Pandora (NYSE:P) is moving ahead with its ad tech initiatives and recently acquired the leader in digital audio ad technology, Adswizz. Reportedly, the $145 million deal is expected to close in the second quarter of 2018.

Per Pandora’s CEO Roger Lynch, “With our scale in audio advertising and AdsWizz’s tech expertise, we will create the largest digital audio advertising ecosystem, better serving global publishers and advertisers — while improving Pandora’s own monetization capabilities.”

The acquisition is a significant milestone for Pandora as it is expected to significantly boost Pandora’s total addressable market and expand its reach in digital audio advertising. It will also open a new revenue stream for the company. Its rivals in the space include Entercom, iHeartRadio and Spotify who are customers of Adswizz.

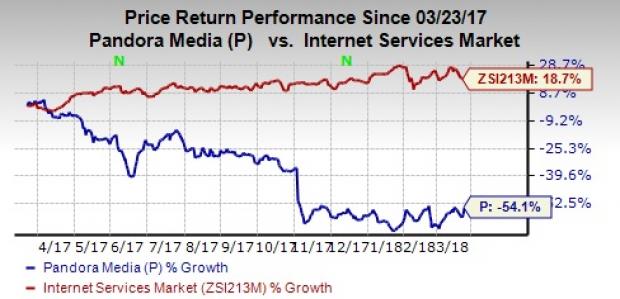

We believe such monetization efforts will help the company’s stock to rebound. Shares of Pandora have lost 54.1% in the past year as against the industry’s gain of 18.7%. However, since the announcement of the acquisition on Mar 21, the stock has returned 7.8%, which is noteworthy.

Will the Measures Lead to a Turnaround?

Pandora is investing more in building ad tech capabilities to expand advertising opportunities.

The company is working to become a more efficient advertising partner and gain a competitive edge over its digital peers. Pandora is also focusing on programmatic advertising, which will help the company leverage scale, targeting and innovative ad formats.

Pandora has also been facing a decline in active users and total listener hours over the last few quarters. In the last reported quarter, total listener hours fell 6.5% on a year-over-year basis to 5.03 billion and the number of active listeners declined 6% year over year to 74.7 million.

This was mainly due to the extremely competitive environment in which it operates. The company is a late entrant in the on-demand music services arena, which boasts big names like Spotify and Apple (NYSE:P) . Notably, Apple Music has been recording phenomenal growth.

Although the company generates revenue from subscriptions, the majority of its revenues is from advertising, which is showing signs of decline. Thus, initiatives in the advertising space appear to be headed in the right direction.

Zacks Rank & Stock to Consider

Pandora carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Facebook Inc. (NASDAQ:FB) and Paycom Software Inc. (NYSE:P) , both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Long-term earnings growth rate for Facebook and Paycom is projected to be 26.5% and 25.8%, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Facebook, Inc. (FB): Free Stock Analysis Report

Pandora Media, Inc. (P): Free Stock Analysis Report

Paycom Software, Inc. (PAYC): Free Stock Analysis Report

Apple Inc. (NASDAQ:AAPL): Free Stock Analysis Report

Original post

Zacks Investment Research