Red Hat (RHT) traded -12% lower on Friday morning, after beating Wall Street earnings estimates but missing on guidance.

The company reported earnings per share of $0.72 and total revenue of $813 million, beating analyst estimates of $0.69 and $807 million. For next quarter, they project earnings of $0.81 and revenue of $822-$830 million, below expectations of $0.88 and $856 million.

While 12% may seem like a steep price to pay for weak guidance, investor expectations were high and the stock has been on a tear, more than doubling since early 2017. Subsequent downgrades by stock analysts including Raymond James, BTIG, Mizuho, and Zacks, may have added fuel to the fire.

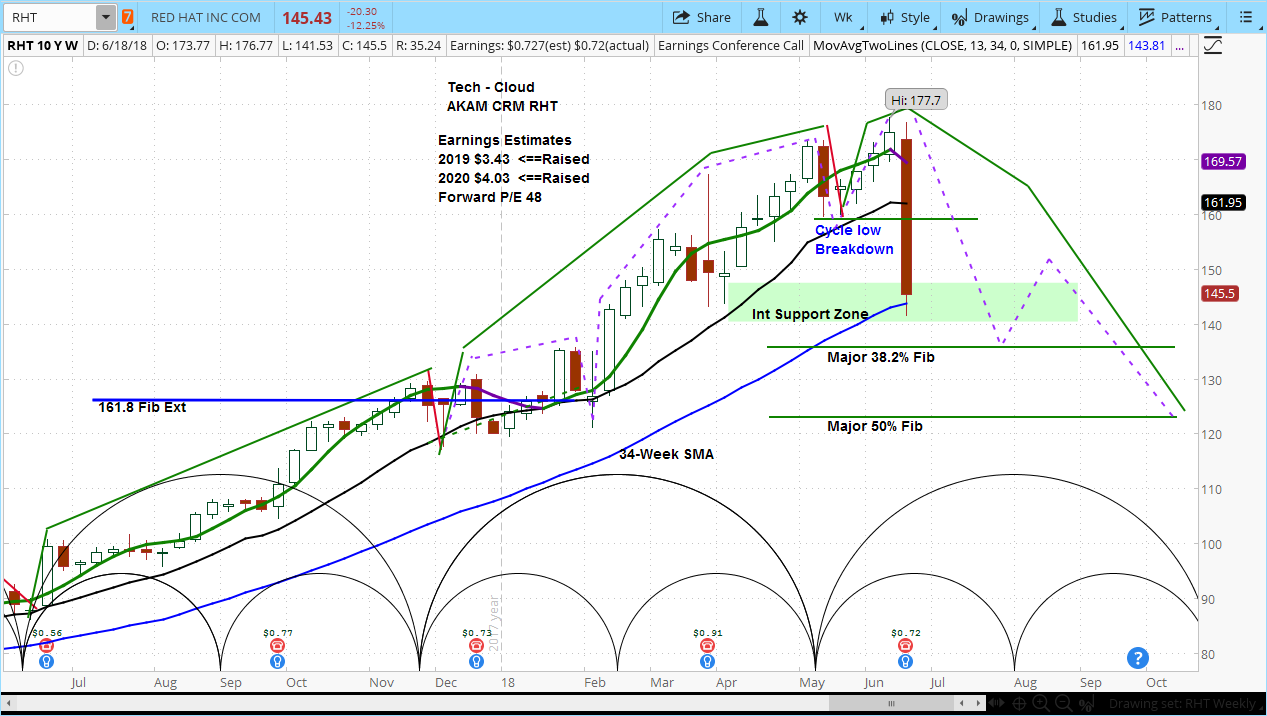

Looking at the market cycles on the RHT weekly chart, we can see that while only halfway through its current minor cycle, the stock has already broken through the cycle low. This means that this is likely a major top. It also means the odds are high that we will see further downside, as it will spend plenty of time in the declining phase before the cycle concludes.

The market cycles point to important lows in August and then further declines into October. Our target is below $122.

For more on cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Red Hat Drops 12% After Earnings, Signalling Major Top

Published 06/22/2018, 11:57 AM

Updated 07/09/2023, 06:31 AM

Red Hat Drops 12% After Earnings, Signalling Major Top

Latest comments

You already missed the big drop. Too late

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.