The surge higher in rates after the US CPI was brief only, but clearly central banks still need to deliver on promises as inflation is set to grind lower, only slowly.

The European Central Bank is locking in on a July hike and possibly positive rates by year end, converging with markets, though still more cautious on what lies beyond policy normalization

Psychologically important levels rejected, for now

The initial reaction to the US CPI was higher rates, but in the end markets took comfort in the details showing a few components being responsible for the upward surprise—this was capped off by a decent 10Y US Treasury auction and in the end, the 10Y yields dipped below pre-CPI levels.

In short, the revisit of plus-3% levels was only very brief.

The discussion around possible 75bp hikes may not entirely be put to rest just yet

Nonetheless, the curve did flatten as the data also made clear that it will be a slow grind lower for inflation. This means the Fed is still under pressure to deliver a series of rate hikes, with our economist looking for a 50bp hike at each of the upcoming three meetings.

For markets, the discussion around possible 75bp hikes may not entirely be put to rest just yet, even though the Fed’s arch-hawk Bullard suggested the 50bp hikes were a good benchmark “for now.”

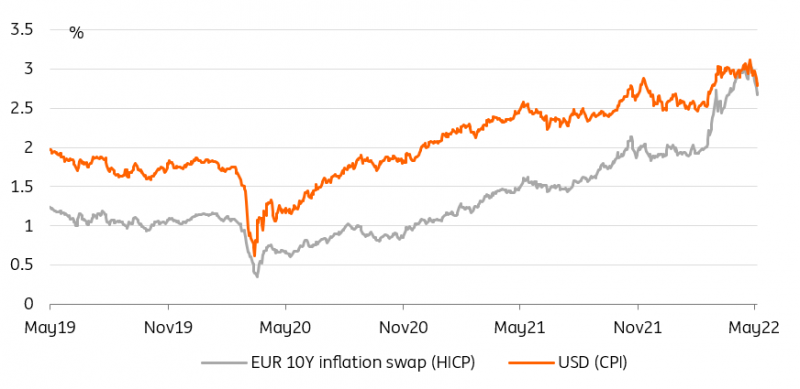

Even if inflation expectations inched up slightly yesterday, we think that the overall decline since late April is in part a reward for the Fed’s more aggressive approach.

Starting to reap the rewards of more aggressive action

Source: Refinitiv, ING

ECB wants to end negative interest rate policy quickly, but is wary of what comes after

Even if late to the game, the ECB has also started to reap that reward of pushing more aggressively towards the exit from extraordinary monetary policies.

Lagarde, true to her form of not taking explicit positions, restated in connection with the timing of the ECB’s first rate hike after the end of net asset purchases that “some time” can be as short as several weeks.

With purchases seen ending with the end of 2Q, this has been taken as a further cue that indeed the ECB Council has now locked on July as the central bank’s rate lift-off date.

The ECB has now locked on July as lift-off date

ECB Schnabel’s speech yesterday was another call for swift normalization. But she also cautioned that achieving the ECB’s mandate does not necessarily require the central bank suppressing domestic demand.

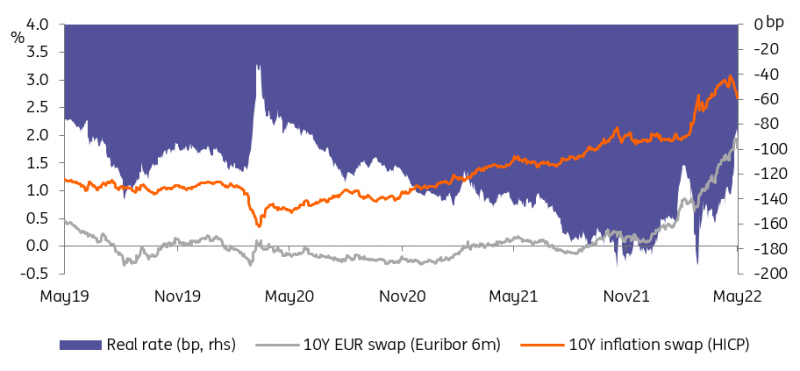

The impact of the war and tightening global financial conditions were already dampening demand. In the US, the 10Y real rate is back into positive territory after a remarkable rise, clearly signaling an end to easy financial conditions.

In Europe, this rate remains deeply negative despite its recent 50bp increase, a point that Schnabel has also highlighted in her call to action. If that were the benchmark, there is more upside in yields.

Financial conditions are already tightening, but from very easy levels

Source: Refinitiv, ING

Bloomberg cited unnamed sources that the Council was also gathering around the view that ECB rates may return to positive territory before the end of the year.

Some ECB members had voiced this view already, but it appears three hikes before the year is out is also becoming ECB consensus. To be clear, the market has eyed the possibility of positive overnight rates by December at least since the start April.

The reiterated calls for gradual adjustments reflect a sense of caution

The ECB has a stated desire to normalize before the window of opportunity closes, but the reiterated calls for gradual and data dependent adjustments also reflect a clear sense of caution.

The macro outlook is starting to get loud also as the Ukraine conflict drags on and COVID disruptions in China look to become more protracted. Market pricing, though, remains aggressive beyond normalization, seeing overnight rates above 1.25% by the end of 2023, an additional four 25bp hikes next year beyond the return to positive interest rates.

Today’s events and market view

Despite the upside surprise in the US CPI data the psychologically important levels of 3% in US Treasuries and 1% in 10Y Bunds have been rejected. However, we remain wary about calling a top in rates just yet as markets will still have to digest a series of 50bp hikes from the Fed and importantly, the first rate hike from the ECB.

After this morning’s UK GDP data only the US initial jobless claims are of note among an otherwise quiet data calendar.

In supply, the focus is on Italy selling up to €6.75bn in 3Y, 7Y (new) and 30Y bonds after spreads have started to retreat from their recent highs. Ireland sells up to €1.25bn in 10Y and 23Y bonds. The US Treasury will sell 30Y bonds.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more