Last month’s Nonfarm Payrolls report came in roughly in-line with expectations, underscoring the US labor market’s resilience and doing little to call the Fed’s aggressive interest rates hikes into question. Policymakers at the world’s most important central bank have repeatedly implied that they intend to raise interest rates until the unemployment starts to rise, at minimum, as they can so as long as we continue to see solid job growth and low unemployment, the dominant trend of monetary policy tightening across the globe remains intact.

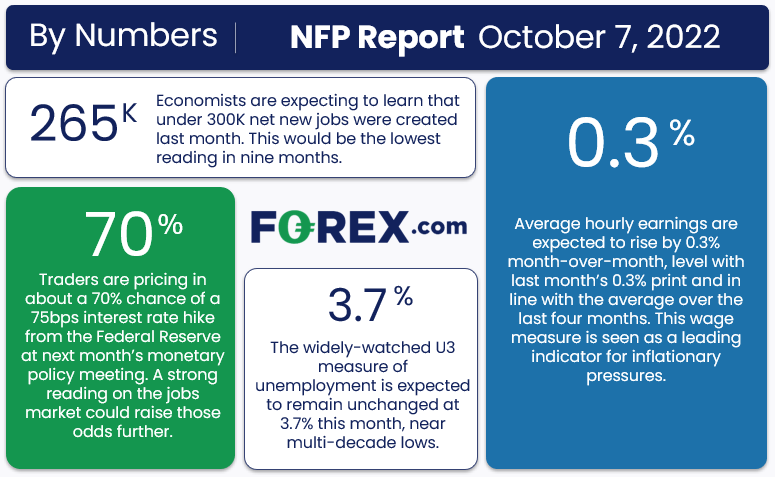

That said, there is a hint of uncertainty about the Fed’s next interest rate decision, with the CME’s FedWatch tool showing that Fed Funds futures traders are pricing in about a 70% chance of another 75bps rate hike next month, so we’re likely to see some market volatility regardless of how this month’s jobs report prints. To put it lightly, the stakes are high for traders, regardless of their favored market. For the September nonfarm payrolls report, consensus expectations are for 265,000 net new jobs and average hourly earnings projected to rise by 0.3% month-over-month:

Source: StoneX

Are the expectations justified? We dive into the key leading indicators for Friday’s critical jobs report below!

NFP forecast

As regular readers know, we focus on four historically reliable leading indicators to help handicap each month’s NFP report:

- The ISM Services PMI Employment component rose to 53.0 up from last month’s 50.2 reading.

- The ISM Manufacturing PMI Employment component fell to 48.7, down from last month’s 54.2 reading and back into contractionary territory.

- The newly revised ADP Employment report printed at 208,000, up slightly from last month’s upwardly-revised 185K print.

- Finally, the 4-week moving average of initial unemployment claims ticked down to 207,000, down sharply from last month’s 246K reading and back near multi-decade lows.

As a reminder, the state of the US labor market remains more uncertain and volatile than usual as it emerges from the unprecedented disruption of the COVID pandemic. That said, weighing the data and our internal models, the leading indicators point to a roughly as-expected reading in this month’s nonfarm payrolls report, with headline job growth potentially coming in somewhere in the 200-300,000 range, albeit with a bigger band of uncertainty than ever given the current global backdrop.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which came in at 0.3% m/m in the most recent NFP report.

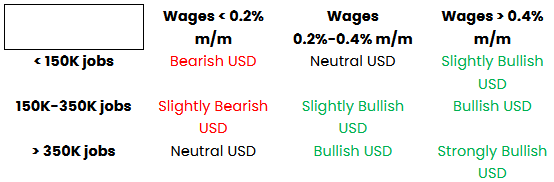

Potential NFP market reaction

The US dollar index has pulled back over the last few weeks after reaching a 20+ year high near 115.00 in late September. The recent pullback has alleviated the overbought condition on the world’s reserve currency, potentially clearing the way for another leg higher as the underlying outperformance of the US economy remains the dominant trend.

As for potential trade setups, readers may want to consider sell opportunities on EUR/USD on a strong nonfarm payrolls reading. The world’s most-widely traded currency pair has recently retraced to its 50-day EMA, an indicator that has reliably provided resistance throughout the year. The psychologically-significant parity (1.00) would also serve as a logical area for the counter-trend bounce to stall.

On the other hand, a soft jobs report could present a short-term sell opportunity in USD/CAD. While the broader trend favors the greenback, USD/CAD is currently holding below last week’s highs and the loonie could be a big beneficiary of the larger-than-expected production cut from OPEC as oil remains Canada’s most important export.