It has been a generally muted week for the New Zealand dollar, save for Monday, when it fell by 1.3% in the aftermath of the strong US employment report. With a light economic calendar this week in both the US and New Zealand, the markets are casting an eye to next week, which is loaded with key events. The US releases CPI, retail sales reports, and the Fed policy meeting on Wednesday. On the same day, New Zealand releases the third-quarter GDP.

New Zealand wrapped up the week on a high note, as Manufacturing Sales sparkled in Q3 with a gain of 3.2%. This was a strong rebound from the -4.9% release in Q2 and ahead of the -2.4% consensus. The manufacturing sector is showing signs of weakness, as Manufacturing PMI declined in October for the for time since August 2021.

Inflation remains the main focus for the major central banks, and next Tuesday’s US inflation report should be considered a market-mover. Inflation has eased over the past several months, but the Fed has been very cautious and is still reluctant to declare that inflation has peaked. The Fed has not looked kindly on market exuberance triggered by soft inflation reports and paraded a stream of Fed members to remind investors that inflation remains unacceptably high and the fight to curb inflation remains far from over.

The markets will get a look at US inflation data later today, with the release of the Producer Price Index (PPI). The index is expected to drop to 7.4%, down from 8.0%. I don’t expect a drop in PPI to send the markets into a frenzy the way that CPI can, but a lower PPI would reinforce expectations that we’ll see a decline in CPI as well next week.

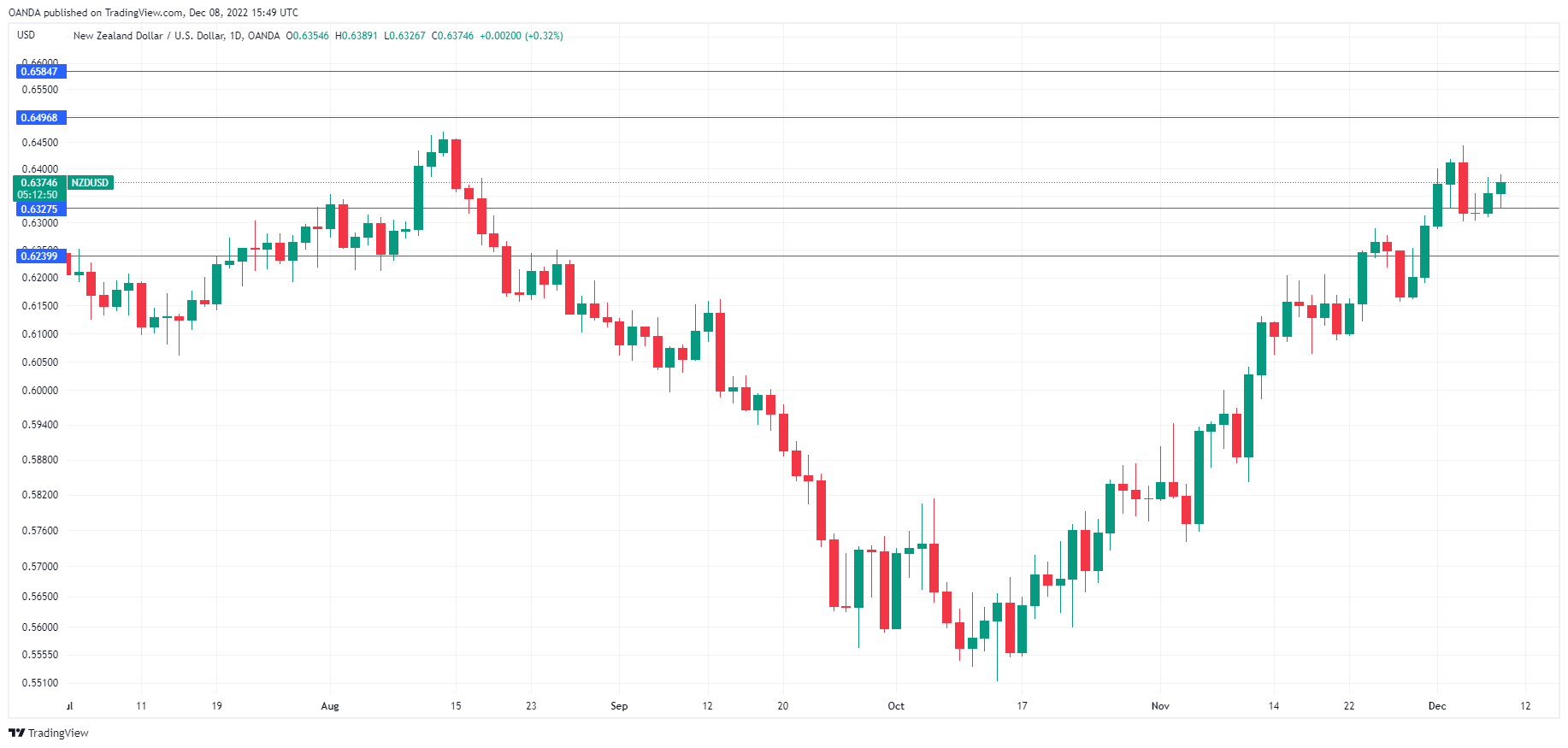

NZD/USD Technical

- NZD/USD faces resistance at 0.6497 and 0.6585

- There is support at 0.6327 and 0.6239