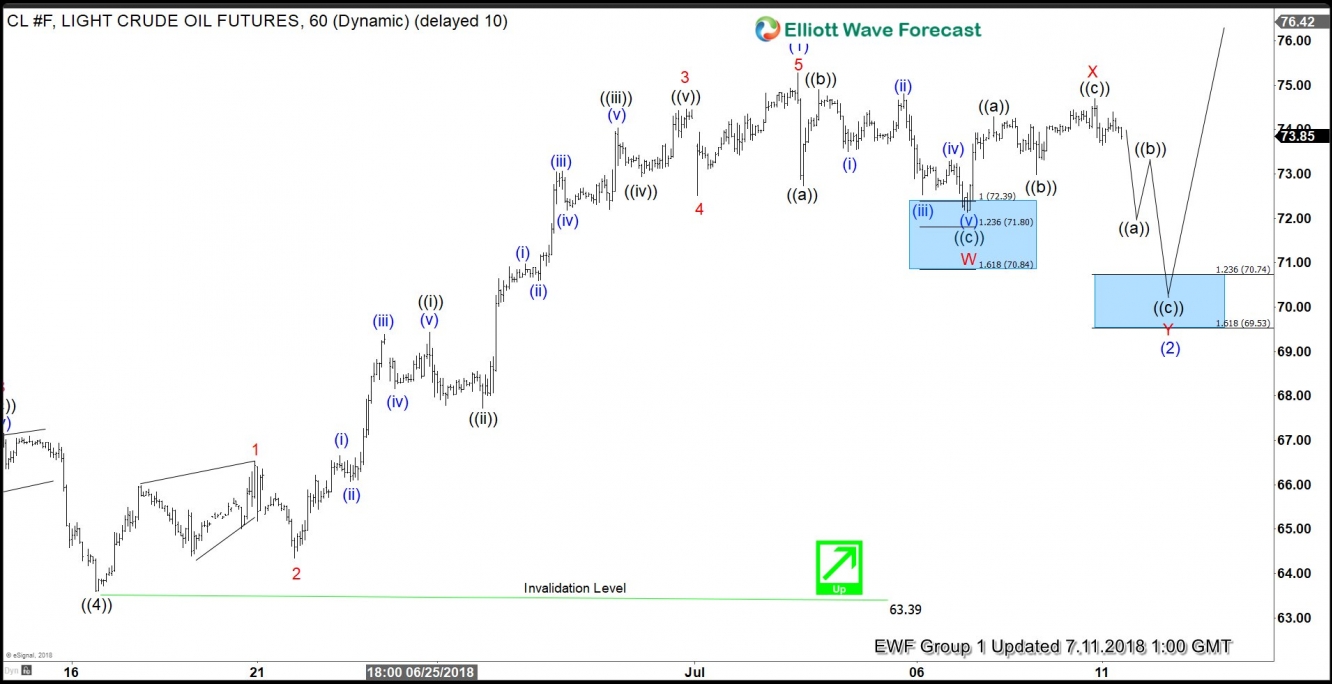

Crude Oil WTI short-term Elliott Wave view suggests that the pullback to $63.39 on 6/18/2018 low ended primary wave ((4)). Up from there, the instrument rallied strongly to the upside and went on to make new high for the year. A rally from there took place in the form of an Impulse Elliott wave structure with extension with lesser degree oscillation showing the sub-division of 5 waves structure in each leg higher.

The internals of rally from $63.39 low ended Minor wave 1 in 5 waves at $66.53. Then the pullback to $64.34 low ended Minor wave 2 in 3 swings. Above from there, instrument rallied higher strongly in Minor wave 3 and ended another 5 waves at $74.46 high. Down from there the pullback to $72.51 low ended Minor wave 4. Then a rally to $75.27 high ended Minor wave 5 and also completed Intermediate wave (1) higher.

Below from there, the instrument is pulling back to correct cycle from 6/18 low ($63.39) in Intermediate wave (2) and expected to find buyers in 3, 7 or 11 swings. Currently, the instrument already did a 3 waves pullback in Minor wave W at $72.14, which is located inside $72.39-$71.82 blue box area and bounced higher. However, while it stays below the $75.27 high, the instrument is expected to do a double correction in 7 swings lower towards $70.74-$69.53, which is 123.6%-161.8% Fibonacci extension area of Minor wave W-X before it resumes the upside provided the pivot from $63.39 low stays intact. We don’t like selling it and expect Oil to stay supported as far as a pivot at $63.39 low is holding.

OIL 1 Hour Elliott Wave Chart