Nine years. Is it short or long? It depends on what we are talking about. In the geological time scale, it’s a blink of an eye. But in the business cycle time scale, nine years is a really long time. The current economic expansion has recently turned 9 years old, as the Great Recession ended in June 2009, according to the NBER. With 109 months of economic prosperity (as of July 2018), the current cycle is now the second longest in the U.S. history (and data traces back to the 1850s), overshadowed only by the expansion which occurred between March 1991 and March 2001.

Now, the question arises: how long can our joy last? Some people believe that because the current cycle is so old, we are on the verge of recession. We don’t agree with that. Why? We agree with Janet Yellen in one thing: expansions don’t die of old age. They end due to some external negative shocks or to aggressive Fed’s tightening. In other words, economic booms turn into busts when the central banks turn off the money tap and they hike interest rates too abruptly.

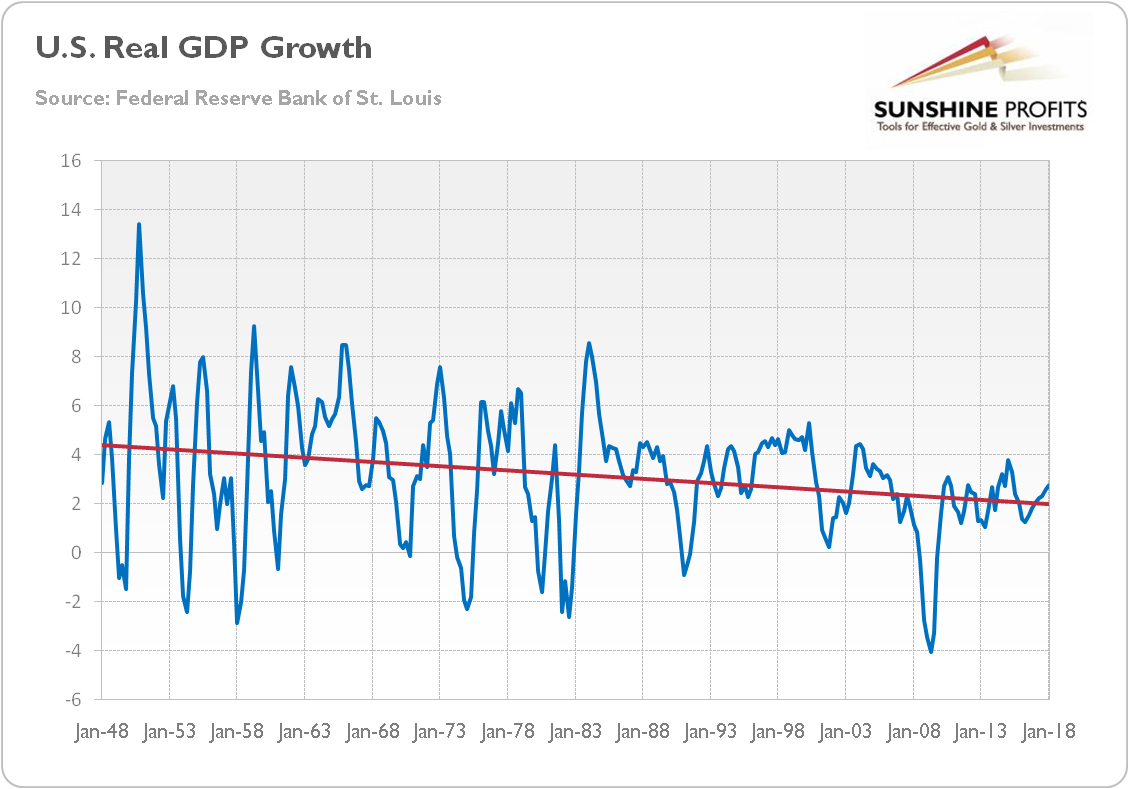

Another important point is that the current expansion is not only one of the longest, but it is also one of the slowest recovery in the U.S. history, as one can see in the chart below. The painted trend line clearly shows that the pace of economic growth has systematically declined over the years. Actually, almost every successive recovery cycle in the past three decades has been weaker than the previous one. And the current expansion has been so far the most sluggish in the post-war era.

Chart 1: U.S. real GDP growth from Q1 1948 to Q1 2018 (and its trend – red line).

When you walk slowly, you will get to your destination later than when you run. So, why is everyone surprised that the current expansion lasts so long? Investors shouldn’t forget that the rearrangement of economy takes some time. The boom was the period when many entrepreneurs made a lot of malinvestments. Now, all these resources have to be reallocated, which is never a smooth and easy process.

The key to understanding our current expansion is to notice that previous irrational exuberance started in the 1990s and lasted almost 20 years with only a short break. We mean here that the stock market bubble burst in 2001, but the Fed prevented the complete restructuration, as it slashed interest rates and reinflated the economy. And then we had the global financial crash, the second-largest recession in the US and the unconventional monetary policy with quantitative easing and ultra-low interest rates as a response to the crisis. Should we be surprised, then, that the current expansion is so slow?

Moreover, the current expansion is probably the most questioned or even hated in the history. We’ve been hearing that “recession is around the corner” for years. Hence, it is not surprising that it is very sluggish and long. If investors worry and doubt the future outlook, they refrain from investing.

What are the conclusions for gold? They are not bullish. As we wrote in the March edition of the Market Overview, “it’s not the calendar, but data that triggers contraction”. The US economy might be in a late cycle, but we are still in expansion, not at a peak. There is still room to grow further. We shouldn’t be surprised if the current upswing becomes the longest one in history, especially given the latest revival of business fixed investment. That’s bad news for the gold bulls. To be clear, we are not saying that there will be no recessions in the future. Our point is that something has to trigger them. When it happens, the price of gold should soar. However, it shouldn’t happen in the near future.

The bottom line is, thus, that investors should be aware of risks to the economy, but they shouldn’t dismiss the today’s strong economy and base their precious metals investment decisions on myths that expansions die of an old age. Stop listen to fearmongers and gold promoters who are obsessed over the risks and try to fool investors. Gold doesn’t need doomsayers’ apocalyptic predictions to shine. To be clear: we are not long-term bearish on gold – we are just rational, providing our Readers with fact-based analysis. And the facts indicate that gold may not shine in the short or medium term.

Moreover, the facts show that the economic fundamentals remain strong at this time, while short-term recession risks remains low. However, there is one indicator that might signal trouble: the yield curve. In the next part of the Market Overview, we will analyze whether it really heralds a recession.