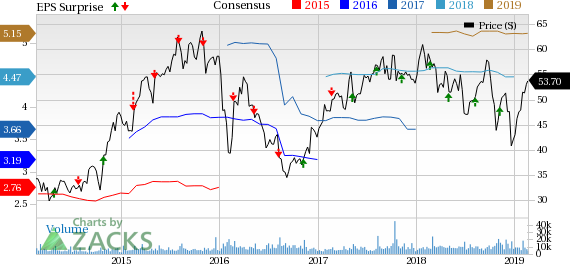

Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) reported better-than-expected earnings per share in the fourth quarter of 2018. The company’s earnings (excluding 15 cents from non-recurring items) of 85 cents per share outpaced the Zacks Consensus Estimate of 79 cents and increased substantially on a year-over-year basis. Higher revenues aided the quarterly results.

Moreover, the cruise operator issued an encouraging view for first-quarter and 2019. For the first quarter, Norwegian Cruise Line expects earnings (excluding special items) of approximately 70 cents per share, above the Zacks Consensus Estimate of 57 cents.

Adjusted earnings for 2019 are anticipated to be in the band of $5.20-$5.30, again above the Zacks Consensus Estimate of $5.15. Both earnings beat and an upbeat guidance pleased investors. Consequently, shares of the company increased in pre-market trading.

Revenues came in at $1,381.2 million, marginally short of the Zacks Consensus Estimate of $1,395.2 million. The top line, however, improved on a year-over-year basis. The year over year improvement was due to the 15% increase in passenger ticket revenues to $958.4 million.

The same from onboard and other sources was up 1.6% on a year-over-year basis to $422.8 million. Gross yield (total revenue per Capacity Day) increased 3% in the quarter on a year-over-year basis.

On a constant currency basis, net yield increased 4.7% in the final quarter of 2018. The measure was up 4.2% on a reported basis. Fuel price per metric ton (net of hedges) increased 7.8% to $496 in the quarter under review.

Total cruise operating expenses were up 8.5% to $817.3 million due to a 7.3% rise in Capacity Days. Also, marketing, general and administrative expenses rose 12.4% year over year to $208.94 million. Gross Cruise Costs (sum of cruise operating expenses and marketing, general and administrative cost) per Capacity Day increased almost 2% in the fourth quarter due to higher marketing, general and administrative expenses.

Fuel price per metric ton, net of hedges, is projected at $456 and $465 for the first quarter and full year 2019, respectively.

Zacks Rank & Key Picks

Norwegian Cruise Line has a Zacks Rank #3 (Hold). Better-ranked stocks in the broader Consumer Discretionary sector are Royal Caribbean Cruises (NYSE:RCL) , Manchester United (NYSE:MANU) and Cinemark Holdings (NYSE:CNK) . All three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Royal Caribbean and Manchester United have gained 12.5% and 8.4% respectively over the last three months. The Zacks Consensus Estimate for current-quarter earnings has increased 7.1% over the last 30 days at Cinemark Holdings.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Cinemark Holdings Inc (CNK): Free Stock Analysis Report

Norwegian Cruise Line Holdings Ltd. (NCLH): Free Stock Analysis Report

Manchester United Ltd. (MANU): Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL): Free Stock Analysis Report

Original post

Zacks Investment Research