Last Wednesday began like any other Federal Reserve announcement day. The markets were on edge. The week leading up to the Fed meeting was met with continuous speculation that the Fed might pivot. Even the White House was endorsing the possibility.

At 2:15 EST, Federal Reserve Chairman Powell stepped to the microphone to announce that the Fed voted to raise the overnight lending rate, yet again. As expected, they were instituting a 0.75% (75 basis point (bp)) rise, making this the fourth straight 75 bp rise which is historically unprecedented.

Initial language was sanguine with indications that the rate of future changes would be considered on the economy’s data at that time. The market initially took off and there was a sigh of relief from analysts and the financial media as they had been predicting we were in a seasonally attractive period.

That did not last long.

At the press conference follow-up, reporters had the chance to ask direct question to Chairman Powell. One reporter got the party started when he stated directly to Chairman Powell that the market was up and must have liked the language he used at the announcement of the raise.

The market had an initial positive reaction based on the following language which was suggestive that less aggressive action would be necessary at future rate hike meetings:

"In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments."

The question from the reporter (as well as the market’s positive interpretation) might have angered the Chairman.

Subsequently he wanted to be very clear not only about the Fed’s restrictive mandate but that the Fed was in charge. The response has been described as the “Fed’s hawkish greatest hits.”

Mr. Powell emphasized that the Fed has further to go to get the policy rate to a restrictive level. His direct response to the reporter’s question went something like this:

“It is very premature to be thinking about pausing” and that incoming data since the last meeting suggests the ultimate level of interest rates will be higher than previously expected and that "there is more ground to cover” before it meets the test of being at a restrictive level.

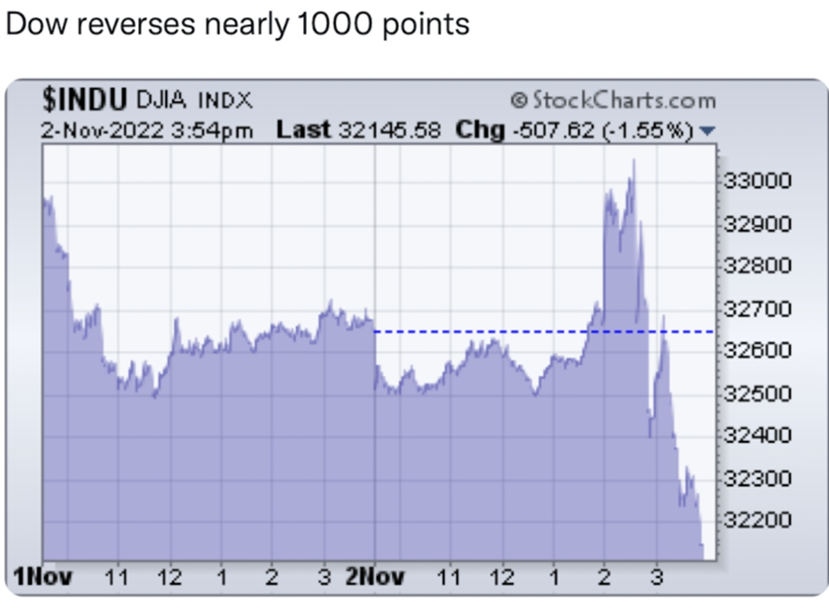

Stocks tanked and interest rates went up after this. By the end of the day stocks had sold off over 2.5%.

