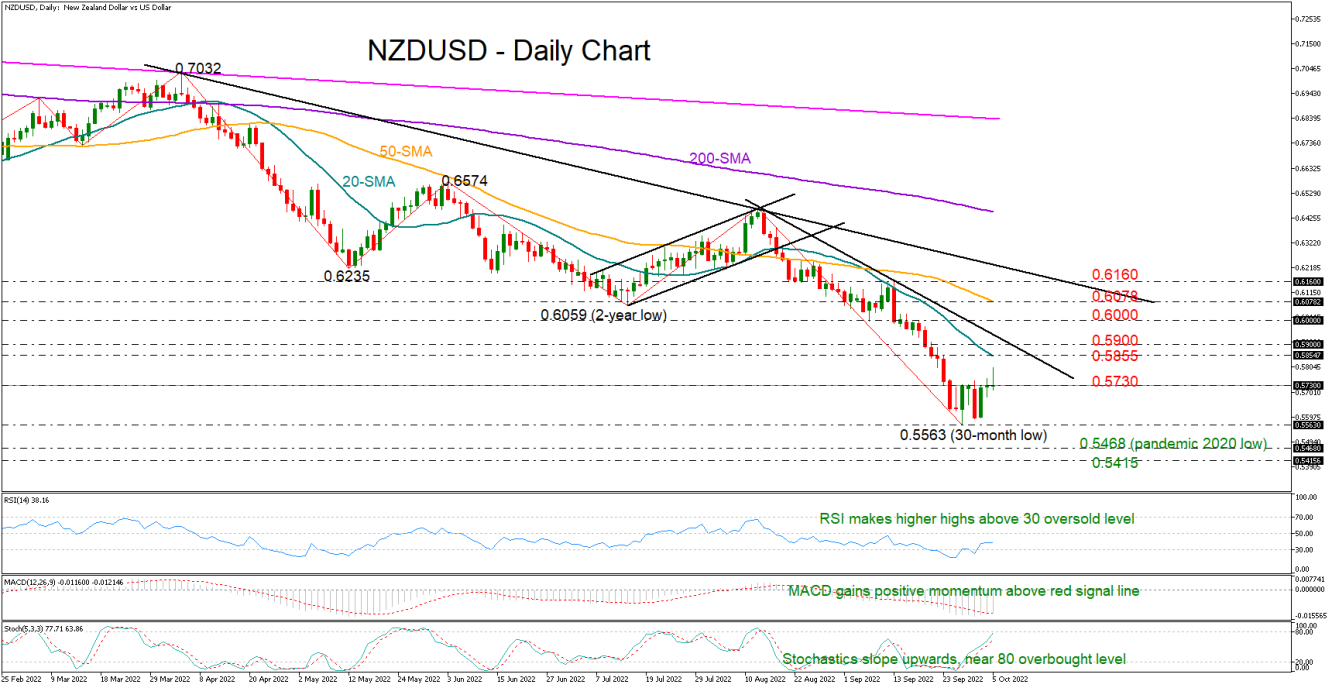

NZD/USD finally jumped above the weekly resistance of 0.5730 to top at 0.5800 in the wake of the RBNZ’s hawkish policy announcement early on Wednesday.

Although the pair has already reversed its advance, the RSI continues to build its uptrend above its 30 oversold level, signaling that the previous bearish wave in the price has probably bottomed out. Likewise, the MACD is extending its positive momentum above its red signal line, mirroring an improving short-term bias as well.

On the way up, the recovery may initially face some challenges between the 20-day simple moving average (SMA) at 0.5855 and the tentative descending trendline currently seen around 0.5900. If the bulls forcefully pierce through this area, the next obstacle could be found between 0.6000 and the 50-day SMA at 0.6078.

Should the bears retake control, pressing the price quickly below 0.5730, all eyes will turn again to the 0.5563 low. A durable extension beneath that bar would bring the pandemic 2020 trough of 0.5468 and the nearby constraining zone of 0.5415 back under the spotlight.

In brief, buying appetite may keep improving in NZD/USD in the short term once the price successfully overcomes the 0.5725 bar.