- Occidental Petroleum reports its first quarter 2023 results this Tuesday, May 9, after the market closes.

- Warren Buffett has denied that he will take control of the company.

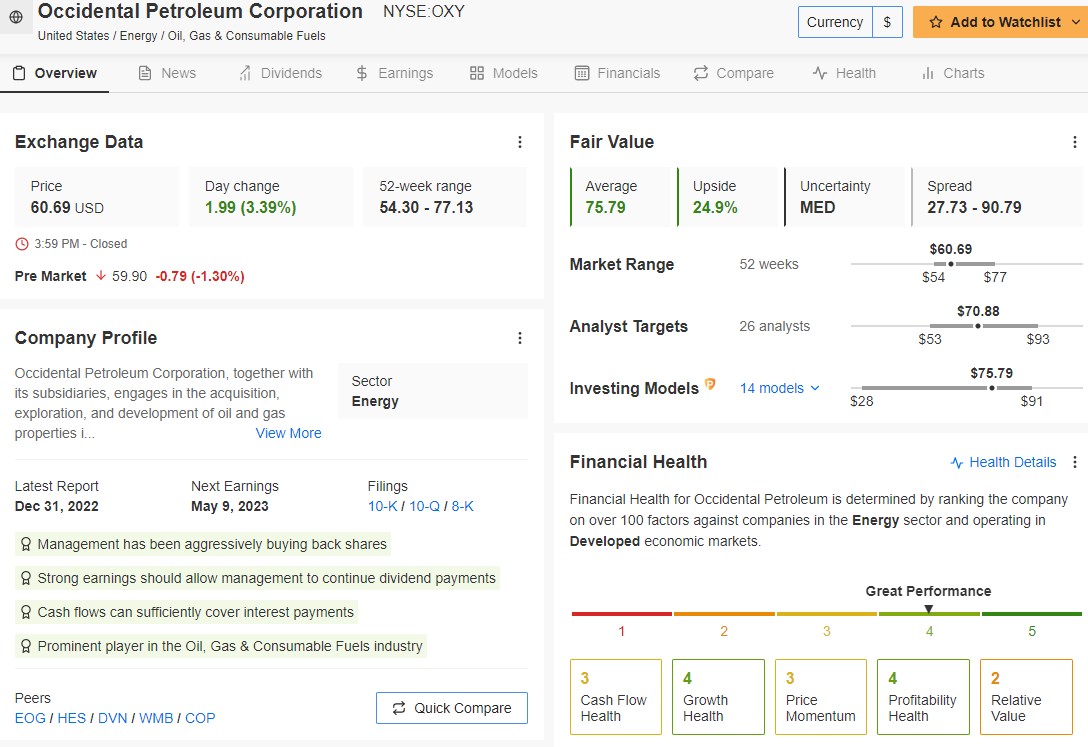

- The company's fair value is $75.79, and its risk is medium, according to InvestingPro.

"There's speculation that we're going to take control of Occidental Petroleum. But we're not going to do that, we wouldn't know what to do with it."

With this resounding statement, Warren Buffett, chairman of Berkshire Hathaway (NYSE:BRKa), dismissed rumors about a possible buyout of the U.S. oil company at the annual shareholder meeting last Saturday.

Nevertheless, the rumors are not for nothing. Occidental Petroleum (NYSE:OXY) is one of Buffett's biggest purchases in recent years, along with Chevron (NYSE:CVX) (9.8% of the portfolio), in the tycoon's growing bet on the energy sector.

Last August, the Federal Energy Regulatory Commission (FERC) granted Berkshire approval to buy up to 50% of the energy giant's outstanding shares.

Since then, Buffett has steadily increased his stake in Occidental. Today, Berkshire Hathaway owns 23.6% of the company. This represents 4.1% of Buffett's portfolio. It ranks seventh in his portfolio, with a stake valued at $12.24 billion.

Source: InvestingPro

Berkshire owns $10 billion in Occidental preferred stock and has warrants to purchase another 83.9 million shares of common stock for $5 billion, or $59.62 each.

The warrants were obtained as part of the company's 2019 agreement that helped fund Occidental's purchase of Anadarko.

What to Expect From the Company’s Results?

