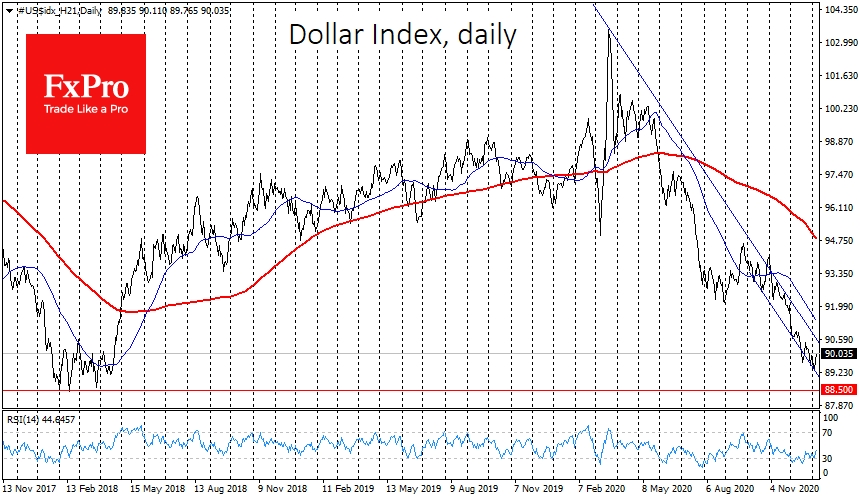

The US dollar got a break in its decline thanks to the optimism of market participants. The dollar index is up 0.5% in the last 24 hours, the biggest gain in two months. This is also a sign of how bearish the market has become for the dollar in recent months.

The NFP jobs data published later today may determine whether we see a slight pause in the dollar's decline or signs of the downward momentum exhausting after the 14% dip from March's peak.

Weekly jobless claims in the USA have declined, which was better than expected. Together with hopes for stimulus, this helps to support optimistic expectations in the markets.

The improvement in long-term expectations can easily be traced back to the performance of the respective government bonds. The Democratic Party can quickly carry out its initiatives at all legislative levels. Hopes for a generous stimulus have triggered a rally in the 10-year bond yield, taking it above 1.0%.

Higher bond yields mean lower prices, i.e. stronger selling. On the other hand, this price decrease attracts demand for relatively high-quality US debt instruments from abroad.

Rising US long-term yields can rather quickly translate into problems for emerging debt markets, which are the most vulnerable to fluctuations in demand from international investors.

For example, debt markets in Brazil and to a lesser extent other major emerging markets, came under increased pressure in recent days. This is an unpleasant surprise for EM markets, as at the start of the year most analysts were calling for a boom in capital inflows to these markets in the face of negligible low yields in the US and Europe.

The charts from last month clearly show the rally in the yields of 10-year bonds after the confirmation of Biden and the majority of Democrats in the Senate, pulling the dollar up shortly after.

On the technical analysis side, the pressure on the dollar has lost momentum after a long oversold period and with a decline to the region of almost three-year lows. Dollar bears may need a significant respite and consolidation of strength before a new attack.

On the fundamental analysis side, strong macroeconomic data could bring buyers back into the dollar, while weak data, on the other hand, could permanently deprive it of supporters.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

NFP Will Tell Us If The Dollar Has Paused Its Slump Or Is About To Turn Up

Published 01/08/2021, 05:08 AM

Updated 03/21/2024, 07:45 AM

NFP Will Tell Us If The Dollar Has Paused Its Slump Or Is About To Turn Up

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.