- Netflix stock is back in focus ahead of earnings after enduring a tumultuous 2022

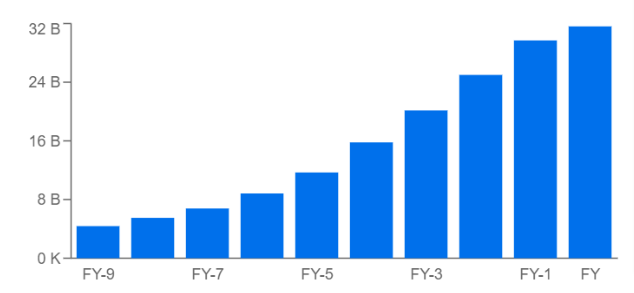

- The company has demonstrated consistent growth in both turnover and profits over time

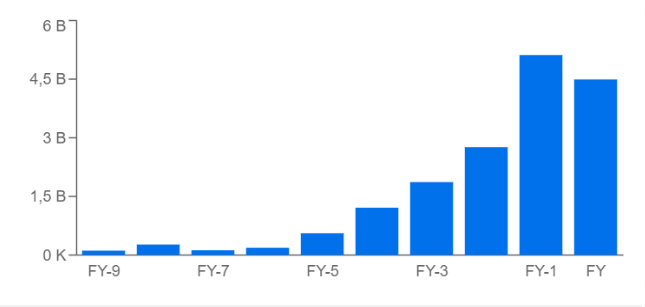

- Earnings per diluted share growth has been impressive over the past 10 years, but such growth rates are not sustainable, casting doubts about future growth

Netflix (NASDAQ:NFLX) appears to have regained the investors' attention after enduring a turbulent period in 2022 due to intense competition from other streaming services like HBO, Disney+, and Amazon Prime.

Despite experiencing a decline, the stock has made a comeback. Let's take a look at the company's fundamentals ahead of its quarterly report, which is due to be released after the markets close today.

What Does the Company Do?

Netflix is a provider of entertainment services. The company has paid streaming subscriptions in over 190 countries. It allows members to watch various TV series, documentaries, and feature films in a wide range of genres and languages.

Members can watch as much as they want, anytime, anywhere, on any screen connected to the internet. Members can play, pause and resume viewing with no commercials. The company also offers its Digital Versatile Disc (DVD) service by mail in the US.

The company offers a variety of streaming subscription plans, with prices varying by country and plan features. Prices for its plans range from approximately $2 to $27 per month.

Members can watch content on any Internet-connected device, including smart TVs, game consoles, TV set-top boxes, and mobile devices. The company acquires, licenses, and produces content, including original programming.

Data at a Glance

First of all, let's take a look at the balance sheet:

The company has consistently grown its turnover and profits over time, except last year, which proved challenging for all tech companies. It remains to be seen how the company will perform in the coming year.

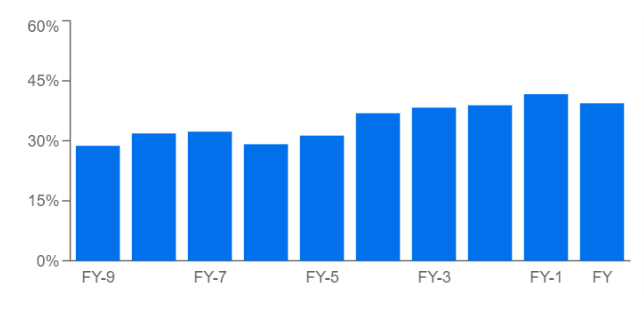

On average, the margins have remained steady at around 30% over the years, suggesting that the company has successfully boosted its turnover without negatively impacting its margins.

This is down to the company's competitive advantage in the industry.

Source: Investing Pro

Source: Investing Pro

Source: Investing Pro

Over the past 10 years, the annual growth rate of EPSd (earnings per diluted share) has been an impressive 50%. However, it is essential to note that such growth rates are typically not sustainable in the long term. And this casts some doubt about the company's future growth.

Source: Investing Pro

Balance Sheet and Cash Flow

Between cash and short-term investments, Netflix has over $6 billion, with total current assets of around $9 billion. This is a good short-term balance compared to current liabilities (around $8 billion).

The debt-to-equity ratio is under control (0.82), again providing a good balance on the equity side.

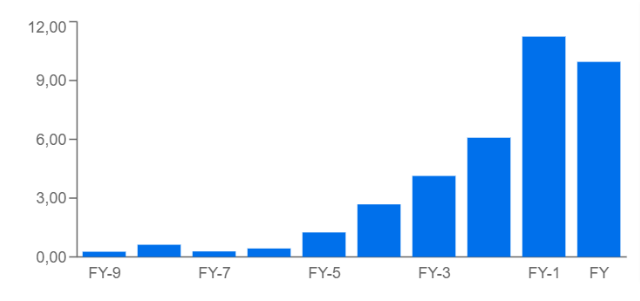

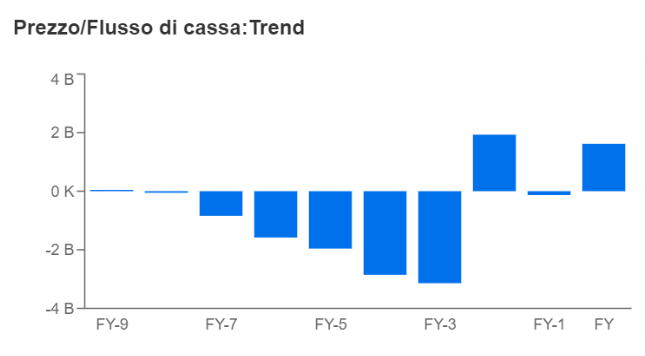

Regarding cash flow, both the operating cash flow and the free cash flow have displayed fluctuating trends. While there has been an improvement in recent years, the company's growth in this area is not yet robust.

Perhaps one of the possible turns that shareholders would like to see (also given unsustainable growth rates for a long time) is a greater focus on improving cash flow and long-term sustainability.

Source: Investing Pro

With an FCF of 1.6 billion (the latest available), the FCF yield is around 1%, which is very low but unsurprising as Netflix has some cash flow issues. On average, a good level of profitability is between 8-10%, so the company has a lot of room to improve on this metric.

Valuations

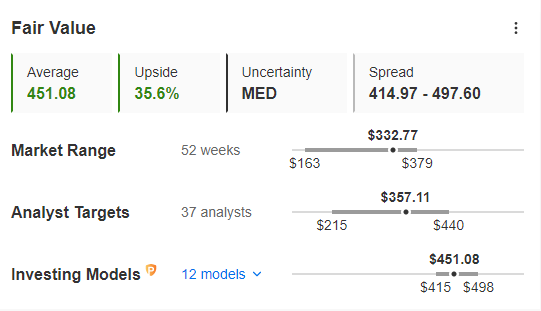

The stock is currently trading at a discount to the fair value of around $451 per share (based on the average of 12 different models).

Analysts are currently cautious, with the average target price for the stock set at $357. This price is close to the current value, with very little room for growth.

Source: Investing Pro

In general, however, as the outlook for further growth dims, the focus should shift to profitability, not least because the current momentum is one of the relative weaknesses across the tech sector.

As we await the next quarterly report, it remains to be seen whether the new initiatives (the end of shared accounts and the inclusion of advertising) will lead the stock higher.

The analysis was carried out using Investing Pro, access the tool by clicking on the image.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, consultation, or recommendation to invest and, as such, is not intended to induce the purchase of any assets. I would like to remind you that any investment is evaluated from multiple perspectives and is highly risky; therefore, any investment decision and the associated risk remain with the investor.