Equity markets got hit hard this week but mostly managed to stay above key moving averages—except Grandpa Russell (IWM).

It is called painting the tape and this week’s art was created by a renowned artist….and if you are wondering who the artist I’m referring to is…it’s Jerome Powell, and not Jackson Pollack.

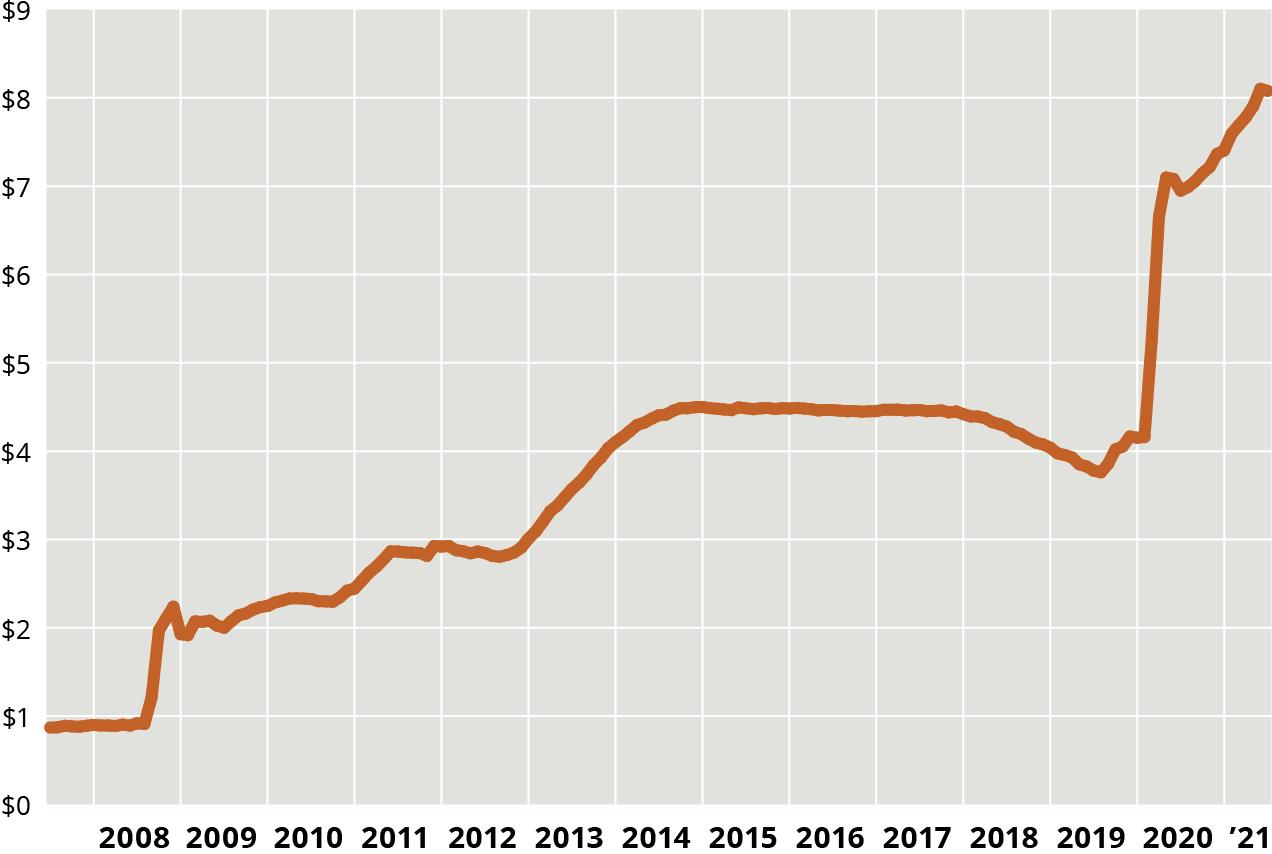

For empirical evidence lust look at the Fed’s balance sheet (grown by $1.45 trillion since January 2021) and its holdings of ETFs which have exploded.

