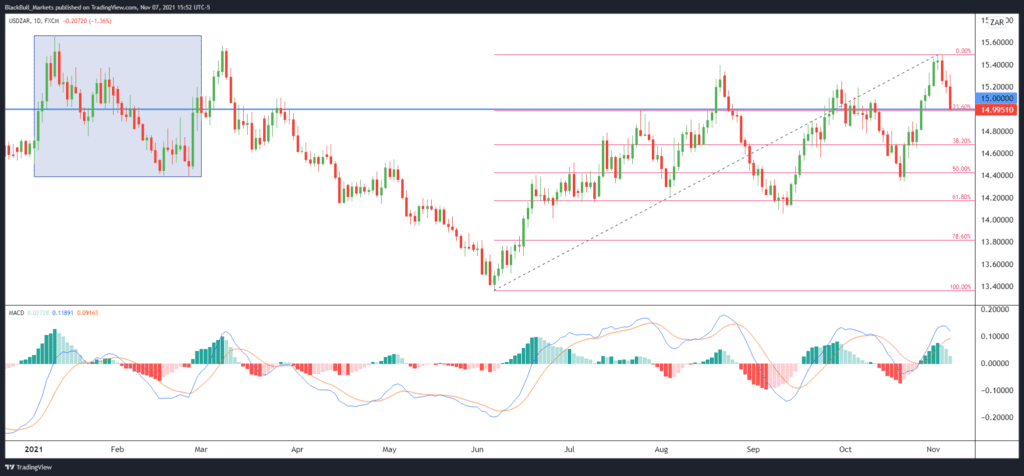

Since we last checked in on USD/ZAR in June 2021, the currency was appreciating toward multi-year highs of 13.37 ZAR per US dollar, previously not seen since January 2019.

In the proceeding five months, leading up to the present, the USD has staged a comeback against the South African currency and is now level with the average exchange value for the first two months of 2021.

Some wild swings occurred during the revival in the USD/ZAR, with many value-overshoots forcing quick corrections. The bullish sentiment didn’t last long without a bearish retracement with this pair.

For the most part, retracements have been hugging close to the Fibonacci levels. What are the factors affecting the USD/ZAR this week?

Risk sentiment will play a large part in the USD/ZAR. Last week saw traders pull away from safer currencies such as the US dollar, indicating a risk-on sentiment was prevalent in the market.

Over last week, coinciding with the start of November, the US dollar depreciated by 1.427% against the ZAR, squeaking below the 15.000 precipices.

There are no hugely critical economic reports due from South Africa this week. However, the ZAR may be under pressure next week after announcing the inflation rate YoY (October).

Inflation is expected to increase by 0.2 percentage points to 5.2%, further pulling away from the South African Reserve Bank’s midpoint inflation target of 4.5%.

Next week, US economic data might be worth watching, including Inflation Rate YoY (October) on Wednesday and JOLTS Job Openings (September) on Friday.

Inflation in the US is predicted to get as high as 5.8% in the October reading, up from 5.4% in September. The JOLTS Job Openings should hopefully show some sign that the tight labor market in the US is beginning to loosen.