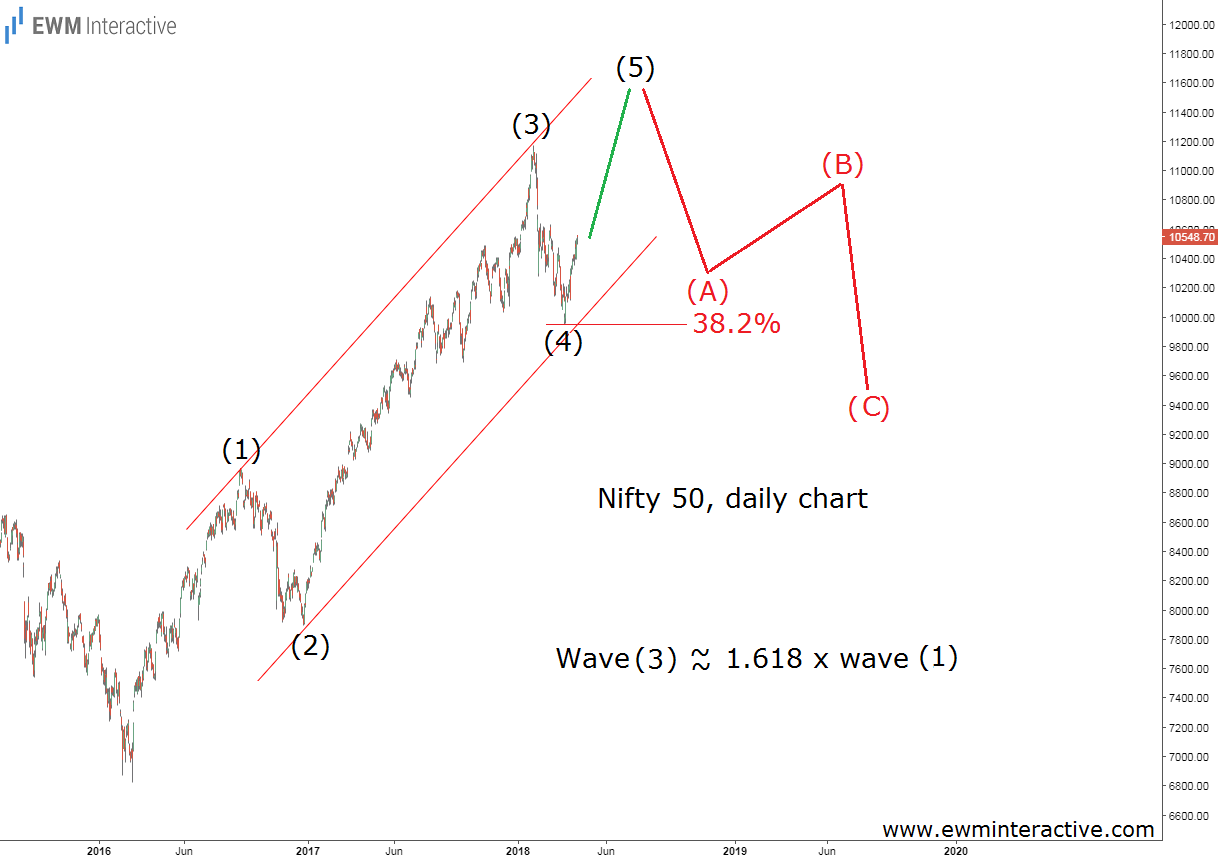

We published our last update on the Indian Nifty 50 almost four months ago, on June 6th, when the benchmark index was hovering around 10 550. Despite the recent selloff from 11 172 to 9 952, the Elliott Wave outlook was still positive. With the help of the chart below, we concluded the index is still headed north and “the bulls should eventually be able to reach a new all-time high between 11 200 and 12 000.”

Our optimism derived from the fact that trends develop in repetitive patterns, called waves. Since Nifty 50 was still in an uptrend, a five-wave pattern known as an “impulse” was supposed to emerge from the bottom at 6826 in February 2016. As visible, wave (4) had bounced up exactly from the 38.2% Fibonacci level and wave(5) was still missing. A new all-time high had to occur, in order to complete the pattern.

On the other hand, the theory states that every impulse is followed by a three-wave pullback in the opposite direction. So instead of joining the bulls when wave (5) exceeded the top of wave (3), traders would be better off staying aside in anticipation of a bearish reversal.

Nifty 50 Elliott Wave Update

Nifty 50 climbed to a new record high of 11 760 on August 28th. Less than a month later, on September 21st, it fell to an intraday low of 10 866. The bearish reversal the Wave principle warned us about nearly four months ago is one month in the past now. The updated chart below visualizes how things have been going.

Actually, wave (4) was not over at 9 952. Instead, it developed as an a-b-c-d-e triangle correction, without changing the overall outlook in any material way.

As of this writing, Nifty 50 is trading slightly above the 11 000 mark. The price is now knocking on the support line drawn through the lows of waves (2) and (4), and if this count is correct, it has a good chance of breaching it. We believe the bears should at least be able to drag the index down to the termination level of wave “a” of (4). In terms of price, this means a decline to under 10 000 is on the cards. It looks like it is too early to buy the dip as the Nifty 50 is poised to lose another 1000 points from current levels.