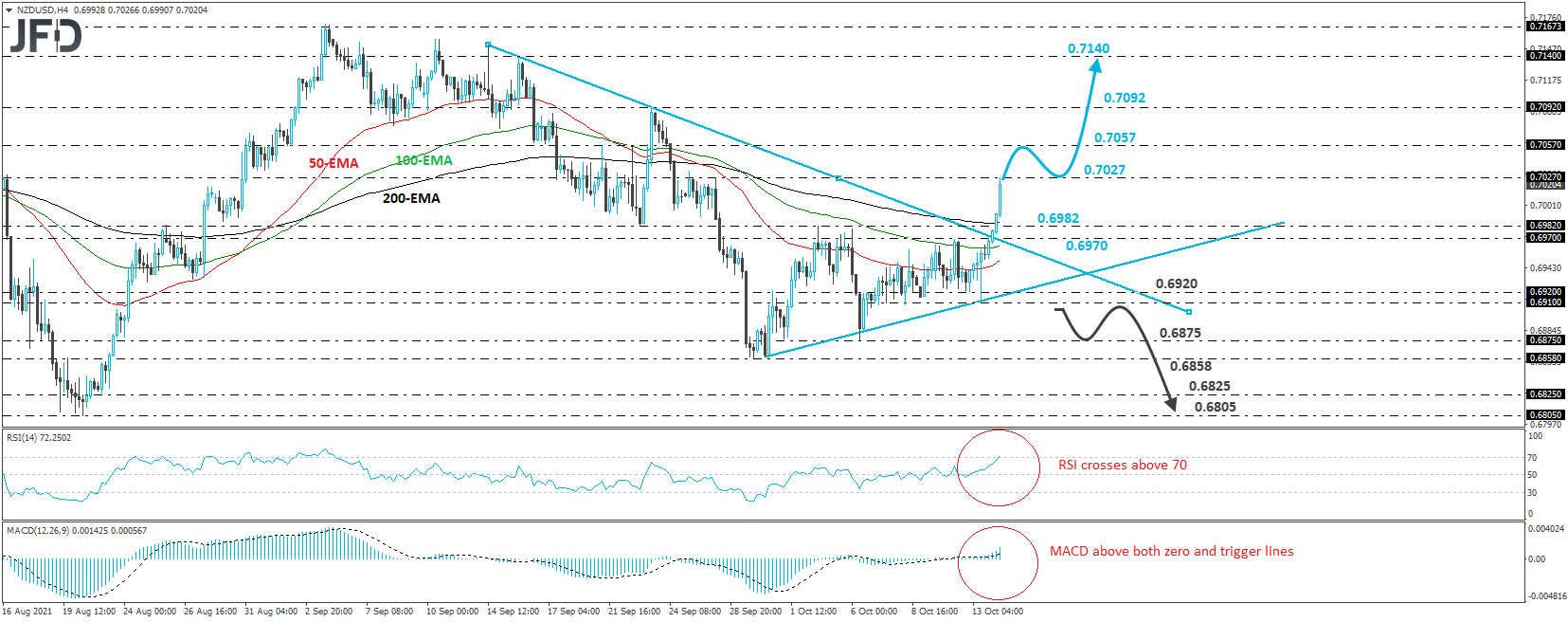

NZD/USD skyrocketed on Thursday, breaking above the downside resistance line drawn from the high of Sept. 14. At the time of writing, the rate is testing the peak of September 28th, at 0.7027. On top of that, since Sept. 30, NZD/USD has been printing higher lows above an upside line drawn from the low of Sept. 30. All these signs paint a positive short-term picture for now.

If the bulls are strong enough to push the action above the 0.7027 barrier, we could soon see them targeting the 0.7057 level, marked by the highs of Sept. 21 and 22. Another break above 0.7057 could target the 0.7092 barrier, marked by the high of Sept. 23, the break of which could encourage larger advances, perhaps towards the peak of Sept. 15, at 0.7140.

Shifting attention to our short-term oscillators, we see that the RSI just ticked above its 70 line, while the MACD lies above both its zero and trigger lines. Both indicators detect strong upside speed and support the notion for further short-term advances in this exchange rate.

The outlook could change back to negative if we see a dip below 0.6910. This would confirm the rate’s return back below both the aforementioned diagonal lines, as well as a forthcoming lower low on the 4-hour chart. The bears may then push the action down to the 0.6875 or 0.6858 levels, marked by the lows of Oct. 6 and Sept. 29 respectively. If neither hurdle is able to stop the slide, then we could experience extensions towards the low of Aug. 23, at 0.6825, or the low of Aug. 20, at 0.6805.