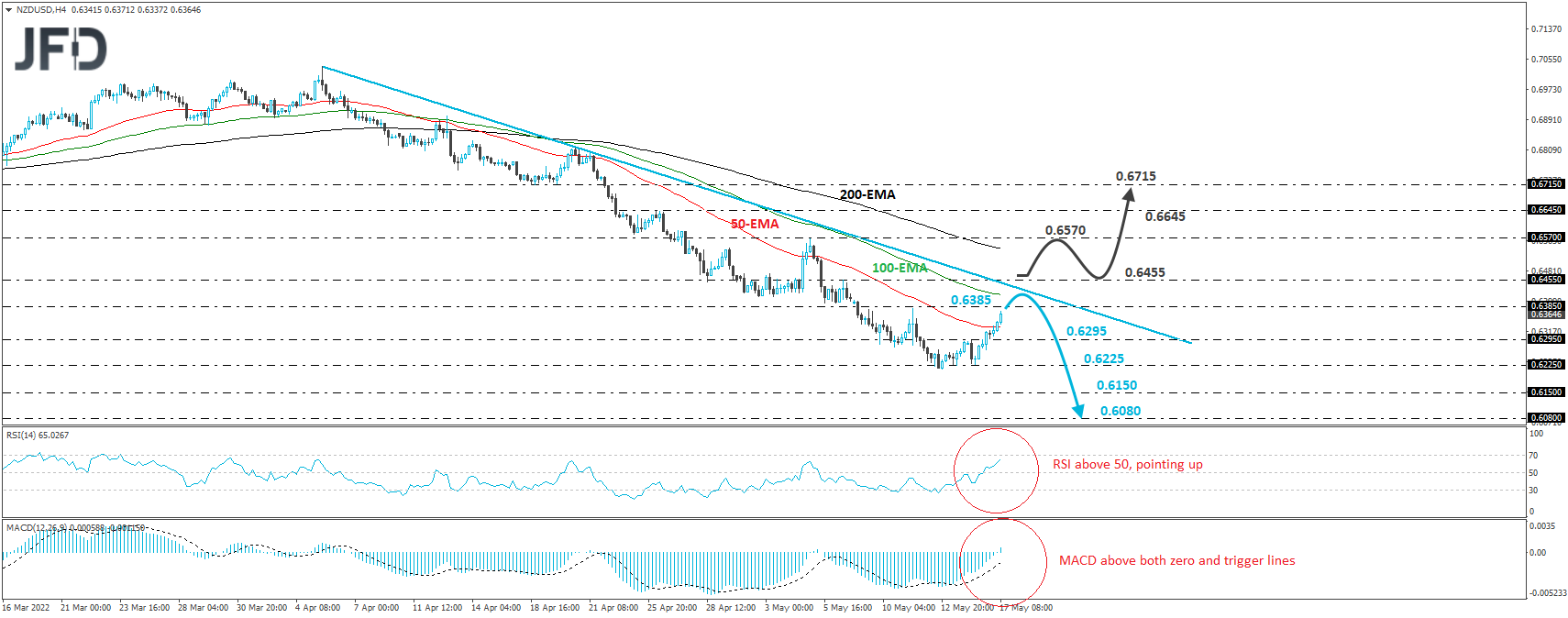

NZD/USD has been in a recovery mode since yesterday, when it hit the 0.6225 zone, which also provided support on May 12 and 13.

However, the rate remains below the downside resistance line taken from the high of Apr. 5, and thus, we would still consider the short-term outlook to be bearish.

The bears could take charge from near that line, or even the high of May 11, at 0.6385, and push for another test near the 0.6225 zone. If the are willing to overcome that territory this time, we would expect them to target the 0.6150 hurdle, which is defined as a support by the low of May 27, 2020, the break of which could see scope for further declines, towards the 0.6080 area, marked by the low of May 25 of that same year.

Shifting attention to our short-term oscillators, we see that the RSI lies above 50 and points up, while the MACD, already above its trigger line, has just poked its nose above its trigger line. Both indicators detect positive speed and support the notion for some further advances before the next leg south.

In order to start examining the bullish case, we would like to see a clear break above 0.6455, a resistance marked by the high of May 6. This could also signal the break above the downside resistance line taken from the high of Apr. 5 and may initially see scope for extensions towards the peak of May 5, at 0.6570.

If that barrier doesn’t hold and breaks, then we could see advances towards the high of Apr. 26, at 0.6645. Another break, above that hurdle, could allow extensions towards the 0.6715 zone, marked by the inside swing low of Apr. 19.