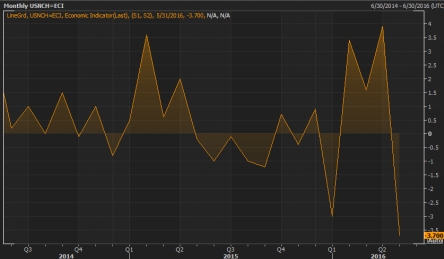

Pending home sales have fallen the most since May 2010. The National Association of Realtors (NAR) is spinning this as potential buyers are being thwarted by a shortage of affordable homes because sales are so good.

Lawrence Yun, NAR chief economist, writes,

"With demand holding firm this spring and homes selling even faster than a year ago, the notable increase in closings in recent months took a dent out of what was available for sale in May and ultimately dragged down contract activity."

Foreigners have bought billions of dollars worth of houses which has created a situation where there are not enough homes for domestic US citizens to purchase. As a result, prices are rising, and homes are once again unaffordable for most hardworking Americans.

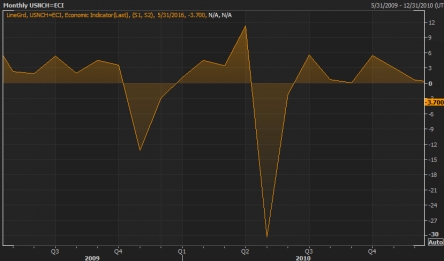

This Reminds Me of 2009 - 2010

We have to go all the way back to 2009 and 2010 to find a similar plunge in pending home sales back.

Interestingly, here are the reports the NAR was publishing just before the entire housing market crashed and the Great Recession hit.

"Existing home sales at highest level since 2007... Similarly, robust sales may be occurring in November."

"U.S. pending home sales surge... Pending sales of previously owned U.S. homes shot up by 6.7 percent in April, the biggest monthly gain in 7 1/2 years."

The NAR is a cheerleader for the real estate market. The NAR is made up of salespeople, brokers, property managers, appraisers, and others who make money in the real estate industry. The NAR will never publish a forecast report that would scare potential property buyers because it would be contrary to their financial interests to do so. Knowing this, traders have to be careful looking to the NAR to guide their investing decisions.