Last couple of weeks have been notable in the stock market. The market failed to break below the December lows despite overall bearishness and negativity. As prices bounced, establishing a higher low in most indices and sectors, an everything rally occurred which triggered a rare bullish breadth thrust signal that has many in the fintwit community announcing that a new bull market has begun.

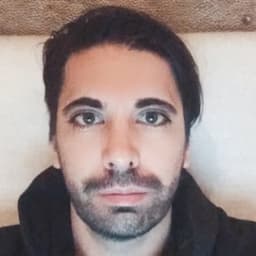

Before we dive into the details, let’s take a look at the market’s technical signals summary table:

Based on my studies, the long term trend is still negative, the short term trend is positive (new signal), the macro leading indicator trend is negative and sentiment is neutral but nearing extreme bullish levels after the recent rally.

Bullish Evidence - Breadth Thrust and Increasing Number of Stocks in an Uptrend:

Powerful and rare breadth thrust signals triggered last week. These breadth signals are based on a highly skewed and constant ratio of advancing vs declining stocks during a ten day period. The fintwit community rapidly announced and shared this information, for many enough evidence to declare that a new bull market had started.

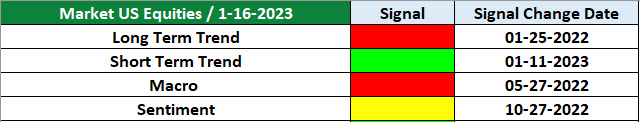

The respected and very experienced technical analyst Walter Deemer was probably the first to highlight that this signal could probably trigger and once it did, explain its bullish implications. Deemer believes we have entered a new bull market.

The triggered bullish thrust signals have a very good track record in predicting a change to a positive trend, with a very high win % and average percentage gain in the 6- to 12-month period.

Even before the breadth thrust signals triggered, my personal studies had shown improvements in breadth measured by the percentage of stocks in a primary uptrend.

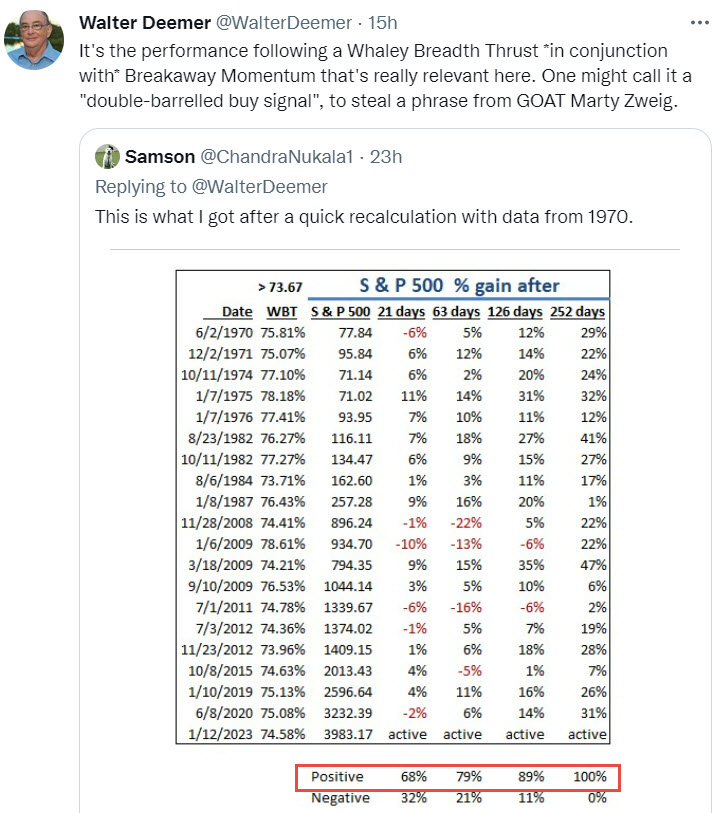

As you can see in the chart below, the lows reached in October 2022 were not confirmed with a lower low in the percentage of stocks in a primary uptrend, which is a bullish divergence. A higher high and an increase to over 50% in the stocks in a primary uptrend would be a bullish confirmation that indeed a new bull market has started.

