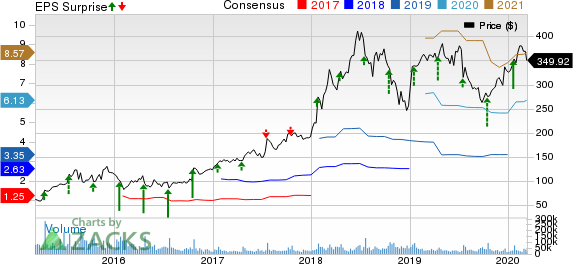

Shares of Netflix (NASDAQ:NFLX) are up 8.1% year to date against the S&P 500 composite’s decline of 10.5%.

The company’s solid content portfolio aided it to successfully weather the coronavirus or the COVID-19-led stock market rout in the past few weeks. Notably, on Mar 11, the Dow Jones shed 1,464.94 points, crashing more than 20% below its recent high in February to languish in the bear market.

The rising incidences of coronavirus, which is now officially designated as a pandemic by the World Health Organization (WHO), prompted several countries to place the worst-hit cities on lockdown to contain the virus. Notably, the Dow Jones futures along with the S&P 500 and Nasdaq futures plunged in Mar 12 morning following President Donald Trump’s announcement to impose a ban on all travels from Europe to fight the plaguing virus.

Although this caused disruptions on the international business front, the increasing number of lockdowns globally are expected to further increase consumption of media content over the Internet.

Netflix is well-poised to make the most of this surge in consumption owing to its diversified content portfolio, courtesy of heavy investments in the production and distribution of localized, foreign-language content and an expanding international footprint.

Notably, this Zacks Rank #2 (Buy) stock’s paid subscriber base increased 20% year over year to 167.09 million in 2019. Netflix expects to build a base worth 174.09 million paid subscribers globally in the first quarter of 2020. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Solid International Content to Counter Competition

Armed with a solid content portfolio, Netflix shows greater potential to advance ahead once the impact of the coronavirus subsides. Moreover, the company’s expanding international content portfolio is not only expected to contribute to subscriber addition but also offset stiff competition from the likes of Disney (NYSE:DIS) , Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN) .

Notably, Disney is set to launch its streaming service Disney+ in India. Moreover, the rivalry in Indian streaming space is set to further intensify with the entry of Apple TV+ at INR 99 per month in 2020.

Moreover, Disney struck a deal with Italy’s Telecom Italia (MI:TLIT) Mobile. It also signed an agreement with Comcast (NASDAQ:CMCSA) -owned Sky to carry its service on Sky Q and Now TV in the UK and Ireland ahead of Disney+’s UK launch on Mar 24.

The service is also set to get launched in France on Mar 31, 2020. Notably, Canal+ inked a deal with Disney to be the sole distributor of Disney+ in the country.

Other European countries including Germany, Italy, Spain, Austria, Switzerland, Belgium, The Nordics (Scandinavia, Finland, Iceland and Greenland) and Portugal will join the UK in streaming the service this summer.

Additionally, Amazon’s prime video is working on four new French projects, slated for a launch in 2020 and 2021.

International Shows, Reasonably-Rated Mobile Plans: A Boon

Netflix is working on projects across Mexico, Spain, Italy, Germany, Brazil, France, Turkey and the entire Middle East to drive international subscriber growth.

Per Netflix, in 2019, local originals were the most popular titles across many countries including India, Korea, Japan, Turkey, Thailand, Sweden and the United Kingdom. Notably, the company’s streaming service is available in 190 countries.

The company recently announced six projects in Turkey that include renewal of the third season of the popular series, The Gift. Netflix is set to release the second season of The Gift in September 2020.

The company’s extending Korean content portfolio continues to bode well for the current year. Netflix recently announced the casting of Lee Jung-jae and Park Hae-soo in lead roles for Round Six, an original series to be directed by Hwang Dong-hyuk. Notably, the streaming giant inked partnerships with two leading Korean content houses, namely JTBC Content Hub and CJ ENM in 2019.

Moreover, Netflix is set to fortify its foothold in Africa. The company partnered with John Boyega's UpperRoom Productions to develop film projects based on stories, cast, characters, crew, literary properties, mythology, screenplays and/or other elements in or around African countries with focus on West and East Africa.

Notably, the streaming giant is set to produce an Egyptian comedy drama in collaboration with popular satirical puppet character Abla Fahita, a star in the region. The series will be released in more than 20 languages in 2020.

Additionally, Netflix is set to spend $420 million this year and the next on producing original content for the audience in India.

Further, launch of low-priced mobile plans in India, Indonesia, Malaysia, Philippines and Thailand is expected to boost Netflix’s subscriber base in APAC, its fastest-emerging region in 2020.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Comcast Corporation (CMCSA): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

Original post