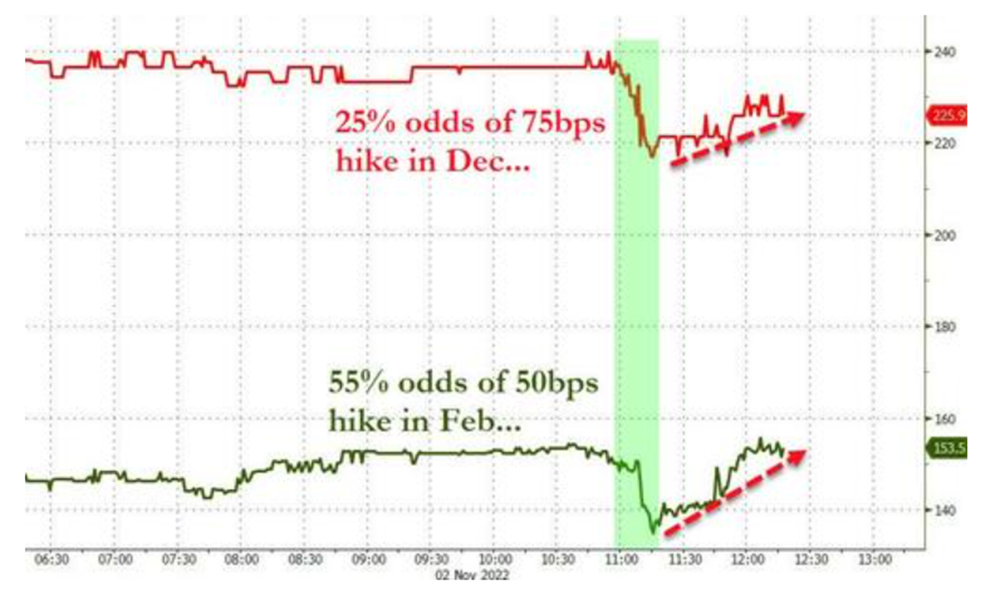

This was most discouraging to the critics who believe the Federal Reserve has raised rates too far, too quickly. The estimation that we are potentially in for another 75 bp hike in December and 50 bp hike next February punished the market quite hard. See chart below:

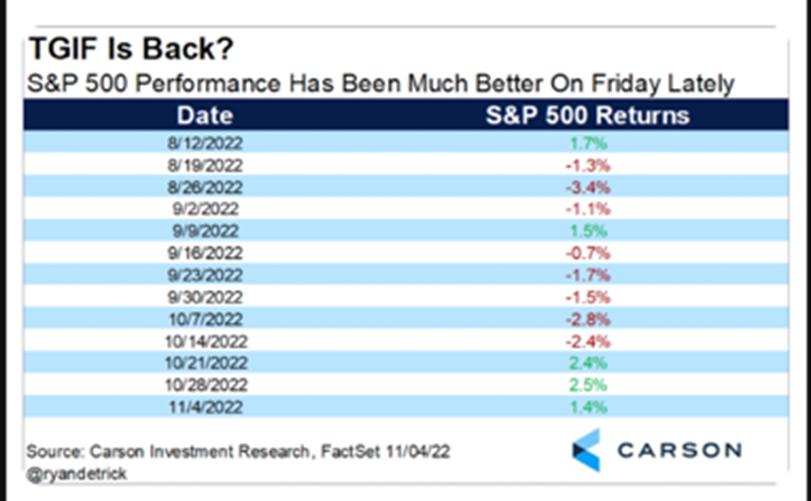

The market S&P 500 ended the week down 3.2%, the tech heavy QQQ was down 5.9% and the Dow Jones Industrials down 1.4%. But it was a good day on Friday which gave some investors comfort that not all is lost.

This was posted on Twitter Wednesday after the market’s close. I found it not only accurate but something to consider.

Titled “the Jerome Call becomes the Jerome Wall.”

Buyers stepped in on Friday and that was a welcome surprise given the long string of negative Fridays we had in August and September.

Will the Fed’s Restrictive Actions Lead to a Recession? Will the Bear Market Continue?

There is no doubt that the Fed’s mandate to bring down inflation puts investors (stock and bond) in an unfavorable position. We have often reported here that inflation is a punitive and insidious financial condition especially when working people feel as if their wages are not keeping pace with the cost of everything.

Additionally, in our viewpoint, inflation numbers are constantly being manipulated and if we were being realistic and using older methods of calculating the cost of goods and services, we likely would have inflation somewhere in the mid-teens (12%-15%). One can easily see this in the price of food and energy (something the Government likes to subtract out of the core CPI numbers as if none of us buy food and spend money on energy???).

