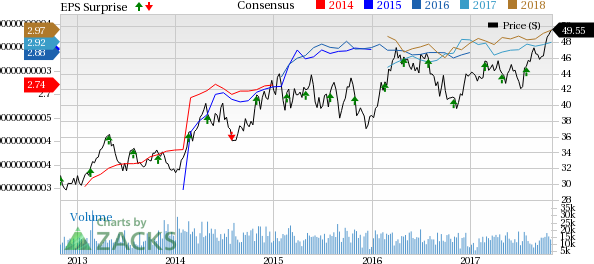

Public Service Enterprise Group Inc. (NYSE:PEG) or PSEG reported third-quarter 2017 adjusted operating earnings of 82 cents per share, which missed the Zacks Consensus Estimate of 84 cents by 2.4%. The bottom line also declined 6.8% on a year-over-year basis.

Excluding one–time adjustments, the company reported quarterly earnings of 78 cents per share compared with 64 cents in the third-quarter 2016.

Total Revenue

Revenues of $2,263 million in the quarter missed the Zacks Consensus Estimate of $2,545 million by 11.1%. Also, the figure declined 7.6% from the year-ago figure of $2,450 million.

During the reported quarter, electric sales volume declined 8.3% to 11,735 million kilowatt-hours, while gas sales volume decreased 44.2% to 481 million therms.

For electric sales, results reflected a 4.7% drop in the commercial and industrial sector, 13.9% decline in residential sector, 4.8% fall in street lighting and 9.5% drop in interdepartmental sector.

Total gas sales volume in the reported quarter declined on 57.1% drop in non-firm sales volume of gas and 4.2% decline in firm sales volume of gas.

Highlights of the Release

During the third quarter, the company reported operating income of $693 million up from $577 million in the year-ago quarter. Total operating expenses were $1,570 million, down 16.2% from the year-ago quarter figure.

Interest expenses in the reported quarter were $100 million compared with $99 million in the year-ago quarter.

Segment Performance

PSE&G: Segment earnings were $246 million, down from $255 million in the prior-year quarter. Quarterly results reflect PSE&G’s expanded investment in electric and gas transmission and distribution facilities.

PSEG Power: The segment earnings were $158 million compared with $170 million a year ago. The downturn was due to a decline in energy prices and the effect of cooler-than-normal weather on demand and output.

PSEG Enterprise/Other: The segment earnings were $13 million compared with $19 million in the third quarter of 2016.

Financial Update

As of Sep 30, cash and cash equivalents were $278 million compared with $423 million as of Dec 31, 2016.

Long-term debt as of Sep 30 was $12,524 million, up from the 2016-end level of $11,395 million.

Public Service Enterprise Group generated $2,734 million in cash from operations in the nine months, down from the year-ago figure of $2,761.

2017 Guidance

The company maintained its 2017 guidance. Earnings are still projected in the range of $2.80-$3.00.

PSE&G’s operating earnings are anticipated in the band of $945-$985 million. The company also reiterated its PSEG Power operating earnings guidance in $435-$510 million range.

Additionally, PSEG Enterprise/Other’s operating earnings expectations are reaffirmed at $35 million.

Zacks Rank

Public Service Enterprise Group holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Peer Releases

Entergy Corporation (NYSE:ETR) reported third-quarter 2017 operational earnings of $2.35 per share beating the Zacks Consensus Estimate of $2.24 by 4.9%. The reported number also improved 1.7% from the year-ago figure.

DTE Energy Company (NYSE:DTE) reported third-quarter 2017 operating earnings per share (EPS) of $1.48 missed the Zacks Consensus Estimate of $1.53 by 3.3%. Operating earnings also declined 24.5% from the year-ago figure of $1.96.

American Electric Power Co., Inc. (NYSE:AEP) reported third-quarter 2017 operating EPS of $1.10 missed the Zacks Consensus Estimate of $1.19 by 7.6%. The bottom line also declined 15.4% from $1.30 reported a year ago.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

American Electric Power Company, Inc. (AEP): Free Stock Analysis Report

Entergy Corporation (ETR): Free Stock Analysis Report

DTE Energy Company (DTE): Free Stock Analysis Report

Public Service Enterprise Group Incorporated (PEG): Free Stock Analysis Report

Original post

Zacks Investment Research