Proto Labs, Inc. (NYSE:PRLB) is scheduled to report first-quarter 2017 results on Apr 27, before the market opens.

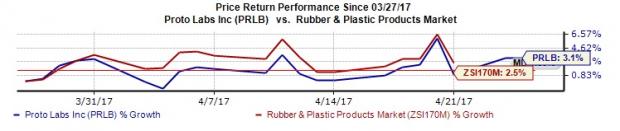

Over the last one month, the company’s shares yielded 3.12% return, outperforming the gain of 2.45% recorded by the Zacks categorized Rubber & Plastic Products industry.

Over the last four quarters, the company reported better-than-expected results in one, in-line results in one, while lagging estimates in two. Average earnings surprise was a positive 0.43%. Let us see how things are shaping up for Proto Labs this quarter.

Factors to Influence Q1 Results

We believe that efforts undertaken in the past few quarters to improve sales performance and operational efficiency will prove beneficial for Proto Labs in the to-be-reported quarter and beyond. Also, an efficient management and marketing team as well as emphasis on research and development of new and improved products will add to the growth momentum.

Inorganic initiatives have been important for Proto Labs’ expansionary policy over time. The company is poised to reap benefits from its acquisition of select assets and operations of German-based manufacturer, Alphaform AG. The buyout will boost the company’s 3D printing operations in Europe. In addition, the expansion of its manufacturing facilities in North Carolina and Japan as well as increase in its Liquid Silicone Rubber and lathe offerings will be advantageous.

Moreover, any shares repurchased under the company’s authorized $50 share buyback program in the first quarter will eventually boost earnings per share.

Despite such positives, Proto Labs is exposed to risks arising from global economic uncertainties and stiff competition from other prototype manufacturers. Also, any failure in the research and development of new products or inability to meet the specific requirements of the customers might severely impact its profitability.

Earnings Whispers

Our proven model does not conclusively show that Proto Labs is likely to beat earnings this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

That is not the case here as you will see below.

Zacks ESP: Earnings ESP of Proto Labs is currently 0.00%. This is because both the Most Accurate Estimate and the Zacks Consensus Estimate stand at 40 cents.

Zacks Rank: Proto Labs’s Zacks Rank #3 when combined with 0.00% ESP makes surprise prediction difficult.

Note that we caution against stocks with Zacks Rank #4 or #5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some companies in the sector that you may want to consider as our model shows they have the right combination of elements to post an earnings beat this quarter:

Parker-Hannifin Corporation (NYSE:PH) , with an Earnings ESP of +0.54% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Nordson Corporation (NASDAQ:NDSN) , with an Earnings ESP of +0.77% and a Zacks Rank #2.

Altra Industrial Motion Corporation (NASDAQ:AIMC) , with an Earnings ESP of +5% and a Zacks Rank #3.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Parker-Hannifin Corporation (PH): Free Stock Analysis Report

Nordson Corporation (NDSN): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

Proto Labs, Inc. (PRLB): Free Stock Analysis Report

Original post

Zacks Investment Research