Premium lifestyle products retailer, Ralph Lauren Corporation (NYSE:RL) seems to be striking the right chords as evident from the progress made on its Way Forward Plan and other Restructuring initiatives. The cumulative effect of this progress is not only reflected in the company’s solid earnings surprise trend but has also seeped in to the recent stock performance.

Shares of Ralph Lauren have shown significant growth last month as against its dismal past performances. The stock witnessed a solid 19.4% growth in the past month, outperforming the industry’s 4.7% upside.

Further, this apparel retailer boasts a VGM Score of A and has a long-term EPS growth rate of 15%. That said, let’s take a closer look at the factors behind this solid performance.

Q1 Performance Reflects Progress on Strategic Plan

Ralph Lauren’s first-quarter fiscal 2018 performance was a testimony to its progress on the Way Forward Plan and Restructuring initiatives that was announced in Jun 2016. Divided in two parts, the plan is all about refocusing on the core, strengthening the brands and returning the company to profitable growth in the long term.

During the fiscal first quarter, the company enhanced quality of sales by reducing promotions and markdowns, alongside reducing Stock Keeping Units (SKUs) count to drive productivity. Further, the company improved inventory turns by curtailing inventory levels by 31% year over year and also achieved cost savings by lowering operating costs. Additionally, the company is keen on optimizing its wholesale distribution by shutting down underperforming points of distribution.

Earnings Trend & Outlook

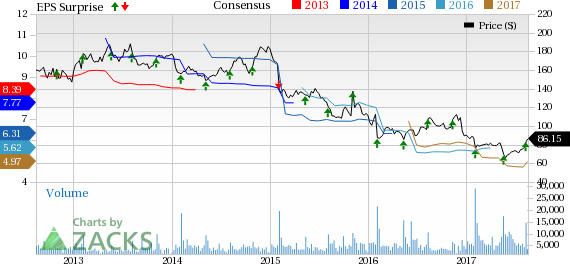

Ralph Lauren flaunts a solid earnings history, with positive earnings surprises delivered in 15 out of the last 16 quarters. Notably, first-quarter fiscal 2018 marked its 10th consecutive earnings beat. Further, the bottom line grew year over year and gross profit margin continued to expand – thanks to favorable geographic and channel mix shifts along with lower promotions and cost-controls. Also, the company curtailed operating expenses, which in turn drove operating margin expansion.

Looking ahead, management remains confident of Ralph Lauren’s performance based on its efforts related to global brand reorganization, constant infrastructural investments and eCommerce enhancements. Further, the company’s efforts to evolve product and marketing bode well. Additionally, management lowered effective tax rate forecast for fiscal 2018, which we believe should benefit the bottom line.

Positive Estimate Revisions

These factors led to an uptrend in the Zacks Consensus Estimates in the last seven days. The Zacks Consensus Estimate for the second quarter and fiscal 2018 rose to $1.77 per share and $4.89 per share, respectively, from $1.70 and $4.81.

Sales Continue to Decline

While all is well with this New York-based company, its sales continued to be soft due to weak demand, brand exits and efforts to drive quality of sales. This marked the company’s second consecutive sales miss.

Currency Headwinds

Apart from the aforementioned factors, foreign currency continued to have an adverse impact on Ralph Lauren’s top-line and margins in the most recent quarter. In fact, currency has long been a hindrance for Ralph Lauren, given its international exposure. Currency impacted revenues by nearly 130 basis points (bps) and operating margin by 50 bps in the fiscal first quarter.

Further, it anticipates the headwinds to continue to impact results in second-quarter fiscal 2018. For the second quarter, the company expects currency headwinds to hurt revenue growth and operating margin by nearly 40 bps, each.

Conclusion

While the company’s soft top-line picture is discouraging, we commend its progress on its strategic plans, which should bear fruit in the long term. Further, we note that the soft sales performance is more or less a function of its ongoing revival efforts and should recover as the company implements its plans. Aptly, Ralph Lauren currently carries a Zacks Rank #3 (Hold).

Meanwhile, investors interested in the space can also count on Michael Kors Holdings Limited (NYSE:KORS) , PVH Corp. (NYSE:PVH) and Lululemon Athletica Inc. (NASDAQ:LULU) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Michael Kors, with long-term EPS growth rate of 8.3%, has increased 15.2% in the last six months.

PVH Corp. has a long-term EPS growth rate of 12.6%. Further, the company has soared 40.5% in the last six months.

Lululemon has a long-term EPS growth rate of 12.6%. Further, the company has to its credit a positive earnings surprise of 5.7% for the trailing four quarters.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

lululemon athletica inc. (LULU): Free Stock Analysis Report

Ralph Lauren Corporation (RL): Free Stock Analysis Report

PVH Corp. (PVH): Free Stock Analysis Report

Michael Kors Holdings Limited (KORS): Free Stock Analysis Report

Original post

Zacks Investment Research