Database and cloud solutions provider Oracle (NYSE:ORCL) stock got smoked on its fiscal Q1 2023 earnings report. Shares were holding up relatively well until the Company revealed the extent of damage from FX related headwinds. Up until 2022, FX headwinds didn’t really impact stocks too much as the market focused more on the performance in constant currency metrics. However, the aggressive interest rate hikes from the Fed have brought the negative impacts of a strong U.S. dollar to the forefront. This has been painfully made evident by the panic sell-off in various U.S. companies with extensive international business including NVIDA (NASDAQ:NVDA), Salesforce (NYSE:CRM), Netflix (NASDAQ: NASDAQ:NFLX), IBM (NYSE:IBM), and Johnson & Johnson (NYSE:JNJ). They have all had to unavoidably cut their forward guidance to some degree. In fact, 30% of the revenues for companies in the S&P 500 (NYSE:SPY) generate revenues outside of the U.S. This will continue to be a concerning trend while the Fed continues to pursue rate hikes to tackle record inflation. The strong U.S. dollar vaporized (-$0.08) per share off Oracle’s earnings, up from the original (-5%) earlier estimate in June, in addition to lowering forward guidance. The Company included performance numbers for its Cerner (NASDAQ:CERN) acquisition in the recent fiscal Q1 2023 earnings release, which helped juice performance. Oracle proves it’s still a leader in the cloud and enterprise resource planning (ERP) segment. The near-term FX related sell-off could be presenting a buying opportunity for long-term investors to stake a position in Oracle.

Oracle’s Enterprise Resource Planning

ERP is a type of business management software that enables real-time analysis, automation, data sharing, and management of an organization’s business processes through a suite of integrated applications. It utilizes robust databases to track a company’s resources across all departments including accounting, purchasing, sales, inventory, order processing, human resources, and manufacturing. It’s literally the central nervous system of an enterprise. Oracle announced expanded relationships for access to its database services for Microsoft (NASDAQ:MSFT) Azure Cloud and Amazon (NASDAQ: AMZN) Cloud platform customers. Oracle is a leading provider of ERP besting its competitor SAP (NYSE:SAP) with notable wins .

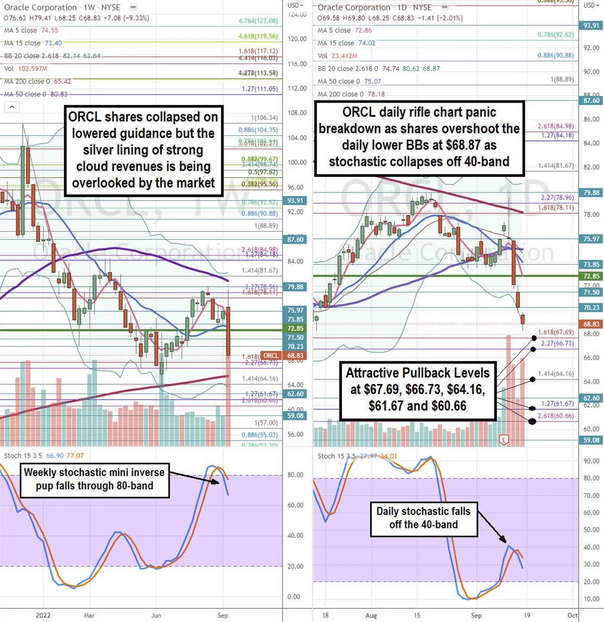

Oracle Attractive Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a medium-term view of the price action on ORCL stock. The weekly rifle chart plunged on earnings through the weekly 5-period moving average (MA) at $74.55, and the 15-period MA at $73.40. The swing sits at the $64.14 Fibonacci (fib) level. Shares fell through the weekly market structure low (MSL) buy trigger at $72.85. The weekly 200-period MA support sits at $65.42 and weekly lower Bollinger Bands (BBs) just under the $64.16 fib level. The daily rifle chart breakdown formed as shares collapsed through the daily 5-period MA at $72.86, 15-period MA at $74.02, and the 50-period MA at $75.07. The stochastic crossed back down after rejecting the 40-band. The daily lower BBs got tested at $68.87. It’s important to watch the lower BBs as potential supports as both weekly and daily stochastic have mini inverse pups. Attractive pullback levels sit at the $67.69 fib, $66.73 fib, $64.16 fib, $61.67 fib, and the $60.66 fib level.

Juiced by Cerner

On Sept. 12, 2022, Oracle released its fiscal 2023 first-quarter results for the quarter ended August 2022. The Company reported an earnings-per-share (EPS) profit of $1.03 versus $1.07 consensus analyst estimates, a (-$0.04) miss. Revenues grew 17.7% or 23% in constant currency year-over-year (YoY) to $11.45 billion, beating analyst estimates for $11.44 billion. This includes the figures for Cerner, which delivered its “best revenue quarter in history” according to Oracle CEO Safra Catz. He noted that even without Cerner, Oracle had 8% YoY organic growth. Cloud Revenues grew double digits and its two cloud businesses (infrastructure and applications) now account for 30% of total revenues. The various segments experienced double digit gains including Cloud Infrastructure up 52% or 58% in constant currency adding over 1,000 new customers, Cloud Application up 43% or 48% constant currency, Fusion ERP up 33% or 38% in constant currency, and NetSuite ERP.

Microsoft Azure and Amazon Cloud Multicloud Connect

Oracle Chairman and Co-Founder Larry Ellison chimed in:

"In Q1 we expanded our relationship with Microsoft by providing all versions of the Oracle database directly to Microsoft Azure customers. Now all Microsoft customers can directly access the Oracle Exadata Cloud Service, the Oracle Autonomous Database and every other Oracle Database version directly from the Azure Cloud. Today we are also announcing that Amazon Web Services customers can directly access Oracle's MySQL HeatWave database running in the Amazon Cloud. This enables AWS users to run transaction processing, real-time analytics, and machine learning on the single unified MySQL service. MySQL HeatWave delivers 7X better price performance compared to Amazon Redshift and 10X better than Snowflake, 25X faster than Redshift ML, and up to 10X higher throughput than Aurora. See today's MySQL HeatWave press release for customer performance benchmark verification."