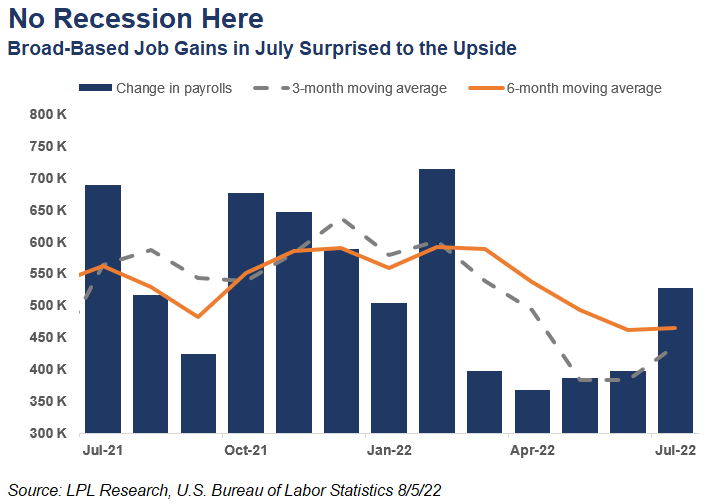

The economy added 528,000 payroll jobs in July after a solid gain in June and May. The strong gains in the job market last month should further cement the claim that the U.S. is currently not in recession. As shown in the chart below, both the three- and six-month moving averages rose in July since the last two months were revised higher. Job gains were broad-based and especially prominent in sectors such as education, health care, and government.

Firms ramped up production and increased manufacturing payrolls by roughly 30,000 in July. New jobs in manufacturing are likely due to improved supply chains and this sector should continue to add jobs as remaining supply bottlenecks improve. Total employment has returned to pre-pandemic levels in February 2020 but not back to pre-pandemic trends. The participation rate dipped slightly to 62.1% as the labor force shrunk in July by 63,000 and the unemployment rate fell to 3.5%, a decline of 0.1% percentage point.

Given the stability in the job market, especially considering rising borrowing costs and higher inflation, we do not expect the National Bureau of Economic Research (NBER) to call a recession at this point. The labor market is strong enough to offset the weaknesses in other parts of the economy such as real estate.

Growing Frustration

The decline in unemployment and the participation rate will frustrate central bankers since a tighter labor market adds inflation risk to the economy. So far, earnings have not kept up with inflation. Average hourly earnings rose 0.5% in July after rising 0.4% the previous month. As of July, average hourly earnings were 5.2% higher than a year ago.

Markets are having trouble digesting the implications of the strong labor market in July. The big headline gain in jobs was a surprise and could convince people like San Francisco Fed President Mary Daly that the economy needs another 75 basis point hike at the Fed’s next meeting. All eyes are now on inflation.