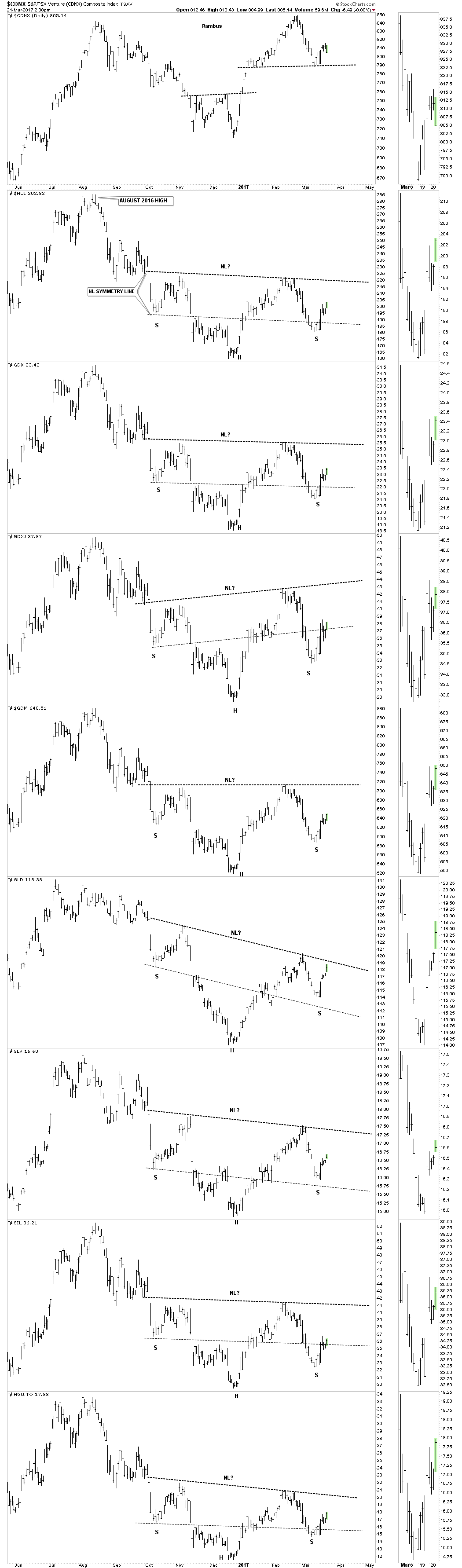

There is a combo chart for the PM complex I’ve been following, on the short-term, 10-month daily view, which shows a potential H&S bottom forming for the Precious Metals complex. I put a neckline symmetry line on the charts to get a feel for where the low for the right shoulder may form.

In some cases the low is fairly parallel to the neckline, for instance for the SPDR Gold Shares Fund (NYSE:GLD), iShares Silver ETF (NYSE:SLV) and the ARCA Gold BUGS Index (HUI), with the VanEck Vectors Junior Gold Miners ETF (NYSE:GDXJ) and Global X Silver Miners (NYSE:SIL) being the most unparalleled. The S&P/TSX Venture Composite Index (CDNX) is showing the most weakness, which probably has to do with some of the small cap energy companies listed there.

GLD is trading the closest to the neckline, so it may give an early heads up for the PM stock indexes. Keep in mind these potential H&S bottoms won’t be complete until the necklines are broken to the upside.

