Today I’m going to peer into my crystal ball and give you the scoop on where high-yield closed-end funds (CEFs) might be headed in 2019.

Then I’ll give you a proven way to zero in on the ones that are the best bargains for your portfolio now.

CEFs Come Out Flying

First, if you own stocks through CEFs, you’re already outrunning the market: my CEF Insider Equity Sub-Index—a great proxy for stock-owning CEFs—is up 13.7% since January 1, a nice lead on the S&P 500’s 12.3% gain.

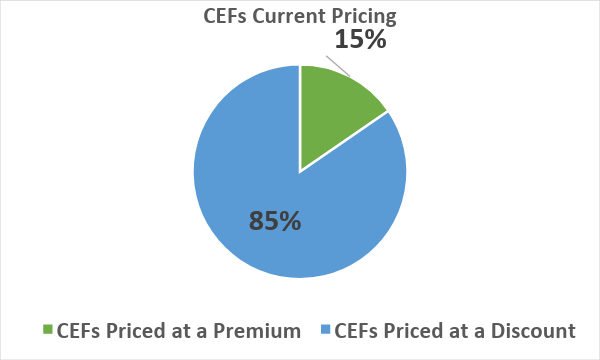

Even better, CEFs are cruising upward without getting ahead of themselves—exactly what we want in a rock-solid income play. As you can see below, 85% of these funds are still cheap when you compare their market prices to their net asset values (NAVs, or the liquidation value of their portfolios):

CEFs Are Still Bargains …

Source: CEF Insider

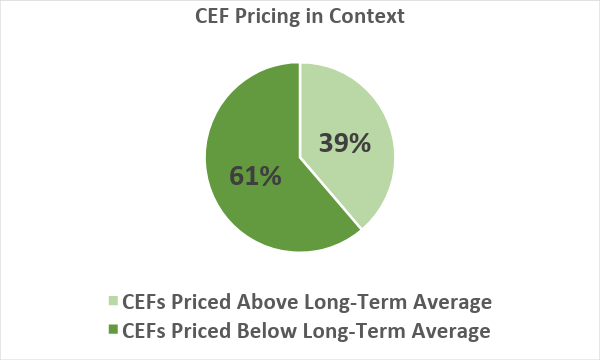

Even better for those of us on the hunt for cheap, outsized dividends, well over half of CEFs are trading at discounts bigger than their long-term averages:

… and Discounts Are Bigger Than Ever

Source: CEF Insider

That points to even more upside for us this year, as we tap the incredible 7%+ dividend payouts you can grab from CEFs (including the 18 in our CEF Insider service’s portfolio, which yield an outsized 7.3%, on average, as I write this)

Two Numbers Point to Big CEF Bargains (and Ripoffs, Too)

So how do we hone in on the highest, safest dividends in the CEF space while hedging our downside?

A great strategy (and one I use myself) is to look at funds where NAV and market-price returns vary widely, then spot whether this gap is justified by what’s happening in the market or in the fund itself.

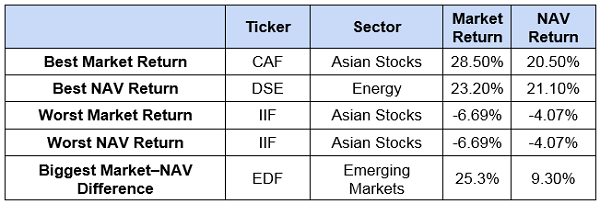

To see this in action, let’s look at the CEFs with the best and worst returns so far this year, by both market price and NAV, plus the fund with the biggest difference between the two:

Let’s start with the Morgan Stanley (NYSE:MS) China A Share Fund (CAF), which fell 18% on a NAV basis and 14.3% on a market-price basis in 2018. That mimicked the Chinese market, which dropped 19.2% last year.

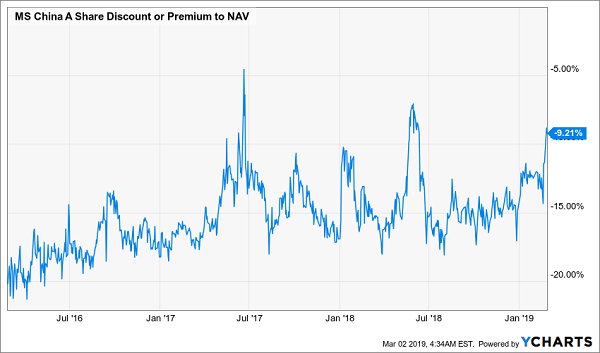

Thus, the fund’s market-price and NAV rebounds in 2019 reflect investors returning to Chinese stocks, which is also driving CAF’s premium to spike suddenly—a common move for the fund after a selloff:

CAF Gets Pricey After a Huge Run

The risks here are clear, but they’re also pretty closely tied to those of Chinese stocks as a whole.