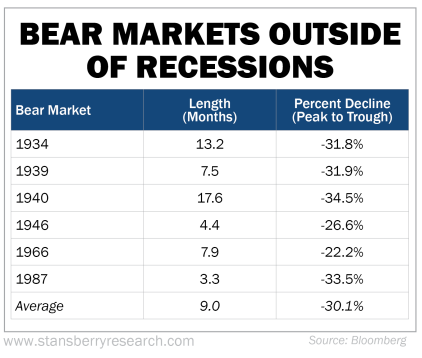

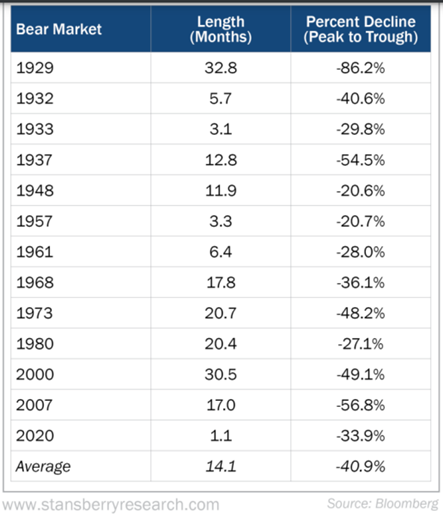

We may not be in a recession. We experienced positive GDP numbers this past quarter, although most of the output was due to government spending. If we do not experience a recession, then our current market returns are reflective of a Bear market outside a recession. About 10 months and a 25% decline. See chart below:

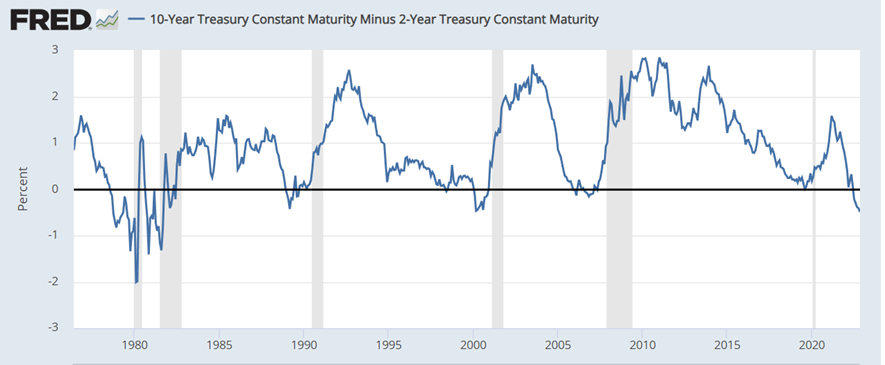

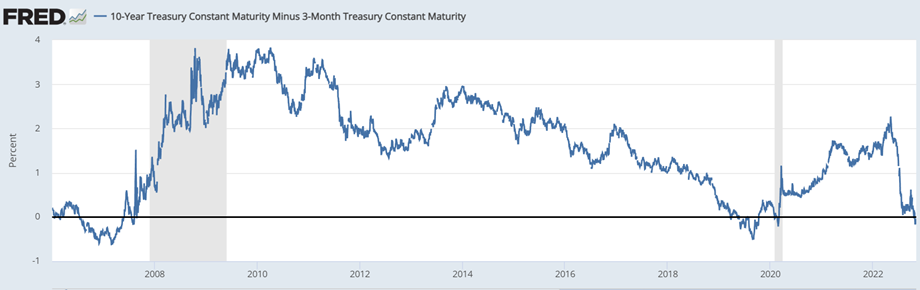

However, the rapid rise of interest rates has created an inverted yield curve on the 10-2 Treasury yield. This inversion predicts future recessions 6 months to 24 months out with an 80% accuracy.

As we learned this past week attending The Money Show in Orlando, the inversion that has a nearly 100% accurate prediction of oncoming recessions is the 10-year minus the 3-month Treasury yields. Folks we are at this juncture right now.

Given these probabilities, the statistics remain that if we go into a recession, the market likely has some downside remaining. Recent (2000 & 2007) recessions were as long as 30 months and experienced more than 30% market corrections before it was over. While we are not predicting this, it is imperative that you stay vigilant, cautious and continue to put in place risk management techniques (hedges) to mitigate any future downside. See chart below:

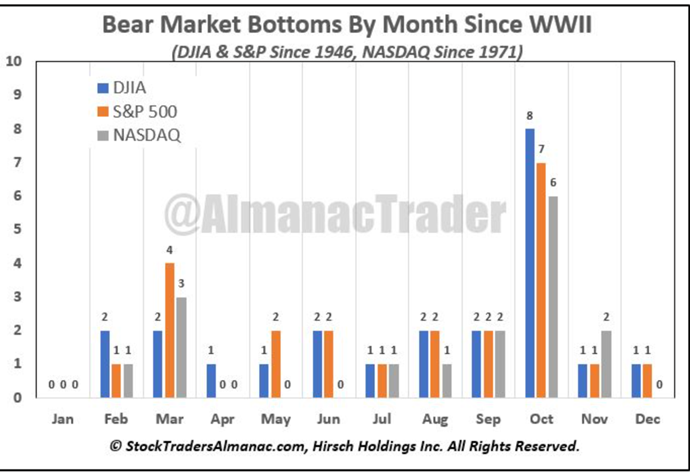

Most interesting is the following chart that shows what happens in the period following the market’s anticipation of a recession. This should provide some optimism and hope for the future.

