With OPEC currently battling to turn the tide of lower oil prices through a cut in production, the latest industry data from the US will not make happy reading.

The most recent weekly report from the Energy Information Administration, covering the week ending February 8, showed US crude inventories rising by 3.6 million barrels.

They ended the week at 450.8 million barrels. Inventories, which rose by more than the 2.7 million barrels forecasted by the market, are now at their highest levels in over a year.

Interestingly, the large build in inventories came amidst a drop in crude imports, which fell by 430k barrels per day over the week. They now sit at 3.8 million barrels per day, marking the lowest level since EIA records began in 2001.

Meanwhile, crude production was basically unchanged. It held at record highs of 11.9 million barrels, where it has been since the start of the year.

Refinery Runs At Lowest Levels Since 2017

The data also showed crude refinery runs falling 865k barrels per day to 15.8 million. Utilization rates fell 4.8% to 85.9%, their lowest rate since October 2017.

Elsewhere in the report, gasoline inventories were shown to have risen 408k barrels, far less than the 826k barrel gain forecast by the market. Meanwhile, distillate stockpiles (including diesel and heating oil) unexpectedly rose 1.2 million barrels, versus an expected drop of 1.1 million barrels.

Goldman Sachs (NYSE:GS) Forecasts Higher Prices

However, despite the large build in crude stocks, oil prices have remained buoyant this week. Investment banking giant Goldman Sachs (NYSE:GS) is forecasting a forthcoming rally in oil prices. It claims the “shock and awe” production cuts by OPEC and its allies should start to feed into higher prices from the second quarter onwards.

Indeed, in the research note released this week, Goldman Sachs claimed:

“The production losses to start 2019 are already larger than we expected….Disruptions have increased with risks that Venezuela’s production decline accelerates following the introduction of additional U.S. sanctions related to the Venezuelan oil industry.”

Saudi Arabia To Cut Production Further

Official commentary from Saudi Arabia, the largest oil producer within the OPEC cartel, has also been very supportive of higher prices.

This week, Khalid al-Falih, the Saudi Arabian Energy Minister told reporters that the kingdom will be slashing its oil output even deeper, to roughly 9.8 million barrels per day in March. This is 500k barrels more than the level required by the OPEC production cut deal which went live in January.

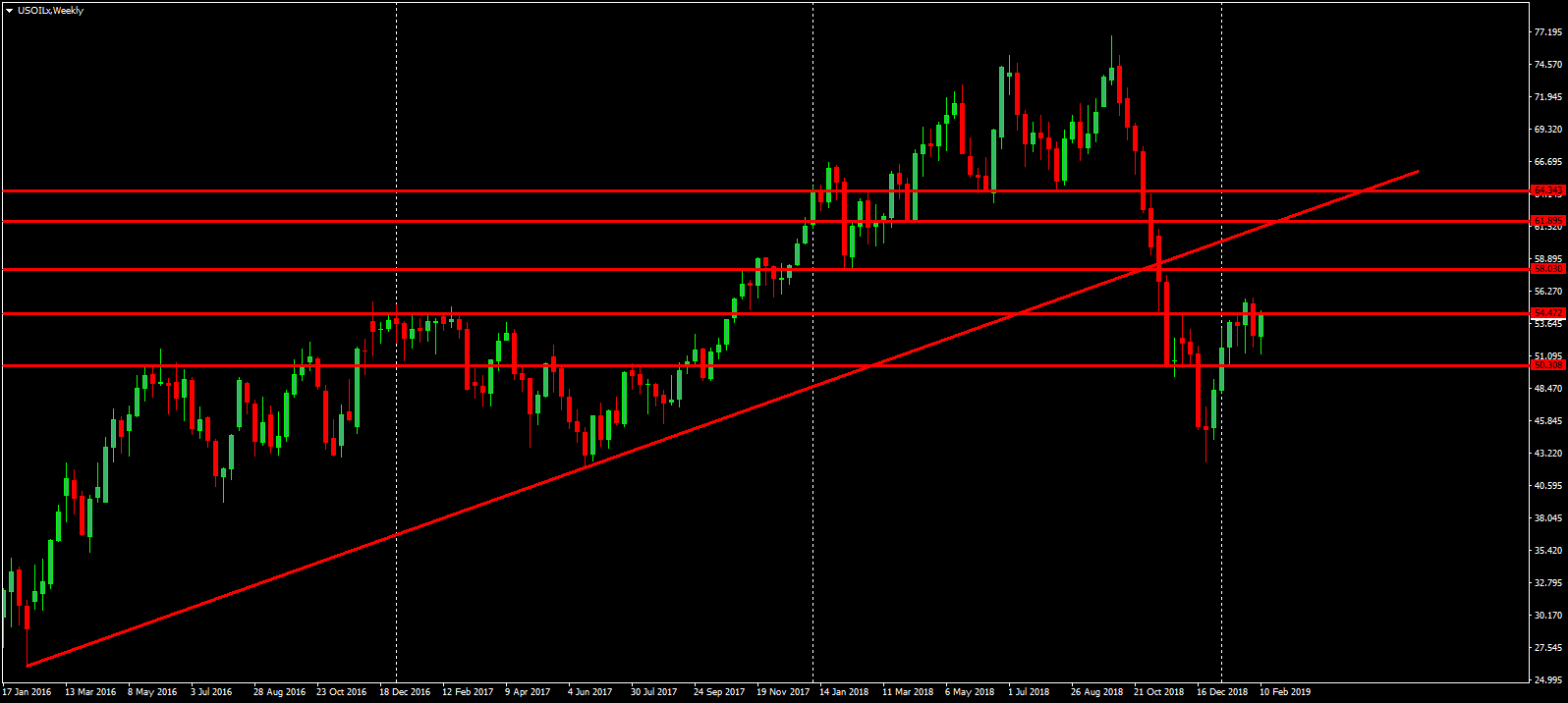

Technical Perspective

Despite the news of a further inventory build, oil prices remained positive this week, trading up off initial low levels. They ended the week back in the upper half of the recent four-week range. For now, price is battling to get back above the 54.47 level which remains a key short term resistance. Above there, focus will turn to an eventual retest of the broken bullish trend line from 2016 lows.

However, the path to higher prices is tricky due to the amount of structural resistance overhead. The structural resistance was created by the many swing lows price forged on the bull run from 2016 to late 2018. With plenty of these levels overhead, any move higher is likely to be choppy with a lot of break-and-retest opportunities.