The World Cup has trumped forex so far in trade this week, with the major currencies consolidating in relatively tight ranges against one another. The US dollar is consolidating against its, gaining ground against the commodity dollars and pound sterling but losing ground against traditional safe havens like the yen and Swiss franc.

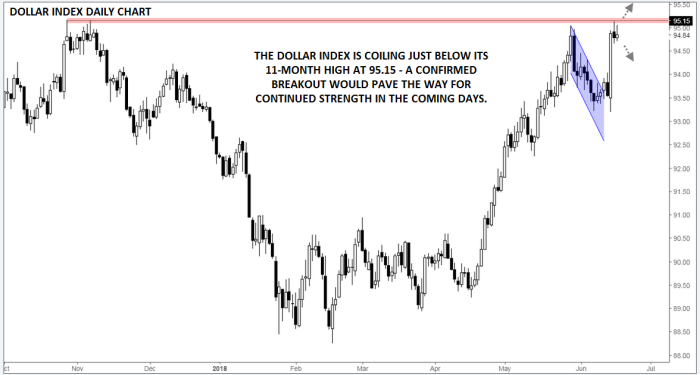

The US Dollar Index, which measures the performance of the world’s reserve currency against a weighted basket of six of its major rivals was testing a critical level as went to press on Tuesday. The index surged up to test its 11-month high at 95.15, breaking out from a bullish flag pattern in the wake of both Wednesday’s FOMC and Thursday’s ECB meetings; this level capped rates in October, November and late May as well.

Short-Term Trade

Over the last two days, the dollar index has formed two small-bodied candles, signaling indecision among USD traders. Whether this consolidative price action precedes a breakout above resistance – or a pullback from the key 95.15 ceiling – remains to be seen, but because traders have had an opportunity to digest last week’s big moves, short-term traders can have more confidence playing a break from Friday’s range.

Source: Trading View, FOREX.com

Fundamentally speaking, the highlight of this week’s trade may well be Wednesday’s central-banker panel at the ECB Forum, when the heads of the Federal Reserve, European Central Bank, Bank of Japan and Reserve Bank of Australia will discuss policy and issues in central banking. Otherwise, Thursday’s BoE meeting and Friday’s Canadian CPI report could each influence their respective currencies, with a potential spillover effect on the USD.

Cheers