Investors in high-yield real estate investment trusts (REITs) are still living in 2020, and we can tap that for 7% dividends and price upside in the coming weeks.

Let’s start where just about every investment story begins these days: the spring 2020 crash. One thing that stood out during that chaotic time was the relative ease with which workers made the shift to working from home. That gave rise to fears that companies would cut back on office space, an obvious negative for REITs that own office towers.

On the retail side, mall REITs started chasing rent checks from store owners, who were dealing with both COVID restrictions and the accelerated shift to e-commerce.

So it’s no surprise that REITs took it on the chin back then.

Stocks Recover, Real Estate, Not so Much

What’s surprising, though, is that a year later, REITs are still far behind the market, even though their outlook is much brighter today. Now that 30% of the US population has had at least one dose of the vaccines and some states are starting to reopen, real estate should be on an uptrend. And while REITs saw a bit of a bump in recent months, after the vaccines were approved, they’ve mostly moved sideways since.

This is our buy window. Now let’s look at why this contrarian opportunity exists, and a 7%-yielding closed-end fund (CEF) that’s nicely positioned to exploit it.

Why REITs Are A Coiled Spring

Although it is obvious that the post-COVID office will be different than before—with more “hybrid” workspaces, where workers sometimes work from home and sometimes work in the office, seeming likely—that doesn’t necessarily mean overall demand for office space is going to fall.

Rather, many companies are already reopening their offices, and they aren’t just “traditional” firms like banks and insurers. Facebook (NASDAQ:FB), for example, is planning to reopen its offices in May, and many other tech firms will likely follow.

And when they do reopen, expect a new normal to come into effect, with the pandemic forcing companies to space out their workers more, and use space more creatively. This could actually cause more demand for space over the long-term, benefiting REITs that can accommodate this shift.

Plus, there’s the retail and restaurant boom we all know is ahead, with many people yearning to get out again once they feel it’s safe to do so. Already in the United Kingdom, which is running ahead of the US in terms of the percentage of population vaccinated, would-be customers are reserving seats at pubs across the country weeks in advance.

A 7%-Payer Built For The Post-COVID Real Estate Market

This is where the CEF I mentioned a second ago comes in. This 7% yielder, called the Cohen & Steers Quality Income Realty Fund (NYSE:RQI), holds 159 REITs that own various types of real estate, with cell-tower landlord American Tower (NYSE:AMT) and self-storage firm Public Storage (NYSE:PSA) being its top holdings during pandemic times.

Demand for cellular service has soared with many people stuck at home, boosting American Tower. And Public Storage has seen a boost in demand for its services as cooped-up online shoppers bought more stuff for their houses.

Now, RQI is beginning to pivot for a post-COVID-19 world with added holdings in the retail space, and I fully expect that pivot to be successful, due to RQI’s strong track record of navigating the shifting real estate sector.

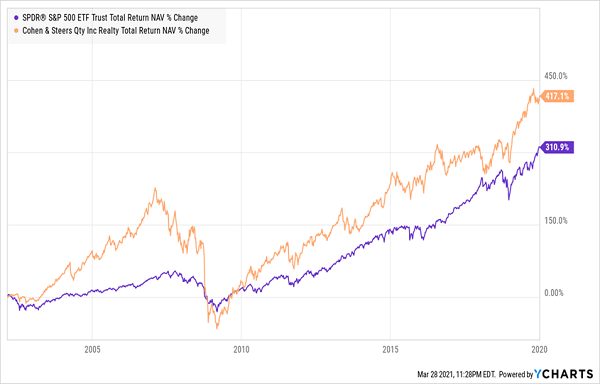

RQI’s Savvy Managers Lead The S&P 500

Before the pandemic, RQI’s NAV (which is our best measure of the fund’s performance, because it tracks the performance of the holdings its managers pick) was beating the broader market by nearly a third from its inception through to the start of 2020, with a 9% annualized total return. Obviously, 2020 slowed the fund down, but not by much—it’s still beating the broader market, despite an awful 2020 for REITs.

RQI Keeps The Lead

That’s because RQI’s managers have been identifying the right pockets of the real estate market for a long time, giving investors a reliable income stream and capital gains along the way.

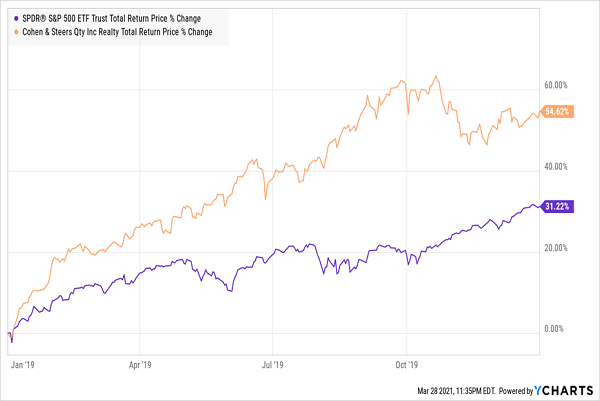

And in good times for real estate, the fund is a real workhorse. Take 2019, for instance. In the prior year, fears of rising interest rates caused real estate to be undervalued. That set up real estate for a fast rebound in 2019—and RQI’s managers drove the fund to a particularly big gain that year:

A Quick Post-Drop Turnaround

And 2021 is looking a lot like 2019 for both real estate and RQI. But the clock is ticking. Often when this setup happens, investors buy aggressively into RQI, and that’s likely to happen again in the next few weeks.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."