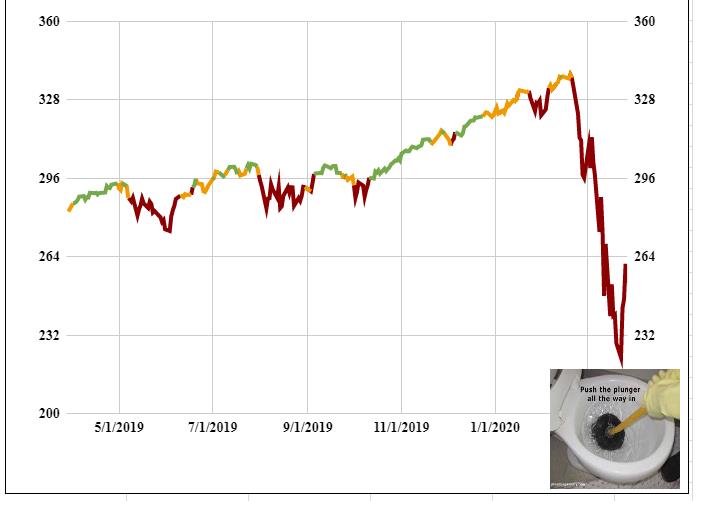

US stock indexes market’s bounced up around +11% with a little help from the Fed and a touch of emergency funding from Capitol Hill ($2 trillion). Meanwhile, the virus’s infection rate continues to explode, with NYC the epicenter. This week’s takeaway is the Plunge Protection Team efforts to prop up the markets worked (for the moment) while virus containment efforts not so much.

The biggest question hanging in the ether is will the fiscal and monetary easing be enough to offset the impact of the shutdown. Regardless, the chances are likely that this week was the expected technical bounce and we will see new lows. However, a further rally to key moving averages is certainly possible before the retest.

The price of oil got hit hard which is logical considering the use of energy has plummeted during the worldwide quarantine amid a price war that was already underway. Gold continues to lead equities and at its highest levels on a relative basis to stocks since 2016. Supply disruptions plague the gold market as the demand for physical gold has skyrocketed.

This past week’s highlights:

- Risk Gauges went more negative as utilities outperformed the SPY (NYSE:SPY)

- Credit Markets stabilized but it’s still hard to find bids on a lot of corporate debt

- Market Internals and Market Sentiment are overbought short term

- Volatility (NYSE:VXX) is holding its bullish market phase despite the 11% rally off the lows

- Leading sectors continue to be Semis and Biotech

- Gold recovered nicely after the Fed stepped in to stabilize the markets