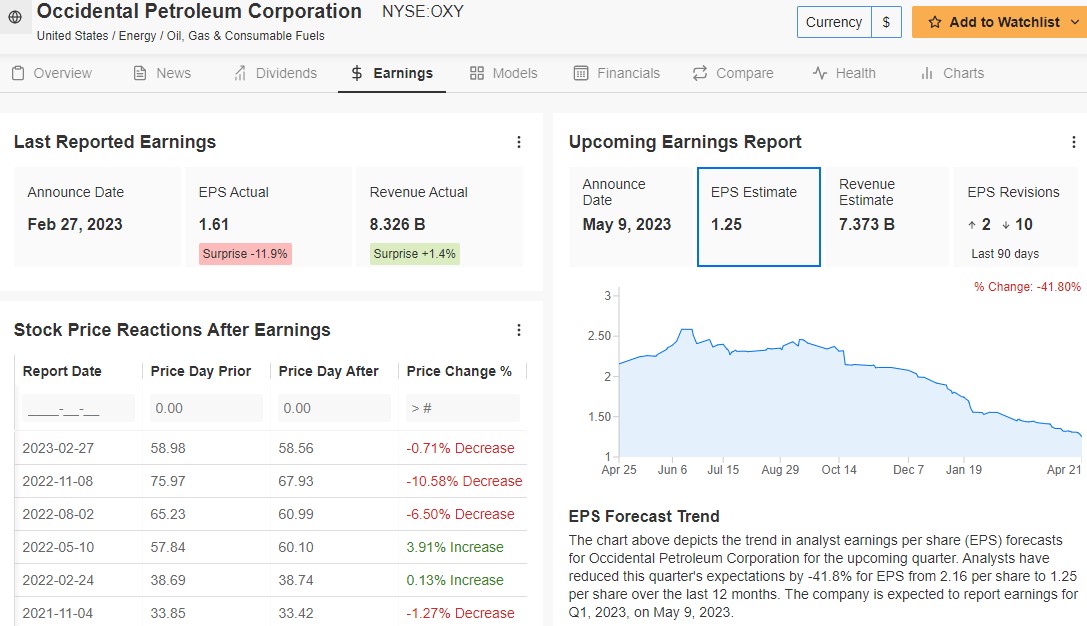

This Tuesday, May 9, after the market closes, the company reports its 2023 first-quarter results. The consensus expects a profit of $7,373 million.

As for earnings per share (EPS), analysts have lowered their expectations for this quarter by -41.8%, from $2.16 per share to $1.25 per share over the last 12 months.

Source: InvestingPro

According to InvestingPro, Occidental is in good financial health, and its shares have performed well. The average fair value based on 14 financial models is $75.79, and the risk is medium.

Source: InvestingPro

To the company's credit, InvestingPro notes that management has aggressively repurchased shares, with a 5.3% return over the past 12 months.

Repurchase yield measures the difference between share repurchases and share issuance over the past 12 months divided by the company's market capitalization.

In addition, strong earnings should allow the management to continue paying dividends, and cash flows can adequately cover interest payments. Occidental Petroleum's trailing 12-month dividend coverage ratio is 14.2x.

On the downside, the company has lost 3% of its value so far in 2023. However, its shares doubled in value in 2022, making it the highest-yielding stock on the S&P 500.

Taking all its factors into account, the analysts' consensus is that the stock is a buy.

With InvestingPro, you have Occidental data for the last 10 years at your disposal. You can try InvestingPro free of charge for 7 days.

In recent years, Buffett has doubled his investments in energy while trimming his holdings in technology and banking even though oil and gas stocks have enjoyed high valuations for several years, while technology stocks are typically cheaper.

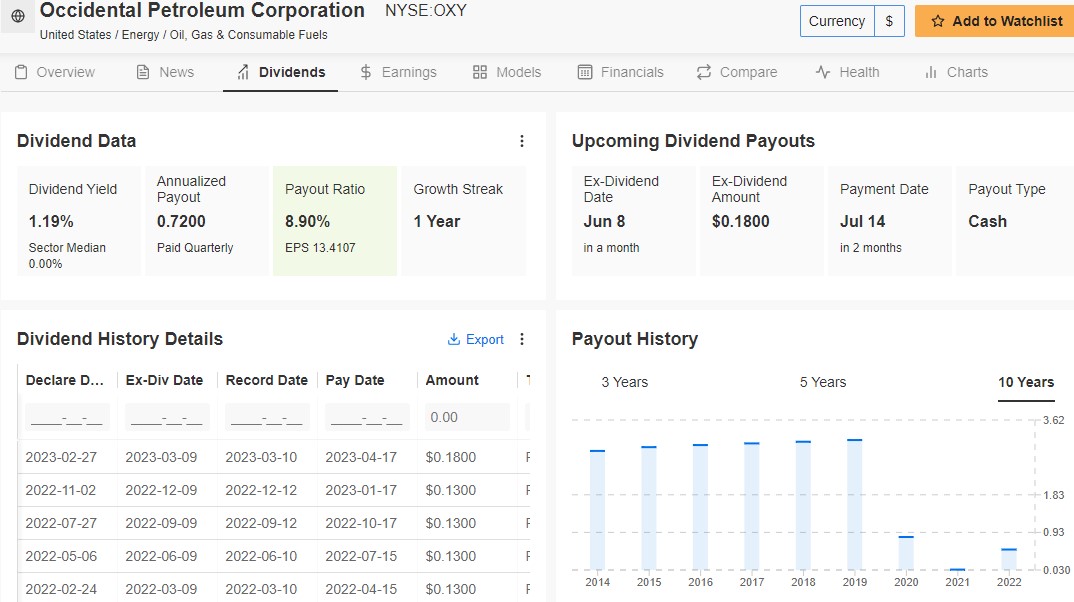

Occidental announced a regular quarterly dividend of $0.18 per share on 4 May. Shares must be purchased before the ex-dividend date of 8 June and will be paid on 14 July.

Source: InvestingPro

Occidental shares closed at $58.96 on Monday.

Disclaimer: This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest nor is it intended to encourage the purchase of assets in any way.