A new filing with the SEC revealed that Nelson Peltz sold a significant portion of his Mondelez International Inc (NASDAQ:MDLZ) stake on Tuesday. The filing footnotes also stated that the sale was made “in connection with the liquidation of a fund managed by Trian.” Could this signal more selling activity moving forward?

Nelson Peltz Cuts Mondelez Stake

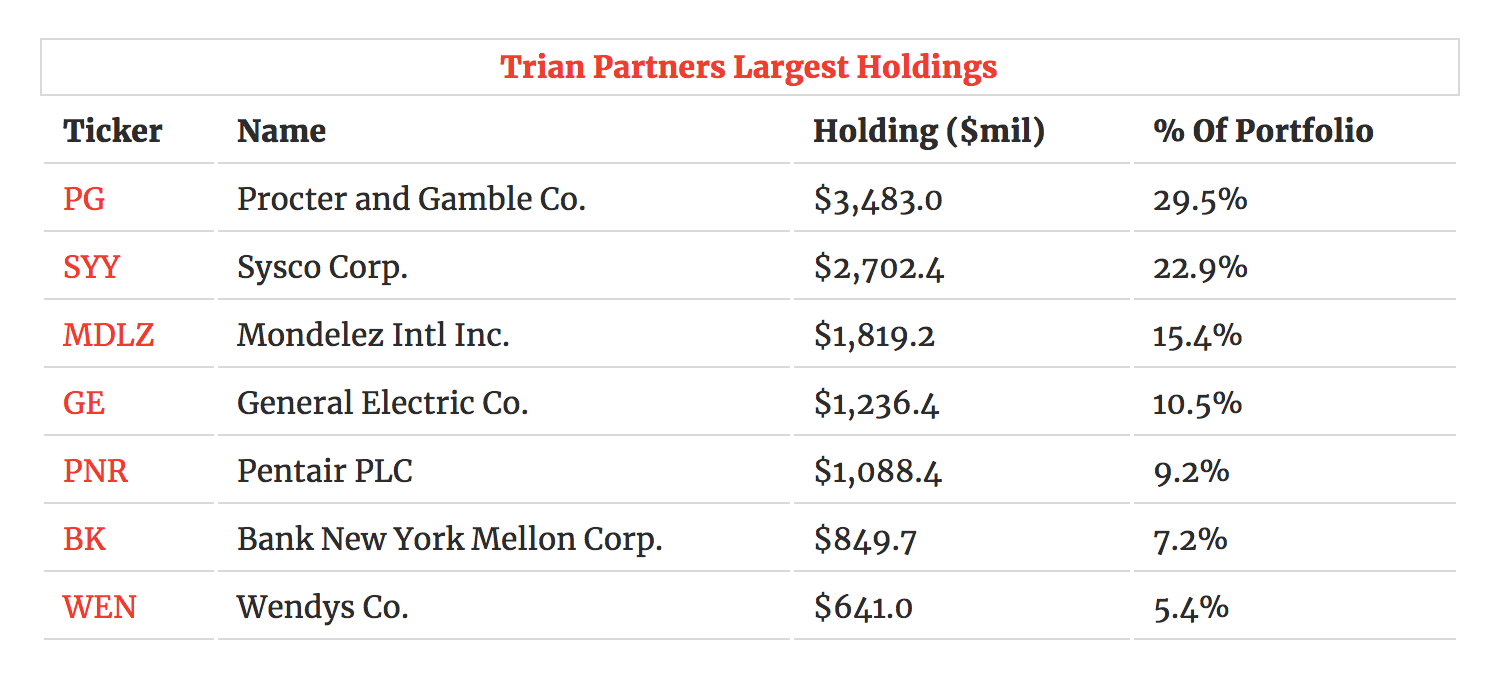

On February 14th, Nelson Peltz’s firm Trian Fund Management filed its quarterly Form 13F regulatory filing. The filing showed that the investment firm held 42,504,701 shares of Mondelez worth $1.8 billion as of December 31st. This was also Trian’s third largest stock position which represented 15.4% of its listed holdings.

The following table summarizes the firm’s listed holdings as of December 31st:

source: finbox.io Nelson Peltz Page

However, a new filing yesterday revealed that Mr. Peltz sold 6,523,275 shares worth a total of $284.9 million on Tuesday, February 27th. This reduced his position in the company by 15%.

Why Should Investors Care?

Although the filing stated that the transaction was made for portfolio management purposes, the sale could signal that Trian will continue to exit its position moving forward.

Shares of Mondelez have generally underperformed the market over the last year (down -1%) which have traded in a range of $39.19 to $47.23 per share. The S&P 500 increased by 11.6% over the same time period.

Similarly, shares of Mondelez have underperformed over the last five years (up 54.3%) while the market has increased by 71.3%. The recent selling activity by Mr. Peltz and Trian could signal that they’re starting to exit a losing position.

Furthermore, it was reported in mid-February that Nelson Peltz was leaving the board of Mondelez as he prepares to become a director at Procter & Gamble Co. (NYSE: PG) where his firm holds nearly a $3.5 billion stake (easily its largest position). It is important to note that Peltz is being replaced by another Trian Partner but clearly less resources are being attributed to Mondelez. Could it be a sign that the firm is starting to abandon ship?

