USD/JPY: Profit taken on USD/JPY short

Macroeconomic overview

Grumbles from Donald Trump about the strength of the dollar pushed the currency down for the seventh day in the past ten on Tuesday. The shift has been most pronounced against the yen.

In an interview with the Wall Street Journal he said:

"I would talk to China first," but "our companies can't compete with them now because our currency is strong and it's killing us.”

Anthony Scaramucci, a senior adviser to U.S. President-elect Donald Trump, said: “We need to be careful about the rising currency.”

Technical analysis

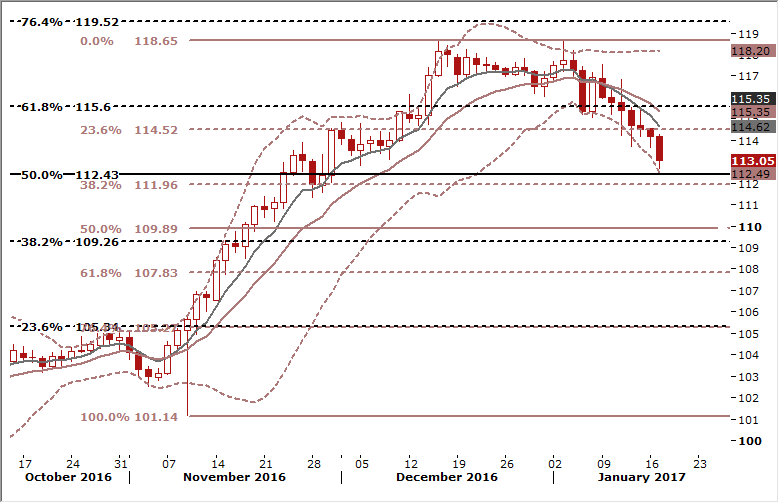

The USD/JPY dropped to lower 14-day ema Bollinger band and is close to an important support level at 112.43 (50% fibo of 2015-2016 fall). A strong resistance area is between today’s high at 114.28 and 23.6% fibo of November-December rise at 114.52.

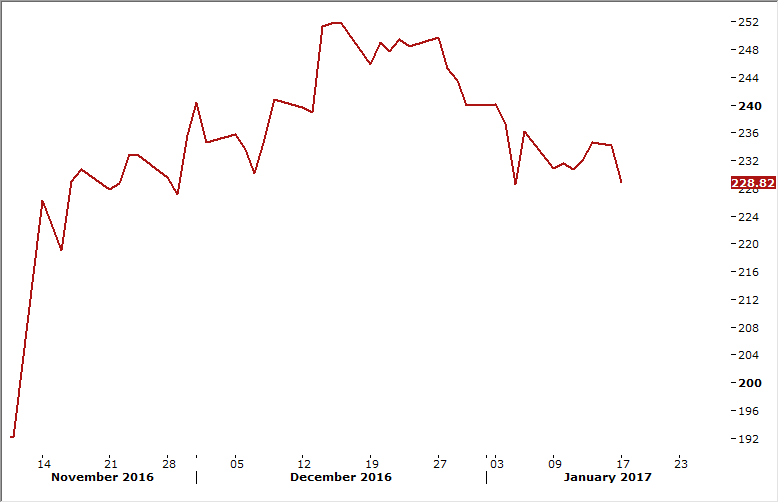

Yield spread between U.S. 10-Year. and Japanese bonds

Trading strategy

(GrowthAces.com)

EUR/GBP: UK inflation hits highest level since mid-2014

Macroeconomic overview

British inflation rose more strongly than expected in December to hit its highest level since mid-2014, propelled by higher air fares and the Brexit-fuelled fall in the value of sterling.

Official data showed consumer prices rose 1.6% compared with a year earlier, the Office for National Statistics said, above market expectations for a 1.4% annual rise. The Office for National Statistics said rising air fares and food prices, combined with a smaller fall in petrol prices than in December 2015, were behind the increase.

Excluding oil prices - which have risen sharply in recent months - and other volatile components such as food, core consumer price inflation rose by 1.6%, compared with market expectations for 1.5%.

