After weeks of headlines regarding the status of Brexit heading into the October 31 “hard deadline,” things have been pretty quiet the last two weeks, as the decision was made to extend the deadline to January 2020 and hold elections on December 12. This is essentially another vote for Brexit. If Boris Johnson ends up with a majority, Brexit will happen sooner than later. However, if the Labour Party and Jeremy Corbyn are able to claim a majority, there will most likely be a second vote on the Brexit referendum. December 12 is just under a month away and volatility has slowed. However, as we get closer to the elections, watch for comments from all parties as they try to persuade voters. According to the Telegraph on Friday, the Brexit Party said they have stepped down from 43 non-Tory Party seats. As a result, sterling went bid as this is considered Brexit friendly.

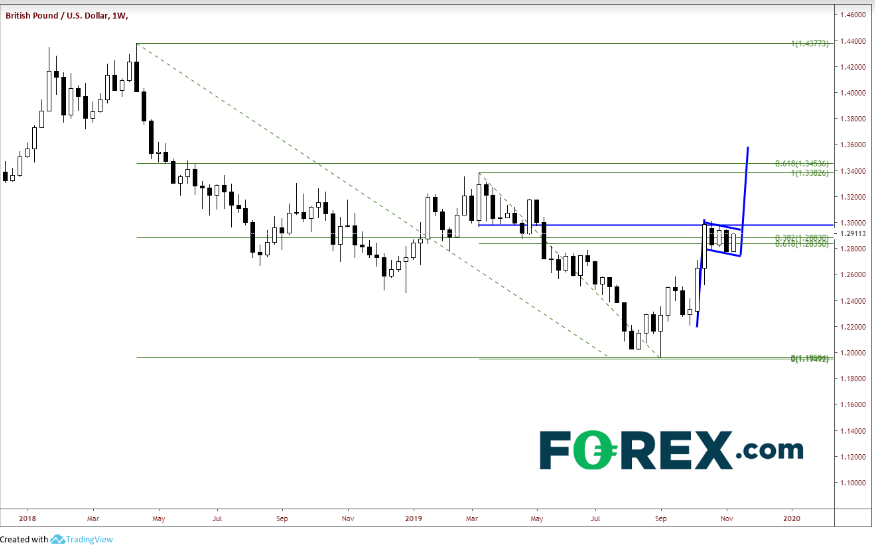

On the headline, GBP/USD spiked 40 pips. That may not seem like a big move, but with the low volatility we’ve had lately, this was a welcome move (for those long GBP). However, is GBP/USD just biding time until the elections? On the weekly chart, the 1.2800/1.3000 level seems to be a perfectly normal place to pause if price were to advance further. In early October, there was a good deal of speculation that Brexit may indeed happen (after a few years of negotiating). GBP/USD moved from near 1.2200 to near 1.3000 in two weeks. We have been in consolidation mode since then, forming a flag formation. The target for a flag is the length of the flag pole, added to the breakout point of the flag. If price breaks above 1.3000 soon, the target is near 1.3600, over 600 pips higher.

Source: Tradingview, FOREX.com

Why was this a normal place for price to stall?

- Horizontal resistance and prior lows from March 2019 (which now act as resistance)

- Near the psychological resistance level of 1.3000

- 38.2% Fibonacci retracement level from the highs of April 2018 to the lows in September 2019

- 61.8% Fibonacci retracement level from the highs of March 2019 to the lows in September 2019

As we get closer to the December elections, if the markets feel there will be a clear winner, it will begin to price in the potential outcome. If it appears that Boris Johnson and the Conservatives will have a majority, GBP/USD could be near 1.3600 in a hurry. If it looks like Jeremy Corbyn and the Labor Party will win, GBP/USD could be down near 1.2200 just as fast.

Watch the headlines as we get closer to December 12.