of the strength of the Chinese currency.

Should the dollar trend reverse and retreat from its highs, we could see a serious yuan rally from the current 6.38 with a potential renewal of the 2018 USD/CNH lows at 6.25 or even 2015 when the pair traded below 6.20.