Newmont Mining Corporation (NYSE:NEM) recently provided an update on 2019 and long-term outlook.

The company projects attributable gold production for 2019 of 5.2 million ounces, at the midpoint of its earlier view of 4.9-5.4 million ounces. Production is expected to be boosted by higher grade production from the Subika Underground project in Africa. Moreover, production guidance for 2020 is 4.9 million ounces and in the longer-term, production is expected to remain stable in the band of 4.4-4.9 million ounces per annum through 2023.

All-in sustaining costs (AISC) per ounce is expected to be $935 and $975 for 2019 and 2020, respectively. Earlier, the company projected AISC of $870-$970 per ounce for 2019. In the long term, AISC is projected to be stable in the band of $875-$975 through 2023.

Costs applicable to sales (CAS) for gold is expected to be $710 per ounce in 2019 following lower mining costs at Yanacocha, higher production at Ahafo and lower operational costs at Tanami along with the completion of the Tanami Power Project. CAS is projected at $750 per ounce in 2020. In the long term, the same is projected in the range of $690-$740 per ounce through 2023.

Total capital expenditure guidance for 2019 is $1,070 million and $730 million for 2020. In the long term, capital is projected in the band of $500-$600 million through 2023. Development capital includes Tanami Power in Australia, the Ahafo Mill Expansion in Africa and Quecher Main in South America along with expenditures to advance studies for future projects.

Sustaining capital is projected at $680 million for 2019 and $660 million for 2020. In the long term, sustaining capital is projected in the band of $450-$550 million through 2023.

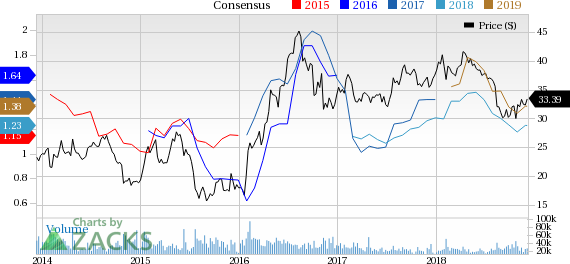

Shares of Newmont have lost 3.7% in the past year compared with the industry’s 7.4% decline.

In October, Newmont narrowed attributable gold production guidance for 2018 in the range of 4.9–5.2 million ounces from the previous projection of 4.9–5.4 million ounces.

The company’s cost outlook for 2018 has improved as AISC is expected between $950 and $990 per ounce compared with the previous projection of $965-$1,025 per ounce. However, CAS outlook for gold are unchanged in the range of $700-$750 per ounce.

Zacks Rank & Stocks to Consider

Newmont currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the basic materials space include CF Industries Holdings, Inc. (NYSE:CF) and The Mosaic Company (NYSE:MOS) , sporting a Zacks Rank #1 (Strong Buy) along with Ingevity Corporation (NYSE:NGVT) , carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CF Industries has an expected long-term earnings growth rate of 6%. The company’s shares have gained 4.2% in the past year.

Mosaic has an expected long-term earnings growth rate of 7%. The company’s shares have surged 40.6% in the past year.

Ingevity has an expected long-term earnings growth rate of 12%. Its shares have moved up 15.2% in a year’s time.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Ingevity Corporation (NGVT): Free Stock Analysis Report

CF Industries Holdings, Inc. (CF): Free Stock Analysis Report

The Mosaic Company (MOS): Free Stock Analysis Report

Newmont Mining Corporation (NEM): Free Stock Analysis Report

Original post