Let’s skip ahead to the India Fund (IIF), because the story there is similar. IIF’s weak NAV return and market return are the result of India’s economy, which is expected to see slowing growth in 2019 and 2020 after beginning to ratchet back in late 2018. Recent tensions with Pakistan don’t help things, so this fund’s decline is pretty rational and unsurprising.

Now let’s consider the Duff & Phelps Select Energy MLP & Midstream Energy Fund (DSE), whose huge NAV return is better than the energy sector’s 15.5% gain for 2019.

Part of DSE’s strong showing in 2019 stems from energy’s rise, but there’s something going on inside the fund, too. In late November, DSE began shifting from investing in energy MLPs to midstream MLPs, a more narrow sector that was extremely oversold in 2018, so has bounced back fast in 2019.

The timing of that change was particularly good, narrowing DSE’s discount slightly, to 9.9%, from where it was in November. Again, a rational response to a change in the fund’s fundamentals.

When a High Yield Signals Danger

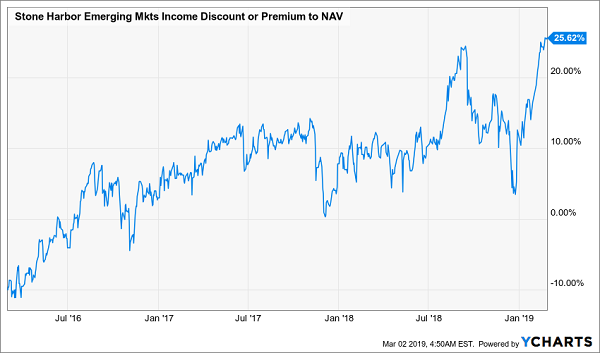

Finally, what’s up with the Stone Harbor Emerging Markets Income Fund (EDF (PA:EDF)) and the huge discrepancy between its market price and NAV returns? This is where we see the irrationality of the CEF world really shine through.

EDF is a poorly performing emerging-market fund with a high expense ratio (2.96%!). Despite those massive fees, the fund’s total NAV return over the last five years has been a measly 3.4% annualized, far below the S&P 500 and hundreds of other CEFs.

This is partly due to the complex emerging-market debt the fund invests in, partly due to fees and partly due to poor decisions, like holding over 10% of its assets in Argentinian debt (yes, the country that has defaulted more than once). This is a fund that should be sold cheap, but its current premium to NAV is not only one of the highest of any CEF, it’s at an all-time high:

Lousy Performance Brings … a Premium!?

Why has that premium been climbing lately? Yield-chasers are driving up its market price: EDF has never cut its dividend and now pays a shocking 15.9% yield. If you only look at that yield, this seems great. But unfortunately, EDF’s returns are less than a quarter of its yield, which means its dividend is not being covered by gains and will be cut.

And while first-level investors have driven EDF’s price sky-high, the fund is a rarity now; many CEFs are fairly priced (and quite a few are still cheap!), despite strong gains so far this year.

Yours Now: 8.3% Dividends and Big Gains From America’s Top Stocks

CEFs’ discounts to NAV make them hands down the best way to buy stocks.

Why?

Because these weird markdowns are basically free money! Why would you buy a “regular” stock when you could buy through a CEF and get it for 10% to 20% off? It’s a no-brainer!

And don’t let EDF’s spooky 16% dividend drive you away—there are plenty of CEFs paying safe high single- and double-digit dividends, and some even pay them monthly!

My top pick of the bunch holds some of the best stocks in the pharma and biotech sectors and has clobbered the market, with a monstrous 904% return since inception:

This Market-Slayer Is Still Cheap!

Plus, this fund throws off an incredible 9.8% dividend!

And as I write, this stout income play—which has traded at fat premiums many times in the past—goes for a totally unusual 7% discount. That sets us up for even more “bounce back” upside while we pocket that huge 9.8% payout!

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets.