Ely Gold Royalties Inc (OTC:ELYGF) features a unique royalty generation model. The company holds a sizeable portfolio of resource properties in the Western United States—mostly Nevada—that it makes available to sell outright or through a four-year option contract. Once the buyer completes the payments, it owns outright 100% of the project, and Ely Gold retains a royalty on future production.

The buyer has no work commitments. If a buyer on a four-year option decides not to continue with the payments, the property is returned to Ely Gold.

Trey Wasser, Ely Gold's president and CEO, told Streetwise Reports, "Our model is much more scalable than the traditional joint venture model, as we have no property/exploration management responsibilities. This allows us to build a much larger portfolio that is constantly generating new royalties. It also allows us to keep our overhead very low and operate just like a royalty company. This keeps the company's cash flow positive. We, in turn, then can actively seek and purchase additional existing third-party royalties. This is how Ely Gold is transitioning into North America's newest gold royalty company."

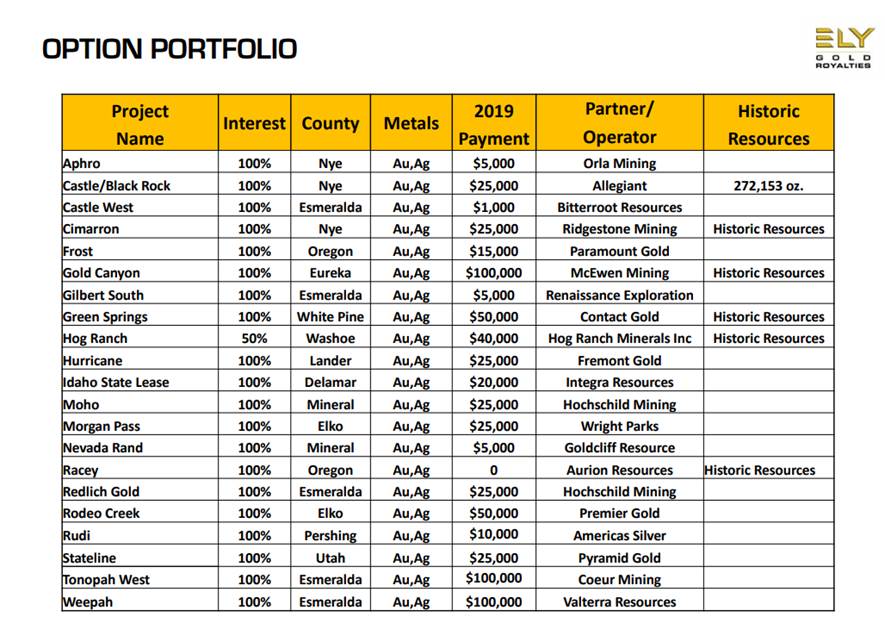

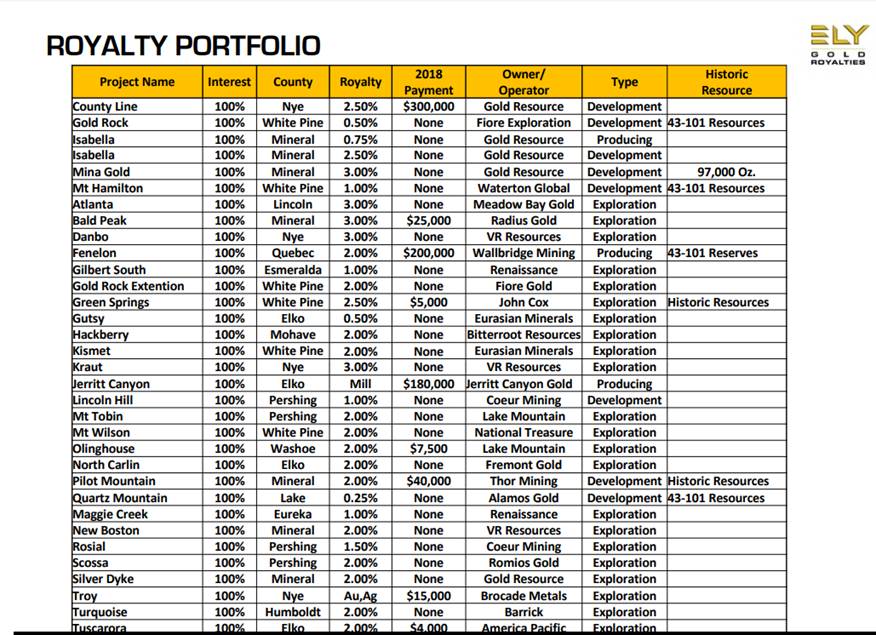

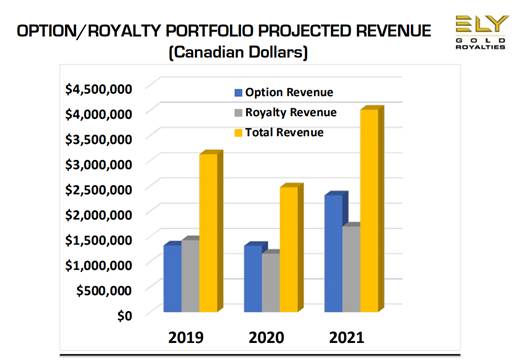

Ely Gold's portfolio currently includes 33 deeded royalties, 21 properties optioned to third parties, and more than 20 properties available for optioning.

