Once upon a time the bond market could be counted on for sober analysis and clear thinking in the critical work of providing reliable economic indicators based on the so-called wisdom of the crowd. But those days appear to be long gone, or so one could surmise after reviewing the conflicting signals emanating from the US Treasury market of late.

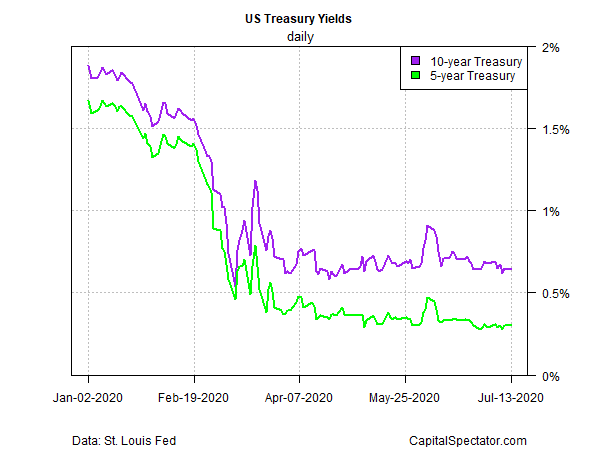

Let’s start with the nominal yields on the 5- and 10-year Treasuries. Based on these widely followed interest-rate benchmarks, recent history has been a yawn as current yields remain in a tight range (roughly 0.6% to 0.9% for the 10-year rate and 0.3% to 0.5% for the 5-year).

There’s much debate about why current yields have been flat-lining in recent weeks. Given the economic upheaval this year, courtesy of the coronavirus pandemic, the sight of Treasury yields going to sleep at a time of rapidly evolving macro expectations raises questions about what’s going on behind the scenes in government-bond-land. One possibility: the Federal Reserve is experimenting with yield-curve control.

Whatever the explanation, nominal rates since April are effectively telling investors that there’s nothing to see here–pay no attention to the central bank behind the curtain.

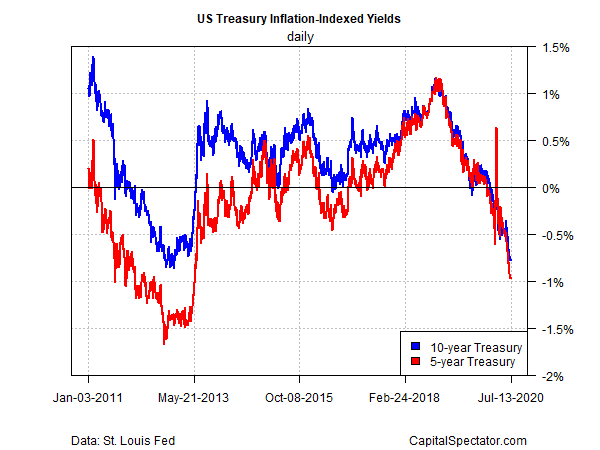

Real (inflation-adjusted) yields are telling a radically different story. Indeed, the inflation-indexed rates on 5- and 10-year Treasuries continue to plummet deeper into negative terrain. The 5-year real rate, for instance, slipped to 0.97% yesterday (July 13), the lowest since 2013, based on data via Treasury.gov.

The implications of negative real yields include a bearish outlook on the economy and a bullish aura for gold, which has been soaring lately.

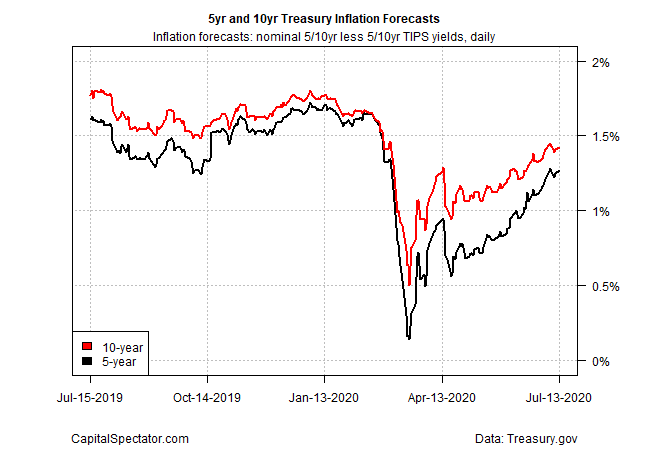

But wait, there’s more. At a time of stable nominal yields ad crashing real yields we have another trend to consider: rebounding inflation expectations, based on the spread for nominal yields less their inflation-indexed counterparts.

After plunging in March, the Treasury market’s implied estimate of future inflation has been slowly but persistently rebounding. True, the outlook for inflation for this market-based estimate remains low – a modest 1.27% via the 5-year maturities as of July 13. There’s also a bounce-back effect in progress after the rush to safety in March when the shock of the coronavirus initially resonated in markets. Nonetheless, it’s striking to see the market’s inflation forecast rise while the same market prices in higher odds of deflation.

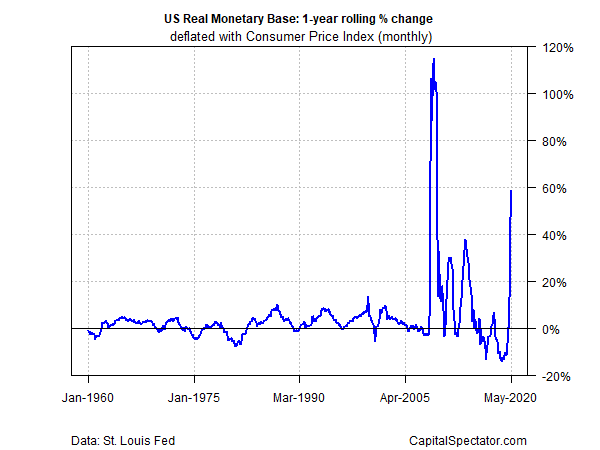

Just to keep things interesting, consider that the Federal Reserve is moving monetary heaven and earth to keep deflation at bay and juice the outlook for inflation. The year-over-year change in the inflation-adjusted measure of M0 money supply, for example, has ramped up dramatically this year. This measure of the monetary base rose soared nearly 60% in May–the highest since the Great Recession. Even greater heights are expected as the central bank continues to battle with the economic blowback from the coronavirus.

Looking for a unified theory that squares all these circles isn’t easy or obvious—or even possible. To say that we live in extraordinary times is an understatement. Exhibit A is the Treasury market. The risk, of course, is that if reading the Treasury market’s tea leaves has become a riddle wrapped in a mystery, what does that say about the price-discovery process elsewhere?