The S&P 500 (SPY) and NASDAQ 100 (QQQ) rallied hard at the close with help from the Plunge Protection Team in the last 30 minutes of the day.

Both indices closed almost 1% above their intraday low and put a much more positive spin on a very negative week.

It appears that the Fed is throwing paint/dollars at the wall, hoping it sticks so that charts look good enough to attract actual outside buying despite the major headwinds.

The following are the big issues going forward:

- Higher than expected inflation

- Good earnings reported, but some companies' guidance are disappointing

- Additional problems with the supply chain and distribution of goods

- Slowing sales, e.g., Apple (NASDAQ:AAPL)

- Companies reporting top line revenue beats, but earnings per share contracting as a result of higher production costs

- Disappointing job growth, low unemployment rate, but much lower than expected job participation rate

- Labor shortages in most industries, especially restaurants, travel, and consumer retailers

- Lingering COVID issues and the new variant (Omicron) which has higher transmissibility, but nobody is sure the seriousness of this virus

- Shutting down travel from other countries and the travel business seems to have grinded to a screeching halt

- Federal Reserve’s testimony before Congress intimating that a much faster Fed tapering (cease buying back bonds) and much less accommodation of monetary stimulus

- Geopolitical stress from Ukraine, Iran, and Taiwan

This week’s market highlights

Risk On /Bullish

- Major indices were under pressure, however, DIA held its 200-day moving average, while QQQ and SPY held onto their 50-DMAs for the time being and are still in bullish phases

- Market Internals bounced off an extremely oversold level setting the stage for mean reversion to the upside

- Sentiment Indicators are showing that the number of stocks below their 10-DMA may have reached its climax for the time being, indicating potential for a bounce

Risk-Off/Bearish

- Risk Gauges retreated to risk-off across all the key equity benchmarks

- Value stocks (VTV) outperformed growth stocks (VUG) this week, with Triple Play indicating VTV is starting to outperform the SPY on a short-term basis

- IWM has not maintained its 50 or 200 DMAs and has a negative TSI of -2.

- Volume analysis showing distribution across the board in all the major indices, led by IWM with zero accumulation days over the past 2 weeks

- Sentiment indicators led by Volatility (VXX) roared this week, up 21% as Cash Volatility (VIX.X) crossed into to a bullish phase, indicating risk-off

- Also noteworthy, China (FXI) is leading on the downside with delisting of Chinese stocks in US exchanges taking the headlines

- Clean Energy (PBW) and Solar (TAN) got hit hard

- China markets selling off are a result of the threat of being delisted from US markets

- Hindenburg Omen Indicator is still at extreme levels, showing 17 market Omens

Neutral Metrics

- Sector Performance is showing a mixed bag, with Utilities (XLU) the strongest performer on the week (risk-off) up almost 1%, while Semiconductors (SMH) were also up for the week (a risk-on indicator)

- Major breakout in long US Bonds (TLT), indicating a flight to safety, but it’s running a bit rich and could be subject to mean reversion.

- Emerging Markets (EEM) continue to plum lows for the year and remain under pressure after losing crucial price support levels

- Soft Commodities (DBA) outperformed the SPY and are now leading both on a short and longer-term basis

- Gold (GLD) held up well against the SPY, but is still stuck below its key moving averages

This week’s Crypto highlights:

- Bitcoin (BTC) is down 14% on the week, currently sitting at $49,000. Unless it makes a miraculous recovery to close above $57,300, this will be the first time Bitcoin has had 3 consecutive red weekly closes since June 2020

- Ethereum (ETH) took a dive but has already recovered to being down only -4.6% on the week

- The ETH-BTC pair is currently trading at its most extreme level since May of 2018, with Ethereum drastically outperforming Bitcoin in recent weeks

- The only large cap coins to have a positive performance on the week are Terra (LUNA) +75% and Polygon (MATIC) +23%, two popular defi projects