- Netflix to report Q2 earnings on Tuesday, July 19 after the market close

- Revenue Expectation: $8.03B; EPS: $2.96

- The global video-streaming company has lost about 64% of its market value this year

Investors shouldn’t get their hopes up when global video-streaming giant Netflix (NASDAQ:NFLX) reports quarterly earnings tomorrow. This year’s 64% destruction in shareholder value indicates little to no hope for a quick turnaround for the Los Gatos, California-based company.

NFLX stock has seen the most significant drop of any NASDAQ 100 or S&P 500 component this year. The reason behind this steep decline is simple: the company can’t seem to find new subscribers in an industry that’s becoming more competitive.

In April, Netflix plummeted more than 35% in a single day after reporting a loss of 200,000 subscribers during the first quarter. The company also added it expects a loss of another 2 million subscribers this quarter.

This debacle comes after two years of unprecedented growth, primarily due to the stay-at-home environment and the worldwide COVID-driven closure of movie theaters. Netflix picked up more than 36 million customers in 2020 and 18.2 million in 2021.

But as business dynamics changed, investors questioned the size of the total addressable streaming market—a number Netflix had previously said to be as high as 800 million. The company currently has about 222 million global subscribers—as of the end of Q1.

To counter those challenges, Netflix is on the verge of releasing a cheaper, advertising-supported service to attract customers who are put off by its subscription cost. The company is also getting users to pay for password sharing, thus generating additional revenue from existing customers.

A Bearish Spell

According to Reuters, Netflix is also working on a franchise strategy to milk more from its bigger shows and movies by turning its hits into various products, such as video games and consumer goods. The franchise strategy complements the company's efforts to build a vast library of original programming with something for every taste.

These changes, however, will take time to pay off. Analysts on Wall Street don't see a near-term turnaround in the company's fortunes, especially when the risk of a recession is growing and consumers are looking to cut their spending amid a four-decade high inflation rate.

The bearish spell in Netflix stock will probably deepen if the widely anticipated recession hits the economy, according to a research note by the Bank of America. The bank says such a scenario could produce more subscriber losses or limit the company's pricing power.

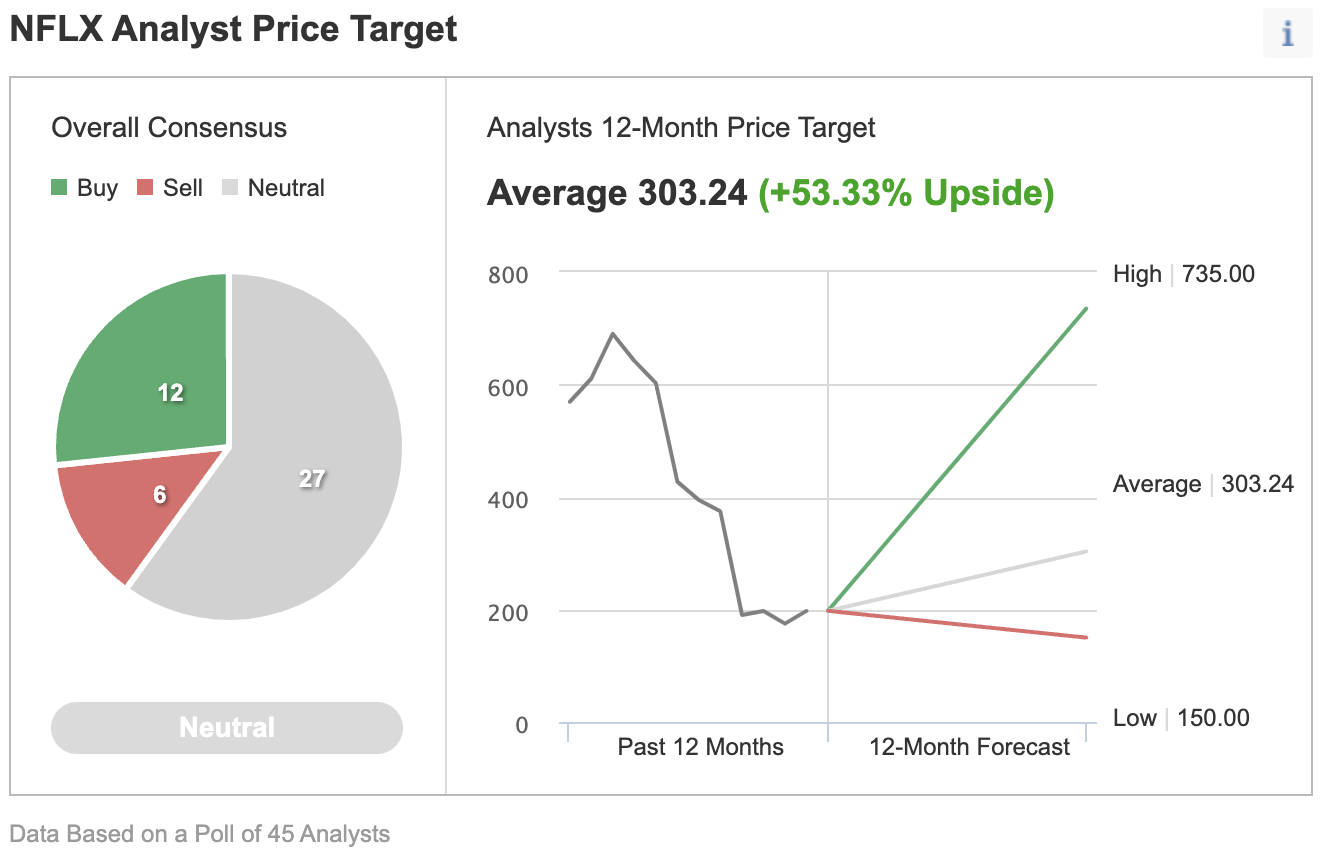

Other analysts seem to be sharing this view. In an Investing.com poll of 45 analysts, 27 rate the stock neutral, 6 recommend selling it, and another 12 rate it a buy.

Source: Investing.com

In the coming months, Netflix’s best hope is to release new shows that people really like and make it stand out among competitors who are fiercely fighting to get a bigger market share.

On this front, there is a glimmer of hope. Netflix continues to release shows that have the power to keep viewers hooked. “Stranger Things” is now the most viewed English-language show with over 188 million hours total viewed. It has broken the view record of past seasons and other Netflix series and has been placed in the Top 10 in 93 countries.

Furthermore, Netflix has a deep slate of programs coming out in the back half of the year, particularly in the fourth quarter. That includes a new season of “The Crown” and sequels to the movies “Knives Out” and “Enola Holmes.” That’s also when its new advertising service will start to appear.

Bottom Line

Netflix faces a tough road to recovery. The streaming market has become more competitive when the economy is going through a rough patch. The number of people canceling Netflix has spiked in recent months and remained elevated, suggesting that the company may not have something exciting to share when it reports earnings tomorrow.

Disclosure: The writer owns shares of Netflix.