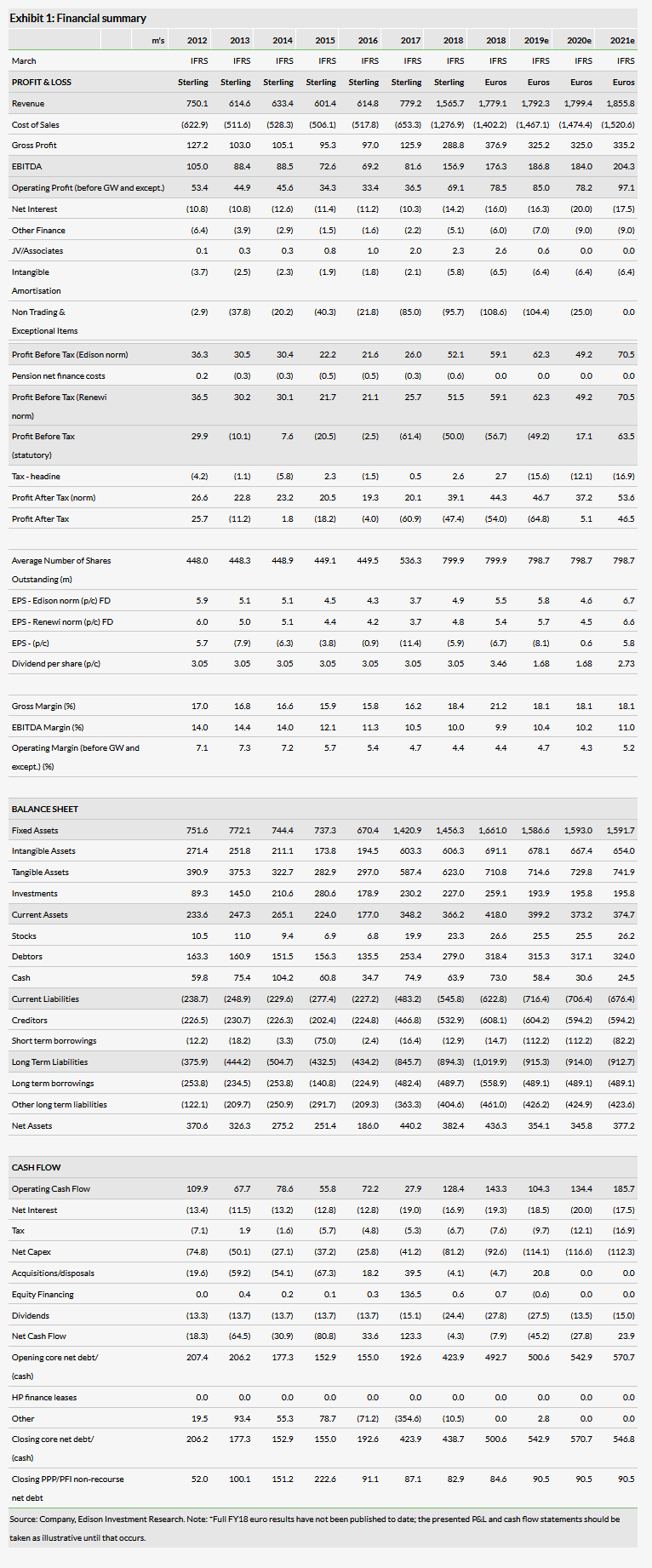

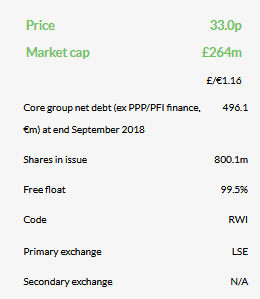

Management flagged stronger Q4 trading, in line with its expectations. Netherlands soil remediation activities require regulatory approval and a prudent stance has been taken over resuming shipments there, which is the primary driver of our significant estimate reduction. In this light, the steps being taken for debt management, including a proposed dividend reduction, are entirely logical. Renewi PLC (LON:RWI)’s rating is at depressed levels – we feel due to earnings uncertainty and higher debt levels – but potential resolutions to both issues are visible. The company is still yielding 4.4%.

FY19 in line, guidance reduced for FY20

The Commercial division had a stronger Q4 including delivering planned synergies following price increases at the start of the quarter. As seen at the H1 stage, other divisional performances remain variable but overall group profitability was as management anticipated. Cost-reduction actions are underway in all divisions to improve performance and plant efficiencies, which will strengthen the group platform for future growth. Separately, we now expect total exceptional charges, which are mainly noncash, of €80m+ in H2, over half of which (c €45m) relates to the Derby energy from waste project delays and financial difficulties at prime contractor Interserve. Other components include synergy delivery costs and proactive provisioning at UK Municipal ELWA, given possible Brexit impacts.

Looking ahead, guidance is now to expect no resumption of remediated soil deliveries from ATM in FY20, which explains over two-thirds of our 36% lower group PBT for that year (with a 20%+ reduction in FY21 also). The existing 3.5x net debt: EBITDA covenant has been extended for a further year (previously due to step down to 3.25x in June), which looks sensible given our projected c 3x end FY19 position and allowing for some normal seasonal working capital fluctuation. A flagged dividend reduction (to 1.45p/1.68c) for the year including a proposed 0.5p final, versus our previous expectation of a flat 3.5c (3.05p) payout), forms part of this debt management strategy. Previously flagged disposals (ie Hazardous, Reym, and Municipal, Canada) are said to be progressing, with the latter business at the due diligence stage, and are expected to reduce net debt in due course.

Valuation: Event-driven net debt reduction upside

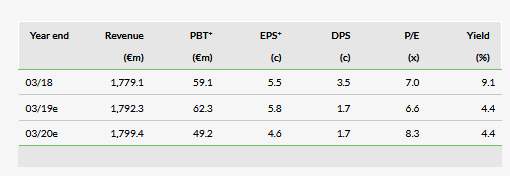

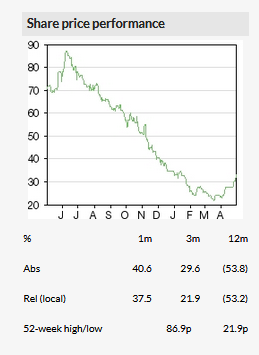

Renewi’s share price has rallied to January 2019 levels but remains over 60% below its 86.9p year high (June 2018) with estimates also under pressure during this time. Factoring in our revised forecasts, the FY20 P/E has compressed to 8.3x with EV/EBITDA of 4.9x, which become 5.7x and 4.2x respectively one year further out. The group net debt position could improve significantly if disposals complete and/or the ATM position is resolved, although the timing is uncertain. Even following the proposed dividend reduction, Renewi is yielding 4.4%.

Business description

Renewi is a waste-to-product company with operations primarily in the Netherlands, Belgium and the UK and was formed from the merger between Shanks Group and Van Gansewinkel Group in 2017. Its activities span the collection, processing and resale of industrial, hazardous and municipal waste.