The company is one the radar of some of the most well-known names in the resource industry. In July, a company controlled by Eric Sprott purchased a 1% royalty on the Fenelon Mine property, located in central-west Quebec, that is operated by Wallbridge Mining Company Ltd., for US$1.25 million. Ely Gold retains a 2% royalty on the property.

Sprott also participated in an Ely Gold private placement, purchasing approximately 5.6 million Ely Gold units at the price of CA$0.18 for gross proceeds of more than CA$1.01 million. Each unit consists of one common share and one half of a common share purchase warrant; the warrant carries an exercise price of CA$0.30 and is valid for three years. This placement has Sprott holding 5.7% of Ely Gold shares, 8.3% if the warrants are exercised.

In January, Exploration Capital Partners 2005 Limited Partnership, where noted resource investor Rick Rule serves as president, subscribed for 9.069 million units at CA$0.11 per unit in the first tranche of a private placement. Each unit consists of one common share and one common share price warrant to purchase an additional share at an exercise price of CA$0.22 for five years. Exploration Capital Partners holds 9.74% of the issued and outstanding shares of Ely Gold on a non-diluted basis, and 17.75% on a partially diluted basis.

Additionally, McEwen Mining recently purchased an option agreement from Fremont Gold Corp. for Gold Canyon claims in Nevada for 300,000 McEwen shares. The claims are located in McEwen's Gold Bar Mining Complex, where the company achieved commercial production in May. McEwen takes over the obligation to pay the option payments to Ely Gold for the property, $112,500 per year for three years and a final payment of $300,000 on or before December 29, 2022.

Ely Gold has been actively selling options on properties, including:

Ely Gold has also been acquiring royalties, including, since the first of the year:

"Ely Gold has royalties on three properties that are producing: Isabella, Fenelon and Jerritt Canyon," Wasser told Streetwise Reports. "In addition, eight or nine of our properties have been optioned to companies—some of the best operators in Nevada—that have mining operations right around the optioned properties. These are operations that are in production or near to achieving production. That means that as the operators explore our properties, all they have to do is find a minor deposit. If they find 200,000 to 500,000 ounces of gold, that might not be enough to build a new mine, but it would work as a satellite deposit. The timeline to production is much shorter, as is the threshold of discovery. They are just looking for more resources to feed their existing mines."

Wasser believes the company is in a sweet spot for picking up royalties. "Ely Gold is now in a position with a market cap of CA$33 million where we are able to look at $2 million to $5 million royalty deals. We have very little competition at that end of the market. For royalty companies with $200 million market caps and higher, that size of deals won't move the needle, but it does for us. These deals really do add up and result in more capital appreciation for shareholders."

Industry observers are following Ely Gold closely. On June 12 Resource Maven Gwen Preston noted that Eric Sprott paid CA$1.67 million for a 1% royalty on the Fenelon Mine property. "This royalty sale is a great example of how Ely balances building a strong royalty portfolio with ensuring it captures opportunities to make money today. Ely paid $700,000 for the 1% royalty just last fall, so it's clearing almost $1 million in a move that also brings a famous and followed mining investor into the shareholder registry."

On June 19, after Ely Gold optioned the Nevada Rand and Castle West properties, Preston commented, "These are just two more examples of the deal-making mode Ely has been in of late. It's monetizing its assets while continuing to build out its robust royalty portfolio. Given the leverage that Ely offers on bullish precious metals markets, this is definitely a company we'll want to hold onto as those markets begin to hit their stride."

After Ely Gold acquired the 1% NSR royalty on Coeur Mining's Lincoln Hill project, Thibaut Lepouttre of Caesars Report commented on May 1, "Considering the average grade at Lincoln Hill is higher than the grade of its adjacent Rochester mine, we would expect Coeur to be very interested in bringing Lincoln Hill into production as fast as possible in which case Ely's net smelter royalty could start to bring in cash."

Ely Gold's shares have appreciated rapidly in the last year, from a 52-week low of CA$0.09 last October, to a high of CA$0.41 in early August, before settling to around the current CA$0.31.

Ely Gold has around 99 million shares outstanding and 126 million fully diluted. It has a tight share structure with approximately 11% of the shares held by management and insiders; 25% by long-term shareholders; 10% by Exploration Capital Partners, a Sprott Resource company helmed by Rick Rule, and 5% by Eric Sprott.

"After spending three years on the road with my partner, geologist Jerry Baughman—president of the company's U.S. subsidiary, Nevada Select Royalty—building up the portfolio, we are now at the point where investors both large and small are recognizing the shareholder value that we are creating," Wasser stated.