The Seasonality and Midterm Cycle

As noted, I had the pleasure of attending The Money Show in Orlando with Mish and Keith Schneider, MarketGauge’s founders. Mish presented twice during the show. There were approximately 850 people attending. It was informative, collegial, and engaging but different market opinion. (Most were in the camp of the things I have mentioned above).

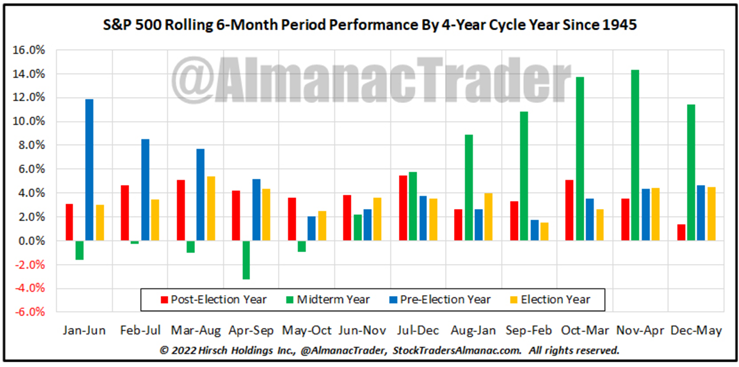

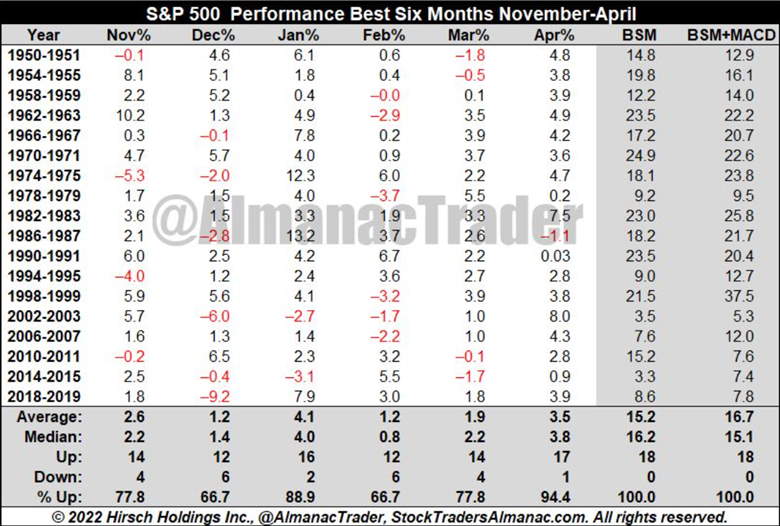

However, there were a few people we talked to that had a different and much more positive take of the markets. One such person was Jeff Hirsch of Stock Trader’s Almanac. I was thrilled to meet Jeff since I once had the pleasure of listening to his father Yale Hirsch (who started the Almanac many years ago). I thought his father was real innovator of looking at market history and statistics to arrive at fairly accurate and pinpointed market prognostications.

It was not a surprise when Jeff joined a panel of scholarly types that each provided their market perspective. Jeff’s was quite different than the others presenting, I took notice. He was emphatic about us entering a strong period for stock performance. I have highlighted his take on the positive seasonality that lies in front of us.

(I only wish to put one caveat on his powerful suggestions that the worse market performance is behind (not in front of) us. We are in uncharted territory where the FED is not our friend. After a 40-year cycle of declining interest rates we are now faced with a period of rapidly rising interest rates and a NON accommodating Fed that is reducing its own portfolio of bonds. This would typically not bode well for stocks and bonds.)

See the positive seasonality charts his company produces below:

Additional things to watch out for (potential opportunities):

- Watch for a break in the US dollar which declined 1.2% on Friday and sent gold up $50. Mish has been talking about the opportunity in gold, base metals, and miners for some time now.

- Transportation stocks. For the most part, all the airlines reported better than expected earnings recently due to high demand and keeping their costs level. However, oil and natural gas are rising yet again, and Diesel fuel is off the charts. This may have a negative effect on this sector. If the Transportation index and the ETF IYT should breakdown, that would be a big negative for the market to head lower.

