Let's move right into the charts (all courtesy of www.stockcharts.com).

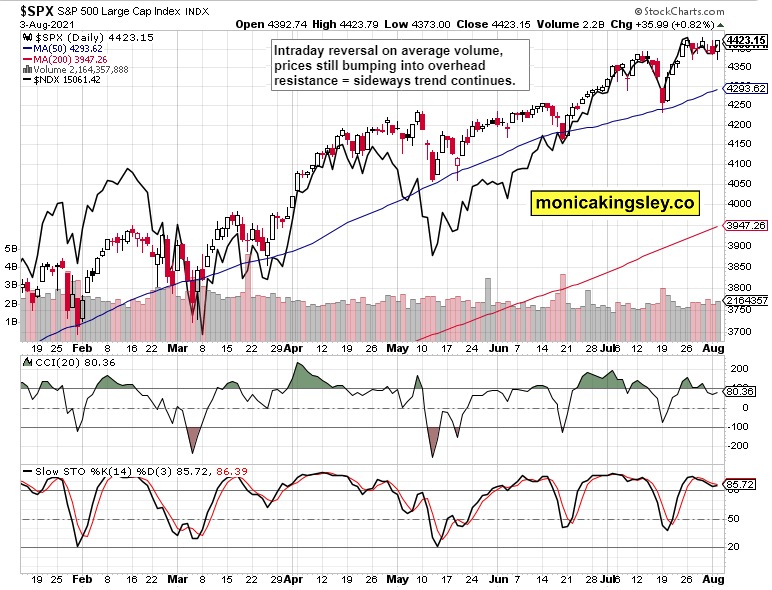

S&P 500 And Nasdaq Outlook

In spite of yesterday's upswing, S&P 500 keeps going sideways, and the indicators aren't all clear on the bulls great prospects. The vulnerability to a bear raid is still very much there.

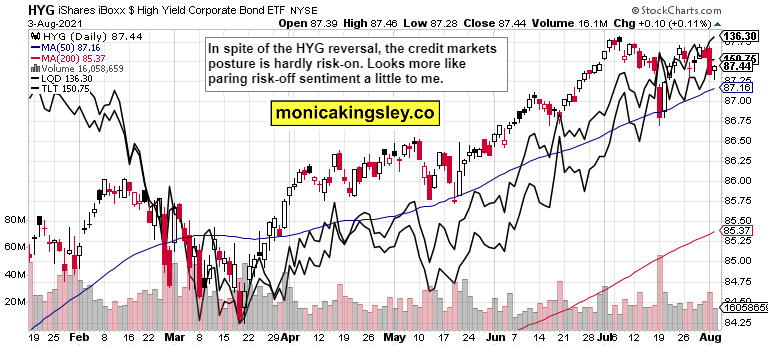

Credit Markets

Credit markets didn't really reverse yesterday. The risk-off sentiment remains very much on in spite of iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG) erasing intraday losses. The stock market bulls aren't out of the woods in spite of the improving market breadth.

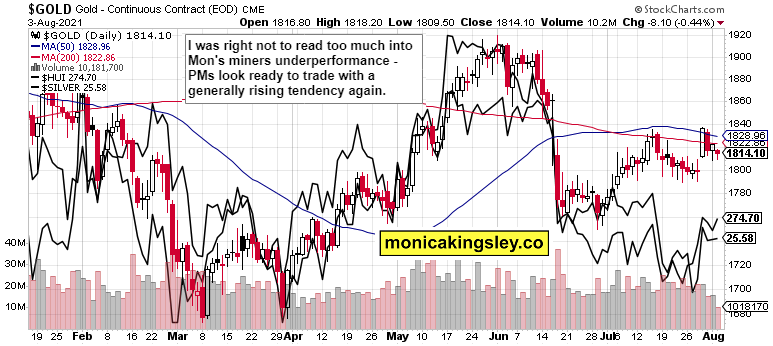

Gold, Silver And Miners

Miners' strong showing yesterday bodes well for both precious metals, and I'm looking for more gains in the sector. Remember that declining real rates on account of the risk-off bond moves, increase gold's appeal just as much as any worries about a decelerating economy or external shocks.

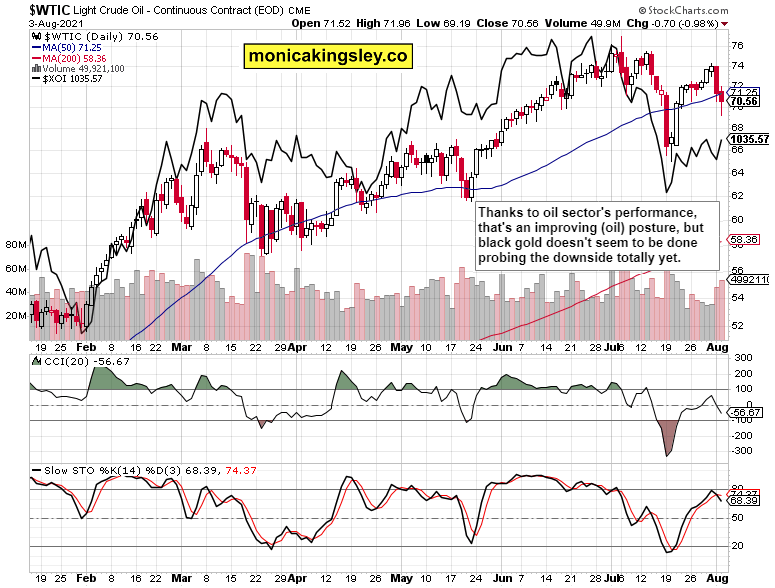

Crude Oil

Yesterday's downswing was partially bought, and the energy sector increase (great performance within the S&P 500) would point to a reversal soon. I'm not convinced that the bottom is in and that the bears have said their last word.

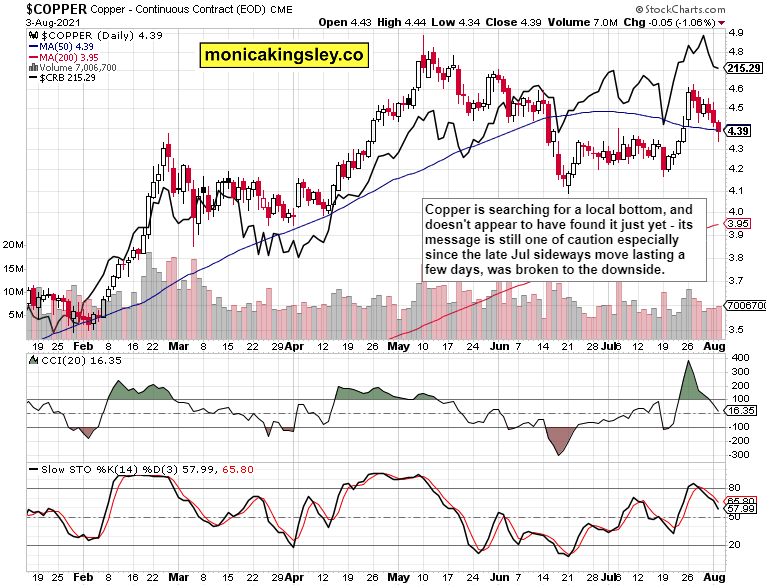

Copper

Copper has traded on a weak note yesterday, and hasn't convincingly stabilized just yet. The volume is indicating buying interest isn't there.

Bitcoin And Ethereum

Trading little changed, both cryptos are more than likely to go higher next, even if the indicators aren't yet hinting at that possibility strongly. Should they turn from here (likely in the current atmosphere, alongside with precious metals), that would be a promising sign for the bulls.