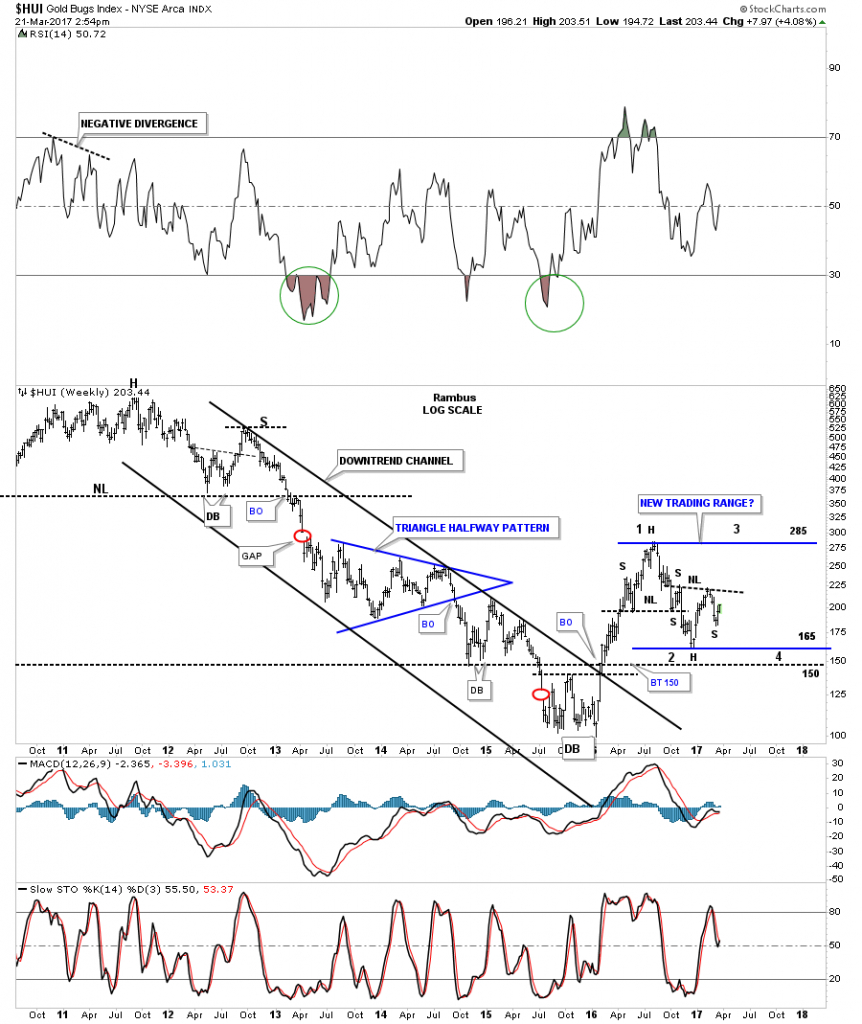

This next chart is a long-term weekly look at the HUI which shows its potential big trading range with the first reversal point starting at the August 2016 high. Reversal point #2, which may be underway, should take the HUI up toward the 286 August high which would be the area in which to look for the 3rd reversal point to the downside.

Note how the top of the trading range formed a H&S top for the first reversal point; now it looks like a H&S bottom for the 2nd reversal point. Interesting, to say the least.

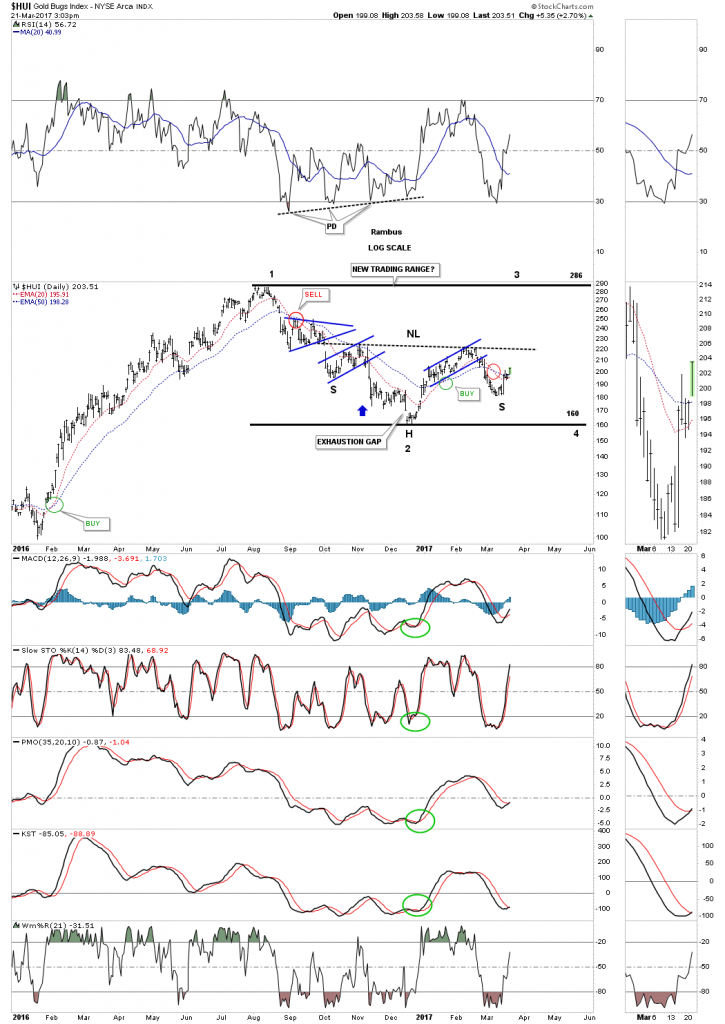

Below is a daily chart for the HUI which shows the potential H&S bottom forming inside the large trading range.

The 20-year monthly chart for the HUI provides a good look at all the consolidation patterns that formed during the bull market years. During the bull market the HUI formed one consolidation pattern on top of the next. I have all the reversal points labeled on each consolidation pattern.

Most of the consolidation patterns lasted anywhere from 14 to18 months or so. On that basis, we are likely less than halfway through this present pattern. The red numbers on the left side of the chart show the same height for each consolidation pattern. And as you can see, our current pattern is also the same height.

This is a good area in which to see a H&S bottom build out, just like the H&S top that built out at the first reversal point that's defining the trading range.

Markets are live entities. Each day new patterns can slowly emerge.

Chart patterns are the sum total of the actions of all the traders who participate. Keeping an open mind, we must evaluate and re-evaluate and constantly be on the lookout for clues as to what will happen next.

Stay tuned. It looks like the Precious Metals markets are getting interesting once again.