Principal Financial Group, Inc.’s (NASDAQ:PFG) third-quarter 2019 operating net income of $1.23 per share missed the Zacks Consensus Estimate by 15.8%. Also, the bottom line decreased 26.3% year over year.

Results reflected soft performance at Retirement and Income Solutions, Principal Global Investors and U.S. Insurance Solutions segments. Nonetheless, Principal Financial recorded growth in assets under management (AUM). The company’s investment performance also remained solid. Moreover, the company displayed a balanced approach to capital management.

Behind the Headlines

Operating revenues rose 3.6% year over year to nearly $4.5 billion. Higher premiums and other considerations plus net investment income drove this upside. The top line beat the Zacks Consensus Estimate by 16.4%.

Total expenses increased 8.8% year over year to $4.1 billion due to higher benefits, claims and settlement expenses as well as operating expenses.

Principal Financial’s AUM as of Sep 30, 2019 was a record $703 billion, up 5.3% year over year.

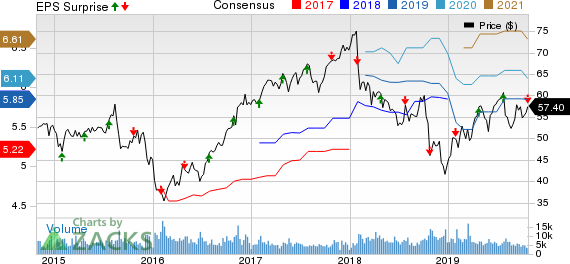

Principal Financial Group, Inc. Price, Consensus and EPS Surprise

Segment Update

Retirement and Income Solution: Revenues increased 5.7% year over year to about $2.6 billion.

Pre-tax operating earnings decreased 36.4% to $169.7 million on account of soft performance at Retirement and Income Solution-Fee as well as Spread business.

Principal Global Investors: Revenues of $369.9 million plunged 41.5% from the prior-year quarter.

Operating earnings declined 43.3% to $123 million.

Principal International: Revenues increased 40.8% year over year to $404.6 million in the quarter.

Operating earnings increased nearly three times to $108.9 million.

U.S. Insurance Solution: Revenues grew 15.4% year over year to $1.2 billion.

Operating earnings of $120.1 million decreased 4.5% year over year due to soft performance at Individual Life Insurance business.

Corporate: Operating loss of $102.1 million was wider than $52.9 million loss incurred a year ago. This downside was due to higher expenses.

Financial Update

As of Sep 30, 2019, cash and cash equivalents were $3.2 billion, up 3.9% year over year.

At third-quarter end, debt was $3.96 billion, up 20.7%.

As of Sep 30, 2019, book value per share (excluding AOCI other than foreign currency translation adjustment) was $43.68, up 4.2% year over year.

Capital Deployment

Principal Financial paid $153 million in dividends, bought back shares worth $44 million and deployed $5 million in mergers and acquisitions in the third quarter.

The board of directors approved fourth-quarter dividend of 55 cents per share, up 2% year over year.

Zacks Rank

Principal Financial currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Investment Managers

Among the investment managers that have reported third-quarter results so far, T. Rowe Price Group (NASDAQ:TROW) , BlackRock (NYSE:BLK) and Ameriprise Financial (NYSE:AMP) beat the respective Zacks Consensus Estimate for earnings.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

T. Rowe Price Group, Inc. (TROW): Free Stock Analysis Report

Ameriprise Financial, Inc. (AMP): Free Stock Analysis Report

BlackRock, Inc. (BLK): Free Stock Analysis Report

Principal Financial Group, Inc. (PFG): Free Stock Analysis Report

Original post

Zacks Investment Research