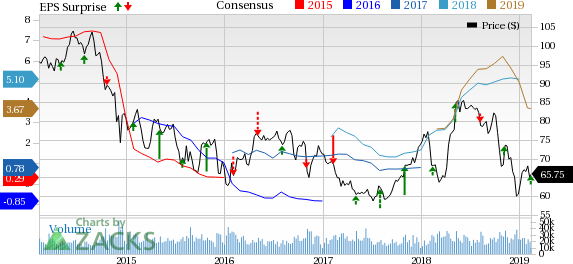

Occidental Petroleum Corporation (NYSE:OXY) reported fourth-quarter 2018 earnings of $1.22 per share, surpassing the Zacks Consensus Estimate of $1.12 by 8.9%. In the year-ago quarter, the company’s bottom line came in at 41 cents per share.

Total Revenues

Occidental's total revenues were $4,802 million, beating the Zacks Consensus Estimate of $4,512 million by 6.4%. Also, the top line improved 33.8% year over year from $3,588 million.

This year-over-year improvement in total revenues resulted from an increased production from Permian Resources, coupled with revenue growth from the Midstream & Marketing segment.

Production & Sales

Occidental’s average daily net oil, liquids and gas production volume expanded to 700,000 barrels of oil equivalent per day (boe/d) from 621,000 boe/d in the prior-year quarter. This improvement in production volume was backed by higher drilling activity and solid output in the Permian Resources region. Permian Resources production improved 57% year over year.

In the quarter under review, total sales volume was 702,000 boe/d compared with 624,000 boe/d recorded in the year-ago period.

Realized Prices

Realized prices for crude oil in the fourth quarter rose 4.5% year over year to $56.11 per barrel on a worldwide basis.

Worldwide realized NGL prices decreased 8.8% from the prior-year quarter to $22.88 per barrel.

However, worldwide natural gas prices were down 13.2% from the year-ago quarter to $1.51 per thousand cubic feet.

Highlights of the Release

Selling, general and administrative and other operating expenses in the fourth quarter were $473 million, up 5.6% year over year from $448 million.

Interest expenses in the reported quarter were $99 million compared with $87 million in the year-ago period.

Financial Position

As of Dec 31, 2018, Occidental had cash and cash equivalents of $3,033 million compared with $1,672 million recorded in the corresponding period of 2017.

As of Dec 31, 2018, the company had a long-term debt (net of current portion) of $10,201 million compared with $9,328 million on Dec 31, 2017.

In the fourth quarter of 2018, cash from operations was $2,500 million, up from $1,421 million in the prior-year period.

In fourth-quarter 2018, Occidental’s total capital expenditure was $1,337 million, higher than $1,160 million invested in the year-ago period.

Zacks Rank

Currently, Occidental carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Oil & Energy Releases

ConocoPhillips (NYSE:COP) reported fourth-quarter earnings of $1.13 per share, beating the Zacks Consensus Estimate by 14.1%.

Hess Corporation (NYSE:HES) reported fourth-quarter loss of 3 cents per share, narrower than the Zacks Consensus Estimate of 44 cents.

Andeavor Logistics LP (NYSE:ANDX) reported fourth-quarter earnings of 66 cents per unit, lagging the Zacks Consensus Estimate by 9.6%.

3 Medical Stocks to Buy Now

The greatest discovery in this century of biology is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating revenue, and cures for a variety of deadly diseases are in the pipeline.

So are big potential profits for early investors. Zacks has released an updated Special Report that explains this breakthrough and names the best 3 stocks to ride it.

Occidental Petroleum Corporation (OXY): Free Stock Analysis Report

Hess Corporation (HES): Get Free Report

ConocoPhillips (COP): Get Free Report

Tesoro Logistics LP (ANDX): Get Free Report

Original post

Zacks Investment Research