The Bank of England is watching closely how quickly prices pick up as it tries to gauge the likely impact on consumer spending which has helped Britain's economy to withstand the shock of June's decision to leave the European Union. The BoE forecast in November that inflation will exceed 2.7% by the end of this year as sterling's big fall after the Brexit vote pushes up the price of imports. But since then the pound has weakened further and international oil prices have risen. We predict that inflation will hit 3%, possibly as soon as this summer. Bank of England Governor Mark Carney has said there are limits to how much of an overshoot the central bank will tolerate above its 2% inflation target.

Data on factory gate prices underscored the inflationary pressures in the pipeline. Output prices rose 2.7%, their fastest annual rise since March 2012. Prices paid by factories for materials and energy rose by 15.8%, the biggest jump since September 2011.

More than six months after Britons voted to leave the EU, May has come under fire from investors, businesses and lawmakers for revealing little about the future relationship she will seek when she begins formal divorce talks by the end of March. She is due to set out more detail on her plans today in a speech to an audience including foreign diplomats and Britain's own Brexit negotiating team.

Britain will not seek a Brexit deal that leaves it "half in, half out" of the European Union, Prime Minister Theresa May will say today, according to her office, in a speech setting out her 12 priorities for upcoming divorce talks with the bloc. Those priorities will include leaving the European Union's single market and regaining full control of Britain's borders, several newspapers reported.

Technical analysis

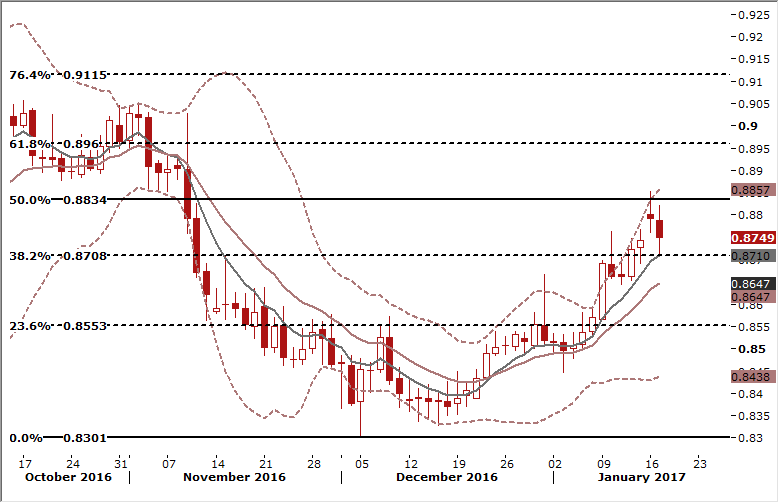

The GBP appreciated against the EUR after higher-than-expected British inflation data. The overall EUR/GBP structure is still bullish. Overbought indicators corrected lower and we used dips as buy opportunities.

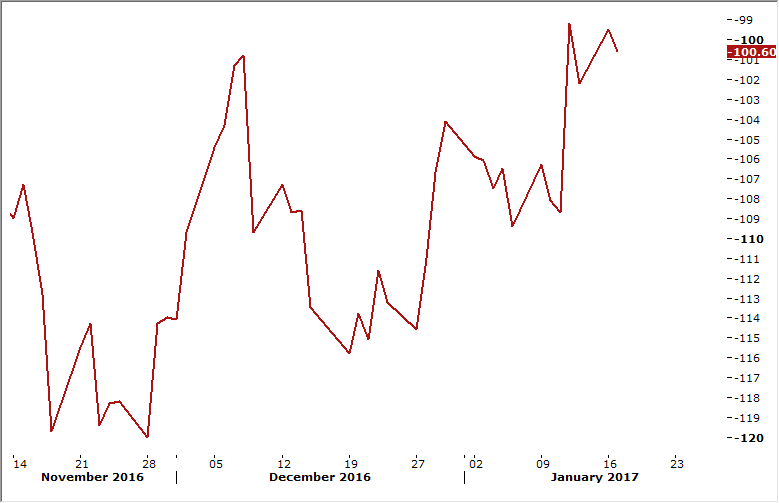

Yield spread between 10-year German and British bonds

Trading strategy

(GrowthAces.com)