- Review our ETF Complete to see where the trends lie with sectors, countries, and global ETFs. Right now, Mexico has been a hot area as well as being short interest rates through an inverse ETF.

- The large cap Dow Jones (DIA) and mid-cap (MDY) have been the strongest areas of the market recently. Watch how they hold up and if the NASDAQ (QQQ) can hold its ground or it gets weaker. So far, the QQQ has been the weakest index during September and the weakest in the market’s recovery in October.

- Pay attention to what stocks and sectors are in favor and avoid those that are not. Recently value has trounced growth and it is likely that this may continue for some time due to a contraction in the earnings growth rates of large growth companies. Shift assets to where they will be treated best. Right now, that is value.

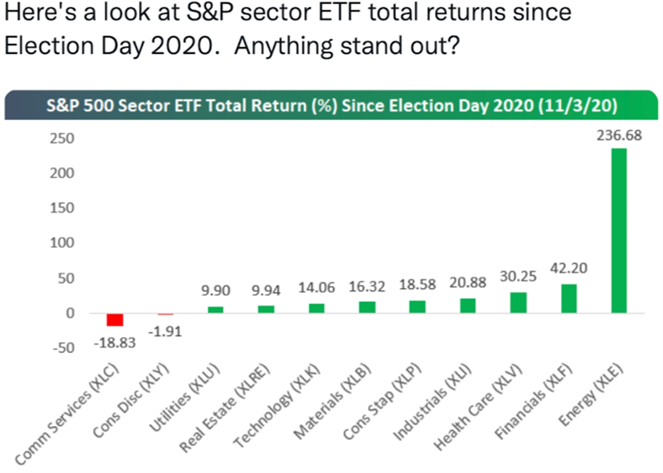

- Election day is this week. Pay attention to the narrative that comes out after the midterms. That may provide some guidance as to the direction of the economy. If the narrative shifts in any one direction (pro energy and fossil fuels as an example), that may have an overriding effect on parts of the market. Check out this graph to indicate what has happened since the election in 2020:

- Pay attention to the S&P 500 trendline. As the saying goes, “don’t fight the Fed.” One more is don’t fight the trendline. It is why we spend so much time at MarketGauge discussing phase changes and the all-important 50/200 day moving averages. Stay vigilant.

Additional BIG VIEW observations

Risk-On

- Risk Gauges have backed off to Neutral levels. (+)

- The short/long-term Volatility ratio is starting to improve off very bearish levels. (+)

- The US Dollar (UUP) took a major hit on Friday, leaving room for precious metals, cryptocurrencies, and other fiat currencies to recover. (+)

- Biotech (IBB) continues to look the strongest of Mish’s Modern Family, but every member of the Family happens to be individually outperforming the SPY benchmark as well. (+)

- The number of stocks above their short-term moving average has worked off of overbought reading while longer term readings continue to improve. (+)

Risk-Off

- After a blip above last week, both QQQ and IWM closed back below their long-term 200-week moving averages, indicating a possibly failed breakout. (-)

- Every major sector was down on the week with the exception of Energy (XLE) and Materials (XHB), an inflationary indication. (-)

- Foreign equities led by China (FXI) and Brazil (EWZ) steadily outperformed US equities this week. (-)

- The Yield Curve inverted even more, with short-term bonds (SHY) making new lows this week while the long-bond (TLT) is weak but hasn’t made new lows since mid-October. (-)

- Oil (USO) is on a tear, especially with China’s economy looking to open back up. (-)

- Industrial Metals and Soft Commodities (DBA) both steadily outperformed the rest of the market this week. (-)

Neutral

- Despite giving up its 200-day moving average, the Dow continues to outperform the rest of the market, while the Nasdaq made new closing lows down almost -6%. (=)

- Volume Analysis backed down to neutral readings for the major indices, with a clear disparity between the Nasdaq and Dow. (=)

- New High / New Low ratios are rolling over in the short term but still look to be holding up on a longer-term timeframe for SPY and QQQ. (=)

- Value stocks (VTV) continue to drastically outperform Growth stocks (VUG) and look like they may even take out their 200-day moving average. VTV also now has a positive TSI value. (=)

- Gold (GLD) closed the week back above its 50-dma on a big Friday move, but it still underperformed Silver (SLV) which nearly doubled its performance this week. (=) and poised for a big run over key daily MA’s