Last week I wrote about how Warren Buffets favorite stock market indicator is signaling huge losses ahead.

Yet – the market and the ‘mainstream’ doesn’t seem to care. At all.

And with how investors are positioning themselves – it seems as it’s only a fool’s game to worry about potentially “huge losses.”

Putting it simply – the market continues upwards with a short-sighted agenda and a complacent attitude.

Since 2018 began – U.S. Macro data has come in weaker than markets expected.

But the New York Stock Exchange (NYSE Composite) continues trending higher and higher. . .

You can see for yourself – the economy’s health and stock prices are diverging.

And for the spread to converge – either the U.S. economy needs to improve. Or stock prices need to fall.

The last time we saw this spread was in January 2018 when the U.S economy started rolling over – yet stocks kept climbing.

Well look what happened then – a sharp collapse in stock prices sooner after. . .

Judging that the ‘Buffet Indicator’ is signaling markets are 40% overvalued according to history – and with the Federal Reserve continuing to tighten – I believe stock prices will be the one to fall – just like last time when this divergence appeared.

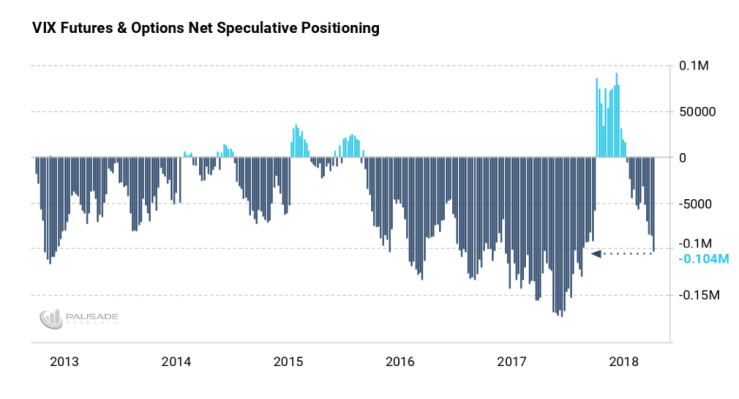

With market complacency this dangerously high, investors are back to shorting volatility – in the billions.

This signals that markets don’t expect any sudden shocks or disorder in markets.

But as we’ve learned from rogue economist – Hyman Minsky – this type of calm and complacency literally breeds future disorder.

This is what he called the Financial Instability Hypothesis (FIH). . .

It states that when investors feel “safe and secure”, they make riskier bets. But this increased risk taking is what fuels future instability.

Therefore, we can summarize the FIH like this: periods of low volatility and market calm are the seeds for high volatility and market disorder in the future. And vice-versa.

So, expect to see investors rotate out of low-and-short volatility plays sooner than later. . .

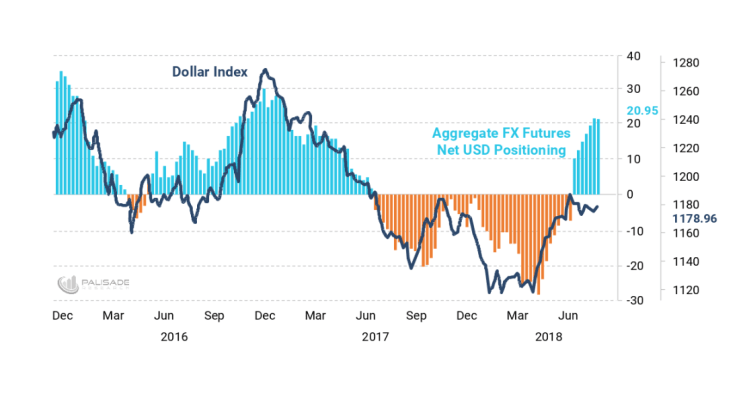

In other news – investors continue piling into the “Long USD” trade.

The recent 7% rally for the dollar was simply investors closing out their short positions – which created a reflexive feedback loop higher.

If you look below – you’ll see that last years steep 13% drop in the dollar caused overcrowding short positions. This helped push the dollar down further – and faster – than many thought.

But like all short plays – once you are done and want to close the position – you must buy-back to ‘cover’ what you borrowed.

This added demand from short covering has pushed the dollar higher since March.

But seeing that the USD Index has traded flat since May – things are mostly likely about to reverse from here and continue downwards. .

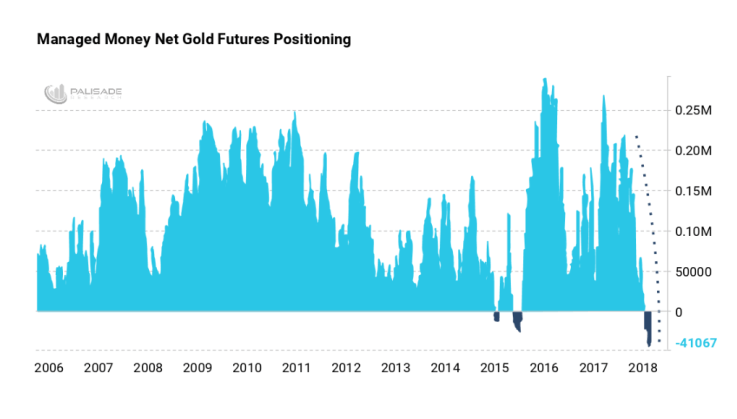

With all this market complacency and ‘long-dollar’ and ‘short-volatility’ going on – no wonder Hedge Funds today have never been so short gold.

But like we saw with the dollar – these record shorts must be bought back eventually; and this will push gold much higher.

Think of it this way: if you have record short positions today, you’ll have record short covering later – which pushes prices much higher.

A good strategy is to take advantage of the markets complacency and the riskier appetite.

Or simply, be contrarian.

Good contrarian plays today are. . .

1. Bet against the dollar

2. Go long gold

3. Rotate from shorting volatility into long high-volatility

I’m not saying that markets will implode overnight. But we’ve seen this before – time and time again.

Words of wisdom: respect the cycles.

Markets get complacent and investors start betting ‘riskier’. But once something goes wrong – or simply just doesn’t live up to expectations – they will rotate out quickly.

Instead of looking at what the markets buying today – start going into the assets that investors will rush into tomorrow.