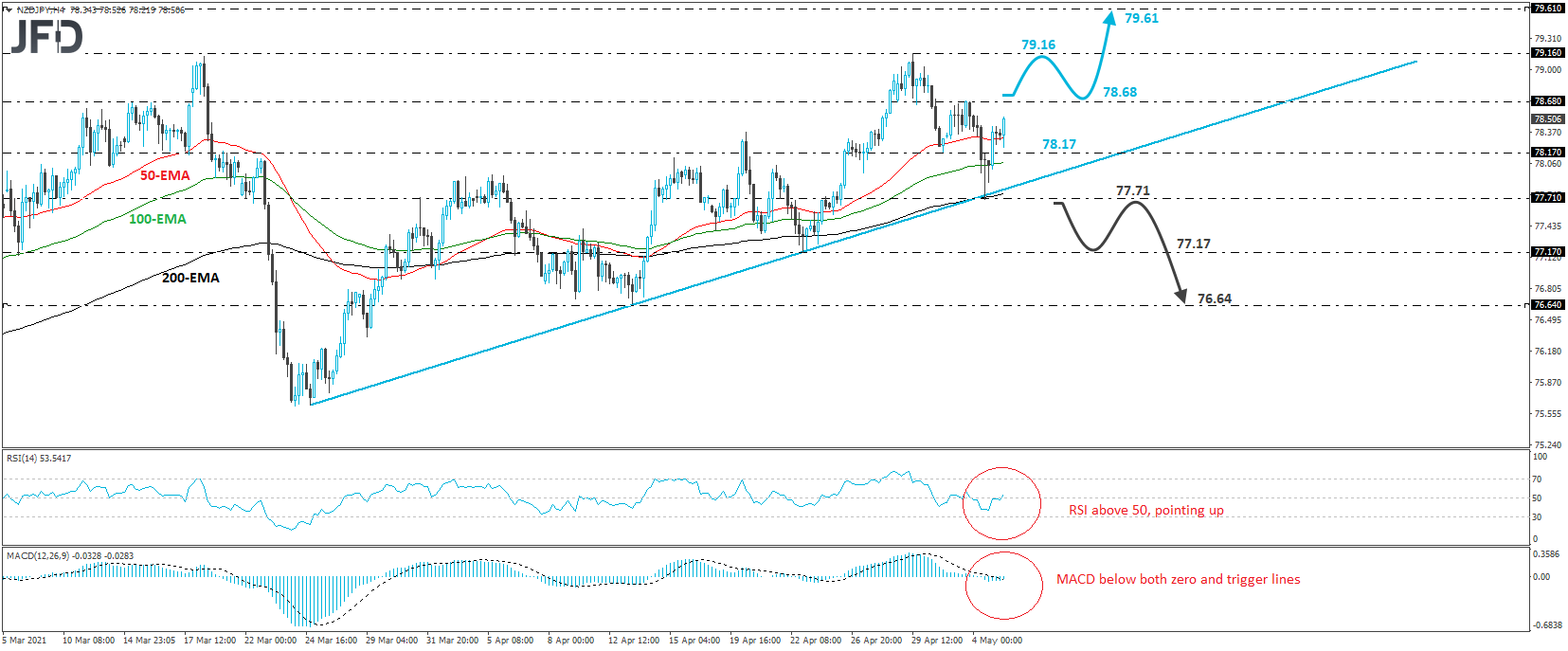

NZD/JPY has been in a recovery mode since yesterday, when it hit support at the crossroads of the 77.71 level and the upside support line drawn from the low of Mar. 24. As long as the pair continues to trade above that upside line, we would consider the short-term outlook to be positive.

At the time of writing, the rate is approaching the 76.68 resistance, marked by Monday’s high, the break of which could allow the bulls to target the key hurdle of 79.16, which rejected further advances on Feb. 25, Mar. 18, and last Thursday. If they manage to overcome it this time around, the rate would be placed into territories last tested back in April 2018, with the next possible resistance being the 79.61 barrier, marked by the peak of the 13th of that month.

Shifting attention to our short-term oscillators, we see that the RSI has just crossed above 50, while the MACD, although still slightly below both its zero and trigger lines, shows signs of bottoming as well. Both indicators suggest that the pair may start regaining upside speed soon, which supports the idea of a trend continuation.On the downside, a dip below 77.71 would confirm a forthcoming lower low and perhaps signal a short-term bearish reversal. The bears may then get encouraged to drive the action down to the low of Apr. 22, at 77.17, the break of which may set the stage for extensions towards the 76.64 area, defined as a support by the low of Apr. 13.