The Euro is modestly higher against the rest of its counterparts on the optimism generated by the parliamentary approval in Greece to accept the terms related to the second bailout package (valued at 130 billion Euros).In addition to this, equity markets are trading with a firm tone, on analyst expectations for a stronger Existing Home Sales report out of New York later in the day.The consensus estimate for the housing data is calling for the highest printing since the middle of 2010.

In the UK, macro data will come with Public Sector Cash Requirements and Net Borrowing figures as well as the meeting minutes from the latest Bank of England (BoE) policy meeting and the UK annual budget report.Corporate earnings will be reported by Eurasian Natural Resources Corporation, J. Sainsbury, Silence Therapeutics and Empresaria Group.Currently, FTSE 100 futures are pointing to a mostly unchanged open, so we will probably need to wait for the earnings releases before we see a real pick-up in volatility.

Asian markets were mostly lower overnight, following the losses seen in the S&P 500 yesterday.The downside pressure was helped by news related to Sony Corp., which dropped after a broker downgraded the company’s stock from “Neutral” to “Sell” and Panasonic followed suit on news that the company plans to close its California plant in charge of manufacturing the silicon components in solar cells.The Nikkei 225 closed roughly 0.5 percent lower and is trading closer to major psychological levels at 10,095.

In the US, we will see the MBA Mortgage Applications numbers before North American market open and this will be followed by corporate earnings from General Mills, Discover Financial, Actuant Corp., and Herman Miller.Oracle was one of the bigger stories yesterday, rising 1.5 percent in the aftermarket session after the company released upwardly revised earnings numbers from the third quarter.The major US indices closed lower, however, as the negative stories out of China hurt risk sentiment and led to renewed expectations for lower global GDP numbers into the second half of this year.

Macro data out of Europe is relatively sparse today, with only Swiss M3 Money Supply and Current Account figures out of Portugal scheduled for release. Brenntag AG and Wendel will release their earnings reports during the session but expectations are tepid and this is pushing down futures in both the DAX and CAC. GBP/USD" title="GBP/USD" width="764" height="390">

GBP/USD" title="GBP/USD" width="764" height="390">

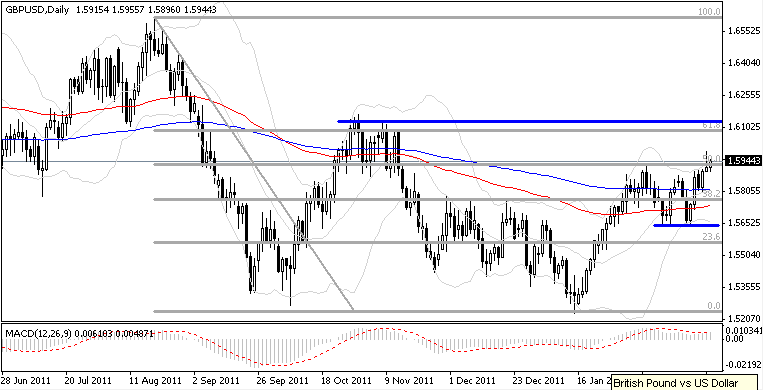

The GBP/USD looks to be forming a head and shoulders pattern on the shorter term time frames.One argument supporting this can be seen with the slightly lower support below the 1.5630 region.Conservative traders will need to see a break here to confirm the pattern but given the lower highs, relative to what was seen in November and August of 2011, support is less likely to contain prices.Aggressive traders can establish shorts at current levels with stops above 1.5980.

The Nikkei 225 continues to press higher in the face of major long term resistance at 10130, which is a historical high as well as the downtrend line seen on the weekly and monthly charts.Even though we haven’t seen any major pullbacks here, we are seeing a doji candlestick formation which suggests that momentum is slowing and a reversal could be imminent.Risk to reward still favors short positions.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Risk Sentiment Aided by Greek Bailout Approval

Published 03/21/2012, 07:44 AM

Updated 07/09/2023, 06:31 AM

Risk Sentiment Aided by Greek Bailout Approval

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.