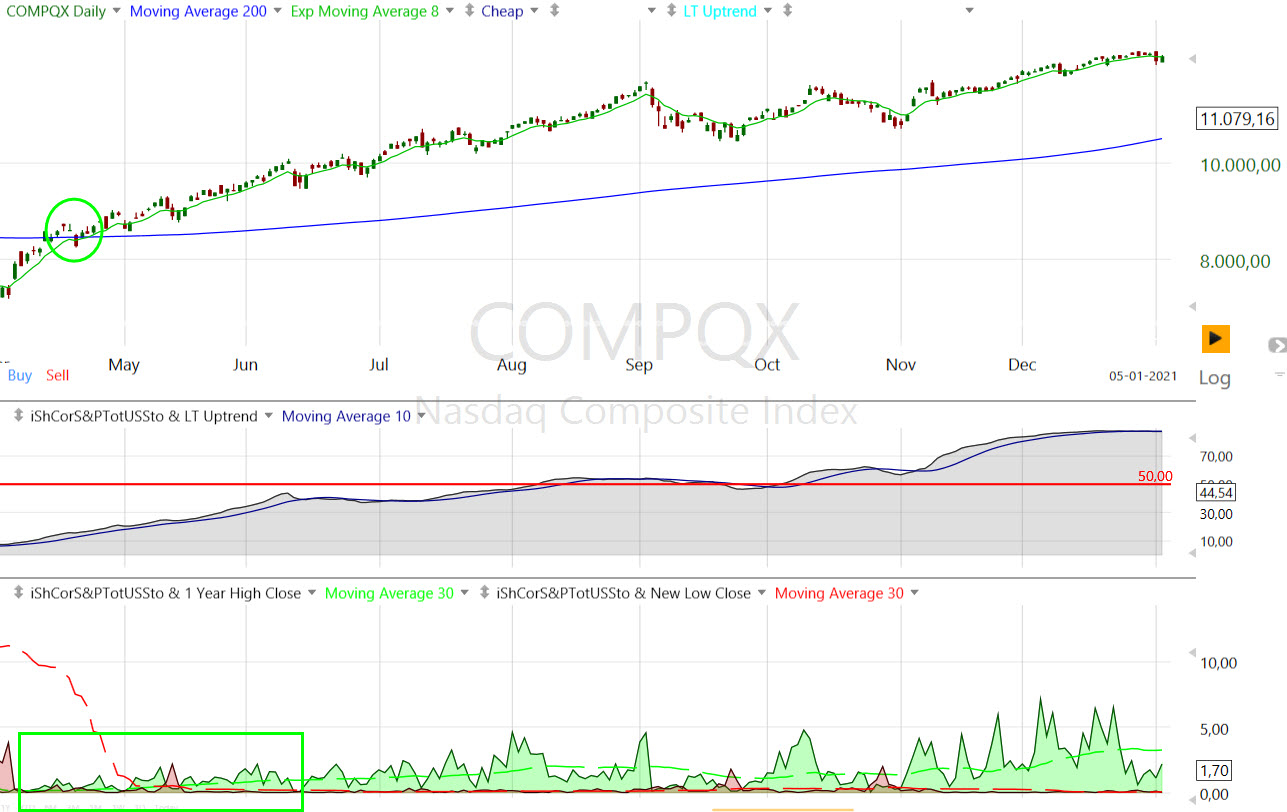

Finally a secondary indicator I use to gauge the market’s primary trend, which was the first one to signal that a bear market was beginning in late 2021, recently had bullish developments.

The High Yield Bond Cumulative Decline Line crossed below its 200 day moving average in October 2021. Last week it crossed above its 200-day moving average. This is another way to see observe the improvement in breadth, with more stocks and bonds moving higher rather than lower since the October lows.

Bullish evidence is mounting and it´s reasonable for many to think that the recent bear market has ended based on the technical action highlighted above.

We Have Not Yet Turned the Corner

Based on my studies there is still work to do before declaring an “all clear” signal and the start of a new bull market.

Bear markets are not only characterized by large declines but also face ripping rallies and high volatility. These huge countertrend rallies can give false new bull market signals before the bear market is truly over.

In order to avoid excessive whipsaw and personally preferring to enter a new bull market a bit later but with more confirmation, the technical criteria I use has yet to signal that a new bull market has begun.

The technical triggers I track are the 8 day moving average/200 day moving average cross in the Nasdaq Composite, the trend of new 52 week highs vs new 52 week lows in US stocks and that the percentage US stocks in a primary uptrend has to be over 50%. If two out of three of these components are in a bullish configuration, then a long term primary uptrend signal is triggered. Currently none of these components are confirming a new bull market. Look.

We can see as the bear market started in late 2021- early 2022, the trend of 52 week lows started to dominate that of 52 week highs, the percentage of stocks in a primary uptrend dropped below 50% and the 8 day moving average crossed below the 200 day.

None of these technical gauges has reversed to a bullish level yet and thus no new bull market signal for me. For reference, here is a chart of how the 2020 bull market started with the technical components turning bullish.

Last but not least, the trend and current level of the Weekly Leading Economic Index is negative. It is currently at levels were the US economy was starting or already in a recession. Historic stock returns have tended to be poor when leading indicators were in negative territory and in a downtrend. Previous bear market bottoms have coincided with leading indicators bottoming and starting to trend higher. We are not there yet.

Conclusions

The short term trend of the market is bullish and there have been notable improvements in breadth as of late. For some this is enough to declare a new bull market has started.

In my view, we are not there yet as there still work left to do according to my technical studies and analysis of the Weekly Leading Index.

If you are committed to start trading and investing with a longer term approach because you believe a new bull market has started, risk management still is important. The recent December lows (3760 in the S&P 500) should be a clear line in the sand as a level that should hold (and a stop to protect your capital) if we are truly in a new bull market.

***

I hope you enjoyed this article and you can follow me on twitter here for more updates.