Precious metals dynamics have looked similar to base metals during these last couple of months.

The four precious metals (gold, silver, palladium and platinum) rallied since July, and peaked in September. In September, precious metals saw a price pullback, as did the base metals.

Gold spot prices (see graph below) reflect this movement perfectly.

After the price retracement in September, gold spot prices increased again. The gold rally that started at the beginning of 2017 appears set to continue. More movements to the upside could occur for the rest of the year.

Source: MetalMiner analysis of FastMarkets

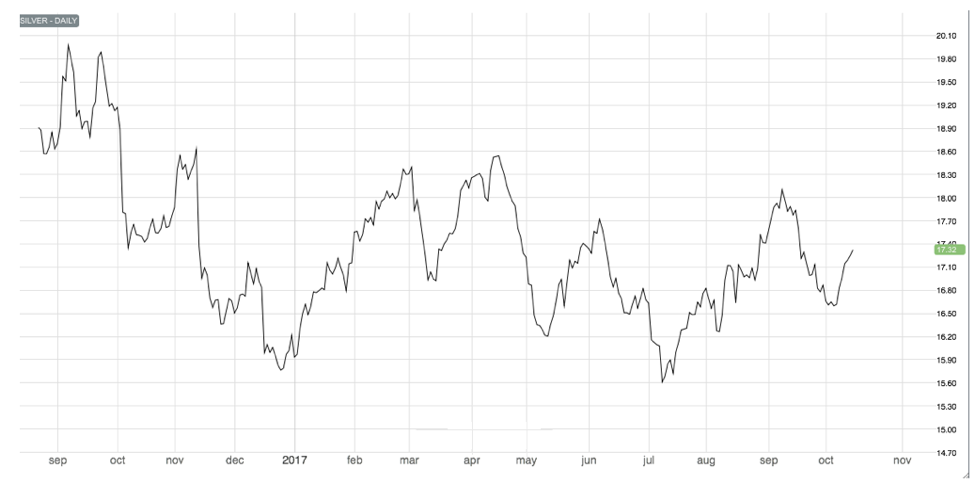

Silver prices, however, have traded sideways, showing less of a bullish sentiment than gold. However, silver has shown the same price movements (in different price ranges) from July to October (see chart below).

Does this set the foundation for a new long-term uptrend?

Source: MetalMiner analysis of FastMarkets

As Fouad Egbaria noted: “As of Oct. 1, palladium closed higher than platinum. The last time that happened? Sixteen years ago.” Palladium prices rallied, as did gold prices, while platinum prices traded sideways, similar to silver.

Palladium prices. Source: MetalMiner analysis of FastMarkets

Platinum prices. Source: MetalMiner analysis of FastMarkets

However, both palladium and platinum showed the same price pattern since July. Those price movements may point toward an ongoing bullish market.

As reported by Reuters, the commodities outlook for Q4 looks bullish. MetalMiner also remains bullish on both commodities and base metals, and expects more movements to the upside while the U.S. dollar remains weak.