Is Mondelez Stock Overvalued?

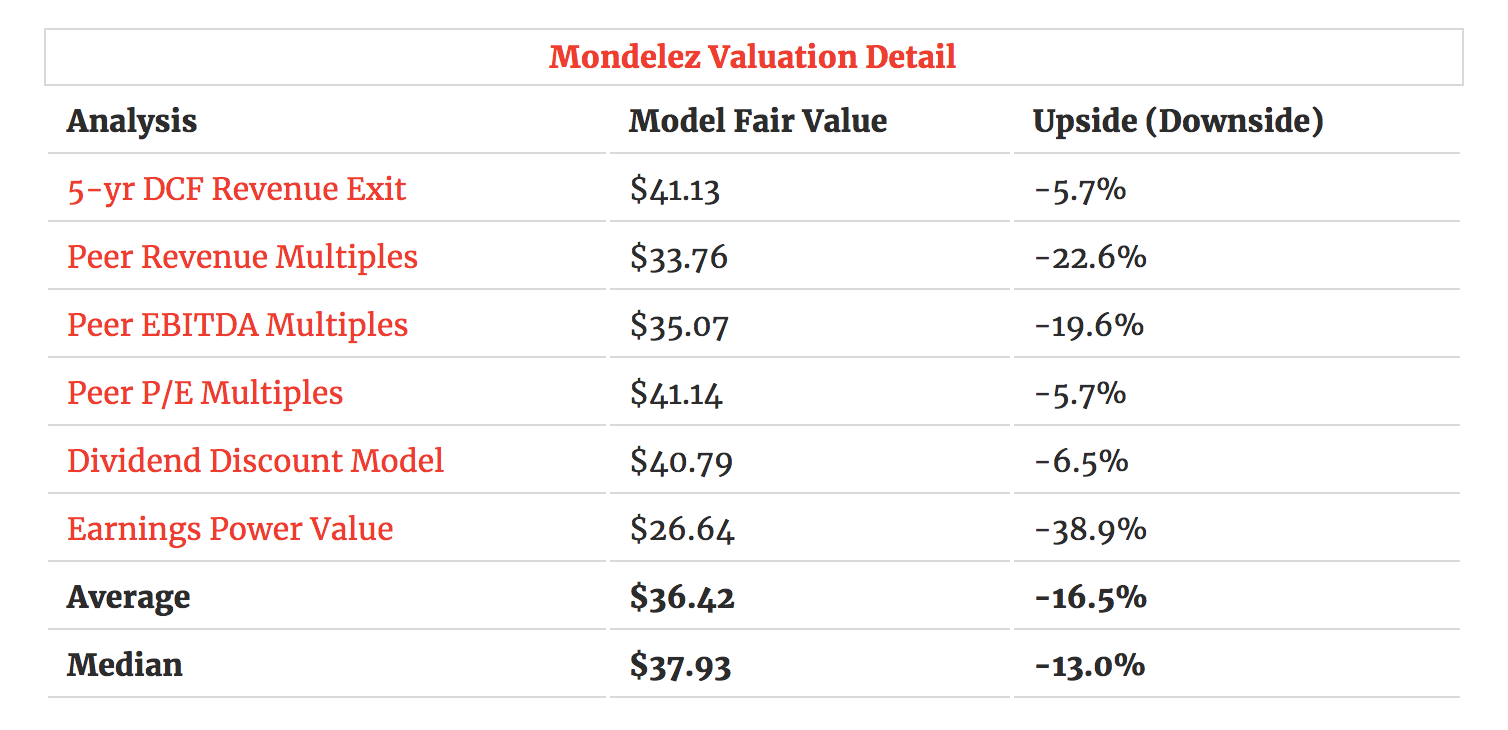

Finbox.io applies pre-built valuation models to calculate a fair value for a given stock and uses consensus Wall Street estimates for the forecast when available. Six separate models calculate an average fair value of $36.42 which implies -16.5% downside as shown in the table below.

source: finbox.io

On a fundamental basis, shares of Mondelez do appear to be trading at a premium to its intrinsic value. This could be another reason why Nelson Peltz is reducing his stake in the company.

It is important to note that investors should never blindly copy the trading activity of illustrious money managers such as Nelson Peltz. However, keeping an eye on their buying and selling activity will help in making a more informed decision.

Here are a few additional items that you should consider before drawing a conclusion:

Valuation: what is Mondelez’s EBITDA less CapEx multiple and how does it compare to its peers? This is a helpful multiple to analyze when comparing capital intensive businesses. View the company’s EBITDA less CapEx multiple here.

Valuation: what is Mondelez’s free cash flow yield and how does it compare to its publicly traded peers? This metric measures the amount of free cash flow for each dollar of equity (market capitalization). Analyze the free cash flow yield here.

Efficiency Metrics: return on equity is used to measure the return that a firm generates on the book value of common equity. View Mondelez’s return on equity here.

Forecast: what is Mondelez’s projected earnings growth? Is the company expected to grow faster or slower relative to its peers? Analyze the company’s projected earnings growth here.

Article originally appeared here.